Kampala, Uganda | THE INDEPENDENT | The government has launched a new 210 billion-shilling financing initiative targeting large-scale farming activities in the country. The Financing Scheme for Private Large Scale Commercial Farmers is designed to overcome challenges encountered by farmers seeking financial.

It intends to provide timely, affordable, and accessible financial resources to farmers who are at the heart of Uganda’s agricultural economy, according to Matia Kasaija, Minister for Finance, Planning and Economic Development. Large-scale farming in Uganda is still limited by continuous reliance on traditional methods like hoeing, relying on weather conditions, and labor intensity.

Difficulties accessing markets are also another limiting factor. The new scheme establishes a financing mechanism to support Private Large Scale Commercial farmers to produce 132,600 metric tons of grain (maize, Beans, Soya beans, Sorghum) and animal feeds. It is proposed that this will cover a total acreage of 114,661 around the country.

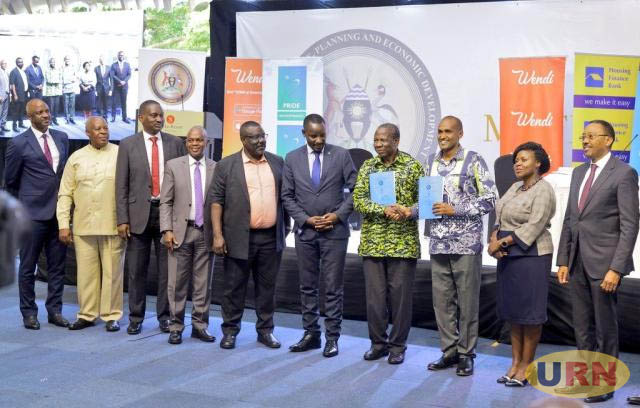

According to a memorandum signed between the ministry and implementing financial institutions, the fund will be shared between the government and the banks.

The government-owned financial institutions: Pride Microfinance (Pride Bank Uganda) Post Bank Uganda and Housing Finance Bank, will provide a principal (lending) amount of 176 billion Shillings.

To enable the banks to operate profitably while offering the loans interest-free, the government will meet the 40 billion expected corresponding interest component of the financing annually. This scheme, with a flexible loan repayment plan, will initially run for a period of six years and a review thereafter will inform its continuity.

The scheme targets to benefit companies, cooperatives, and other formal qualifying entities with available land or which are engaged in large-scale farming with a minimum of 50 acres of land. Frank Tumwebaze, the Minister for Agriculture, Animal Industry and Fisheries stressed that the money is not for trading but production.

On how the banks will determine the qualifying entities, Tumwebaze said his ministry would share profiled large-scale farmers with the Ministry of Finance and the financial institutions in all districts of Uganda. Tumwebaze, who says he proposed this initiative at the beginning of this term of government, said large-scale commercial farmers had not had a friendly financing framework that provides “patient” capital to finance large-scale agriculture production and develop enterprise value chains.

He appealed to the participating banks to effectively facilitate and be supportive to the applicant farmers who he said were left out of the recent initiatives. “While many other wealth creation programs like PDM (Parish Development Model) have provided funds, the target has mainly been small-scale farmers,” he noted.

“Today marks a pivotal moment in the continued efforts to empower farmers, enhance food and feed security, and drive sustainable agricultural growth in the country,” said Ramathan Ggoobi, the finance ministry Permanent Secretary and Secretary to the Treasury. The PSST said this scheme will support the government’s Tenfold growth strategy that aims to grow Uganda’s GDP from about 50 billion dollars in 2022/23 to 500 billion by 2040.

Agro-industrialization, an anchor sector of the strategy, aims to commercialize and formalize farming leading to a fivefold growth of agro-industrial exports with an estimated value of 20 billion dollars by then.

****

URN

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price