What the 2017 –2022 government strategy means to Uganda

Kampala, Uganda | ISAAC KHISA | Uganda’s central bank in partnership with the Ministry of Finance, Planning and Economic Development has unveiled a five-year financial inclusion strategy to enable more individuals and business access affordable financial products and services.

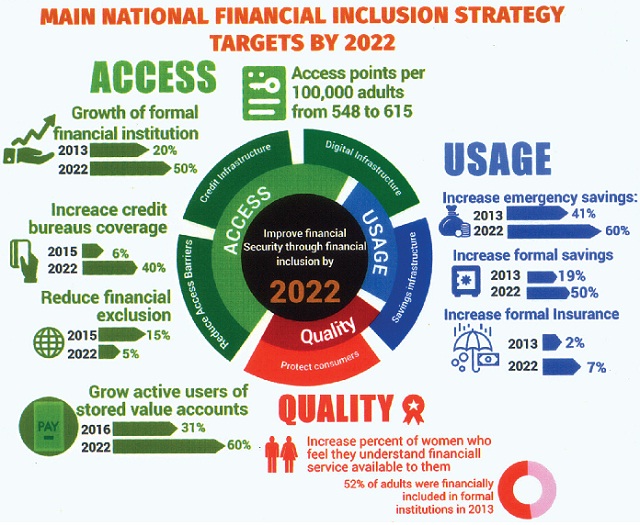

The Uganda National Financial Inclusion Strategy 2017-2022 seek to reduce financial exclusion from 15% as at the end of 2013 to 5%, grow formal financial institution from 20% to 50% and increase formal savings from 19% to 50% during the same period under review.

Emmanuel Tumusiime – Mutebile, the governor of Bank of Uganda told his guests at the Kampala Serena Hotel on Oct. 26 that the new strategy will focus on developing credit and digital infrastructure deepen, broaden formal savings, investment and insurance usage and protect and empower individuals with enhanced financial capability.

“Empirical research suggests that access to formal financial services by the population can contribute to inclusive economic growth,” he said, adding, “It can help poor people raise their incomes, accumulate savings and better cope with shocks to their income and thereby enhancing their wellbeing.”

He said the end goal of financial inclusion is not just having more people with bank accounts, who are making transfers and are getting loans; rather it is ultimately about reducing poverty and enhancing the economic security of families through usage of affordable financial services.

This new strategy is built on the 2011 Financial Inclusion Programme which had four pillars: financial literacy; financial consumer protection; financial innovations; and data and measurement.

Registered achievements

This culminated into BoU crafting, inaugurating and implementing the financial literacy 2013-2017 strategy; issuing financial consumer protection and mobile money guidelines; amending the Financial Institutions Act 2004 to allow for Agency and Islamic banking; and carrying out geospatial mapping of distribution points of financial services countrywide.

This new development comes at the time when more than 52% of the Uganda’s population use non-bank formal institutions, with more than 80% not having a bank account, according to BoU. It also coincides with low level of savings and investments, low level of insurance and low level of digital services usage.

Minister of State for Finance, Planning and Economic Development, Ajedra Gabriel, said the strategy launch is timely due to “desire to accelerate our progress towards broader and more meaningful financial inclusion.”

In his key note address, Norbert Mumba, the deputy director at the Alliance for Financial Inclusion – a global network of central banks and policy makers with more than 110 members – said they applaud the development of Uganda’s elaborate national financial inclusion strategy that is an essential catalyst to scale up and deepen financial inclusion in Uganda as well as the East Africa region.

“Uganda is one of 27 countries that committed to develop national strategies under the Maya Declaration. Uganda has now completed this task and is one of 43 countries that have the national financial inclusion strategy in place,” he said.

Maya Declaration is an initiative that was adopted by a group of developing nation regulatory institutions during the Alliance for Financial Inclusion’s (AFI) 2011 Global Policy Forum held in Mexico to unlock the economic and social potential of the two billion unbanked population through greater financial inclusion.

Going forward

Mumba, however, noted that the national financial inclusion strategy should be receptive to financial growth policies that take into account gender equity with specific emphasis to access for women, address climate change and green finance and take into consideration of the plight of both externally and internally displaced persons.

National Financial Inclusion Strategy by The Independent Magazine on Scribd

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price

So sad to see yet another government follow the well-worn path to failure by focusing a Financial Inclusion initiative on the same Formal Financial Services Sector that has actively disenfranchised low-income consumers for centuries and has little reach outside major population centres, instead of leveraging the various Informal providers who have the trust of underserved consumers as well as the reach throughout the country.