High costs

On the other hand, the Ugandan insurance market is the least profitable for insurance firms because of high costs of acquiring, underwriting, and servicing customers; what experts call the expense ratio.

In Uganda it is 43% compared with 40% in Tanzania and 30% in Kenya. South Africa has an expense ratio of just 10%.

The costs of other entities involved in processing of the insurance business, called third parties, are also very high in Uganda at 11.7% compared with 7% in Kenya and 3.4% in Tanzania. South Africa has costs of 4%.

This implies that Uganda’s insurance firms incur high operational costs in acquiring, writing and servicing insurance and re-insurance products and operators are left with minimal revenue for investment and expansion.

Tripe, in a presentation he made at the Actuarial Society of South Africa held in November last year, said the high distribution costs of insurance in many African countries including Uganda damage the reputation of insurance firms and are the part of the reason people don’t buy insurance.

The title of Tripe’s talk was “The African Insurance Trap”.

Tripe advised insurance firms to design products that meet specific needs of prospective customers and the economy in which they function.

“For example Index Insurance in Malawi, Low-income health insurance Kenya, livestock index- based insurance Northern Kenya,” he said.

Tripe said the lack of trust among customers can be close through real life based marketing, keeping products simple and transparent, and tied with real time customer feedback.

Now experts in insurance say there’s need to re-structure operations and increase publicity of the industry to encourage the population purchase insurance policies widening coverage.

Marketing needed

Another expert, Mustapha Mugisa, who is an insurance fraud examiner and CEO of Summit Consulting Ltd in Kampala, also told The Independent in an interview that insurance firms need to do more marketing.

He said a quick look at the insurance industry in Uganda shows that sellers, agents, brokers and insurance firms are all interested in making sales but place limited effort in marketing to let people know and appreciate their services.

He said the problem is worsened by all of them targeting the same prospective customers, with same products, and in a confusing way for customers.

“Right now, you cannot pinpoint which insurance company is possibly good in oil and gas, financial services or life,” he said, “you cannot deepen insurance penetration in this country unless there’s clarity on who is targeting which segment in terms of geography or sector and growing the relevant expertise.”

Uganda currently has 29 insurance companies. These include 21 firms for non-life /general insurance and 8 firms for life assurance business, and one re-insurer. There are also six Health Membership Organisations (HMOs), 35 insurance brokerage firms, one re-insurance brokerage, and 21 loss assessing entities.

Mugisa noted that insurance firms sell to the same market, mainly in urban centres, and their rates are high mainly to cover costs.

But, Mugisa says, insurance firms could instead be looking at lowering their costs, especially with medical insurance policies, by minimising their claims expense through educating their clients on how to prevent certain risks.

But Miriam Magala, the chief executive officer of the Uganda Insurers Association (UIA) told The Independent that focusing on lack of marketing and distribution networks is not the answer.

She said insurance products are already targeted by way of age, sex, education, geographical location, and other particular requirements of clients.

In her view, the high costs are because of taxes government imposes on insurance products, with the exception of life insurance.

She mentioned the increment in Stamp Duty from Shs5000 to Shs35, 000, the 18% Value Added Tax charge on micro-insurance, withholding tax of 10% on reinsurance, and the insurance revenue levy of 2%.

She said insurance distribution networks are equally many, including fuel stations which are known for selling Motor Insurance products and that banks coming on board as insurance selling points following the amendments in the Financial Institutions Act in 2016, more products will be extended closer to the potential buyers.

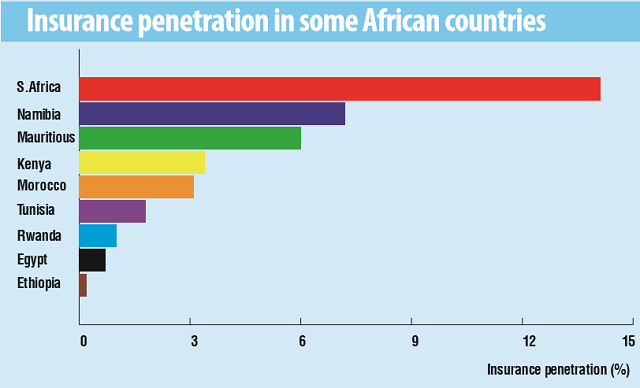

According to her, such proactive steps will grow penetration to 3% over the next 10 years.

She said the plan is built on 5 key pillars- technology, policy and advocacy, research, market expansion and capacity building.

“These will increase how much Ugandans spend on insurance and the penetration of insurance on the whole,” she said.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price