But the source of the precious commodity remains unknown

Kampala, Uganda | ISAAC KHISA | Gold has surpassed tourism and coffee to become Uganda’s biggest earner of foreign currency amidst concerns over its source.

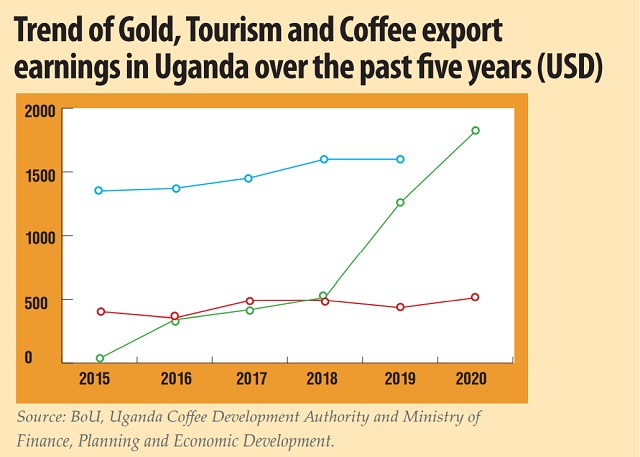

Latest data from the central bank shows that the east African nation exported 35,943 kilograms of gold worth US$1.82bn in 2020 compared with 27,758 kilograms worth US$1.25bn in the previous year amidst a drop in the demand for the precious commodity.

The country exported 13,216kgs worth in US$514million in 2018, 10,830 kilograms worth US$417 in 2017 and 8,639 kilograms worth US$339.54 million in 2016. In 2015, Uganda exported a paltry 1,118 kilograms of gold worth US$35.7million.

This implies that Uganda’s gold exports jumped 3,115 per cent and 4,990 per cent in volume and value respectively in the past five years signaling how the trade in the commodity has become so lucrative to the dealers.

The increase in foreign exchange currency, according to the Ministry of Energy and Mineral Development, is as a result of increase in imports and re-exports of the precious commodity to the foreign markets especially in the Middle East.

This comes at the time gold production in Uganda remains negligible, but has long been known as a conduit for gold worth billions of dollars mined in the neighboring Democratic Republic of Congo.

The trade fueled regional wars, funded rebel fighters and led to United Nations sanctions on traders involved, to try to stop the cash flows.

This saw Uganda’s official gold exports which had peaked at 6,921 kilograms worth US$122.94million in 2006 collapse, averaging just above 11kilograms worth US$0.24 million in 2014.

However, following the setting up of African Gold Refinery (AGR) in 2016 and four other small refineries – Simba Gold Refinery, Bullion Gold Refinery, Metal Testing and Smelting Company Limited, and Aurnish Gold Refinery – export volumes have since surged overtaking tourism that was hit by the coronavirus pandemic in 2020 and coffee since 2018.

Global perspective

Globally, demand for gold fell to its lowest in 11 years in 2020 as the coronavirus overturned the market, prompting huge stockpiling by investors but collapsing sales of jewellery and purchases by central banks, according to the World Gold Council (WGC).

The pandemic also transformed the geography of the bullion trade, sucking gold from Asia, where most gold is sold as jewelry, to Europe and the United States, where investors are the dominant consumers.

It also pushed the value of gold up 25% in 2020, because investors have much more impact on prices than the jewelry market.

Global demand for gold fell 14 percent to 3,759.6 tonnes last year and the first year below 4,000 tonnes since 2009. The year ended on a weak note, with demand over October to December at 783.4 tonnes, down 28% year-on-year and the lowest of any quarter since 2008, the WGC said.

Gold is traditionally used as a safe store of wealth, and investors bought 1,773.2 tonnes last year, up 40% from 2019 and the most for any year on record. Exchange-traded funds (ETFs) holding gold for larger investors added a record 877.1 tonnes to their stockpile, but those inflows reversed late in the year as money flowed back to assets that benefit from economic growth.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price