By Mubatsi Asinja Habati

Has Africa been spared the brunt of the global financial crisis, as many believe? Not if experts from the World Bank are to be believed.

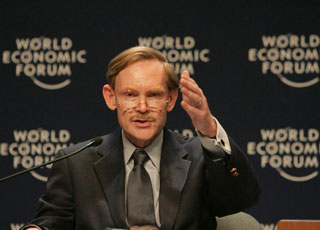

Addressing African leaders at the 12th African Union summit in Addis Ababa last week, the bank’s president, Robert Zoellick, said: “We face a global crisis. Africa will not escape it.”

He said that the financial crisis, after growing into an economic crisis, is becoming an employment crisis, and in the coming months will become a human crisis for some.

“Many of you have already seen the danger signs, on top of the poverty, hunger and malnutrition we saw last year as a result of soaring food and fuel prices,” he told the gathered heads of state.

“Far from being insulated from these events, developing countries are feeling the effects “” and Africa is no exception. The first effects will be concentrated in sectors that are integrated with the global economy.”

Experts say only African banks will avoid the brunt of the global crisis, as most of Africa’s banking sector is not particularly integrated internationally. Stock exchanges are another matter – as investors in the collapsing stock markets in Nigeria and South Africa will testify.

The World Bank’s vice president for Africa, Katryn Obiageli Ezekwesili, took issue with those who had argued that the global economic meltdown would not hit African countries, saying that the rampaging world economic crisis was spilling from the developed world to developing nations.

She said the downturn could dry up the private-sector investments that have propelled developing-country growth in recent years. The overall growth rate for sub-Saharan Africa slowed to 5.4% in 2008, down from 6.6%, The World Bank forecasts that Africa’s GDP growth may decline to 2.5% this year.

Ms Ezekwesili pointed at the declining revenue from Africa’s commodity exports, increasing unemployment, below budget national revenue collections, and declining foreign direct investments and remittances, along with increasing capital flight.

She argued that demand for Africa’s commodity exports was falling due to low demand in the western world. She suggested that mining companies were pulling out of South Africa (platinum), Zambia (copper), the Democratic Republic of Congo (diamond, tin, gold) and Botswana (diamonds) because they can no longer meet the costs of doing business.

Ezekwesili said that last year, only US $ 20 billion was remitted to sub-Saharan Africa, and private capital is today flowing out of the continent in larger quantities. Banks and money lenders will be unable to lend more to investors because of the shaky economy, sparking a spiral of worker lay-offs. Failing companies will lead to low revenue collection by governments, which will in turn cut back on public expenditure, leading to declines in social services, infrastructure and agriculture.

Ezekwesili said governments should regulate markets, invest efficiently in infrastructure, support the real poor, and make energy reforms to revamp the sector, export other commodities in addition to traditional exports, and use their resources judiciously.

“It is important that we have a government that can regulate the activities of the market – the private sector, remittances and the public sector – to keep the economy going,” said Ms Obiageli.

The World Bank has lined up a US $ 7 billion rescue fund for lending to badly hit countries, and could increase lending to US $ 42 billion in the next three years. Africa may need it.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price