By Joseph Were

Uganda, according to a United Nations report launched in Kampala last week, has grown the highest foreign direct investments in the East African region between 2006 and 2008.

According to the World Investment Report (WIR) 2009 compiled by the United Nations Conference on Trade and Developed (UNCTD), Uganda attracted US$ 787 million (approx. Shs 1.5 trillion) in 2008 compared to US$ 733 million in 2006.

Over the same period, FDI flows to Tanzania grew from US$ 597 million to US$ 744 million; Rwanda US$ 16 million to US$ 103 million, Kenya from US$ 51 million to US$ 96 million and Burundi US$ 1 million.

Attracting more FDIs means more companies from outside an economy are investing into it on a long-term basis either by establishing multinational corporations or other international businesses or setting up affiliates.

Uganda has witnessed an avalanche of foreign investors in the banking and insurance sector, telecommunication, mining, oil exploration and related businesses, electricity generation, and agro-related processing.

Uganda’s 2008 performance placed it among the top 10 countries in Africa in terms of attracting FDIs.

But as the Executive Director of the Uganda Investment Authority, Maggie Kigozi, said while launching the report, although attracting FDIs was good, there is need for more investments by Ugandans.

“Unlike some foreign investors,” she said, “domestic investors are likely to remain in the economy even if the country is facing some challenges.”

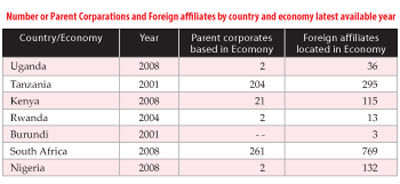

Kigozi explained that although Kenya had less FDI inflows than Uganda it is at an advantage because its domestic investments remain high. According to the WIR figures, Kenya had 21 parent corporations based in its economy in 2008 compared to 2 in Uganda and 115 foreign affiliates based in its economy compared to just 36 in Uganda.

In 2008, the global FDI flows were severely affected by the global financial crisis.

According to the report, the inflows are expected to fall from US $1.7 trillion in 2008 to below US$ 1.2 trillion in 2009, with a slow recovery in 2010 (to a level up to US$ 1.4 trillion) and gaining momentum in 2011 (approaching Us $1.8 trillion).

The global financial crisis has also changed the FDI landscape and led to a surge in investments to poor economies of up to 43% in 2008. The report attributes this to the concurrent large decline in FDI flows to rich countries of 29%.

In Africa, inflows rose to a record level, with the fastest increase in West Africa (a 63% rise over 2007).

UNCTD compiles the World Investment Report as a way of assisting poor countries to build their productive capacity and competitiveness to benefit from FDIs and transfer of technology.

The question, therefore, of whether having more FDIs is good or bad does not feature in the report.

Generally, the report shows that in the first half of 2008 developing countries weathered the global financial crisis better than developed countries, as their financial systems were less closely interlinked with the hard-hit banking systems of the United States and Europe. Their economic growth remained robust, supported by rising commodity prices. Their FDI inflows continued to grow, but at a much slower pace than in previous years, posting a 17% to $621 billion.

The report notes that agriculture and extractive industries weathered the crisis better compared to business cycle-sensitive industries such as metal manufacturing. It gives better outlook for FDI in industries such as agribusiness, services and pharmaceuticals.

The report says foreign participation can boost agricultural productivity, support economic development and modernisation in developing countries like Uganda, which lack private and public investment.

It notes that though small compared to the world FDI, agricultural related FDIs account for a significant share of FDI in poor countries and have a higher value chain with food and beverages representing US$ 40 billion of annual flows. Between 1990 and 2007, however, FDI flows in agricultural production tripled to US$ 3 billion annually, driven by the food import needs of populous emerging markets, growing demand for biofuel production, and land and water shortages in some developing countries.

In East Africa, Tanzania has the highest FDI inflows in agriculture as a share of total FDI flows at 9.5%.

The report notes that in 2008 and the first half of 2009, despite concerns about a possible rise in investment protectionism, the general trend in FDI policies remained one of greater openness, including lowering barriers to FDI and lowering corporate income taxes.

However, it notes, some national policy measures like national bailout programmes and economic stimulus packages introduced in response to the crisis could improve FDIs, other policy measures, could result in investment protectionism by favouring domestic over foreign investors, or by introducing obstacles to outward investment in order to keep capital at home.

“There are also signs that some countries have begun to discriminate against foreign investors and/or their products in a “hidden” way using gaps in international regulations,” the report says.

It notes examples of “covert” protectionism like favouring products with high “domestic” content in government procurement, de facto preventing banks from lending for foreign operations, invoking “national security” exceptions that stretch the definition of national security, or moving protectionist barriers to subnational levels. “Looking to the future,” it says, “a crucial question is which FDI policies host countries will apply once the global economy begins to recover. The expected exit of public funds from flagship industries is likely to provide a boost to private investment, including FDI. This could possibly trigger a new wave of economic nationalism to protect “national champions” from foreign takeovers”.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price