Kampala, Uganda | THE INDEPENDENT | The government has finally released the modalities for the disbursement of the Covid-19 relief package worth 200 Billion Shillings for small enterprises.

The fund was announced back in June as the government closed more sectors as part of the measures to contain the second wave of the Covid-19 pandemic. The money was meant for this category on grounds that small traders had always missed out on previous packages which catered for micro, medium, and large enterprises.

Large and medium enterprises have been given access to funds through the Uganda Development Bank and the Microfinance Support Centre, while micro-businesses have a chance to benefit from the funds that are channeled through the Saccos and Village Savings groups.

Now, the government is partnering with commercial banks and microfinance deposit-taking institutions across the country to manage the fund for small businesses, to help them recover from the effects that the pandemic and the containment measures have had on them.

Under the arrangement, the government provided 100 billion shillings for the commencement of the fund, while participating financial institutions are expected to contribute the other 100 billion. The funds shall overall be supervised by the Bank of Uganda.

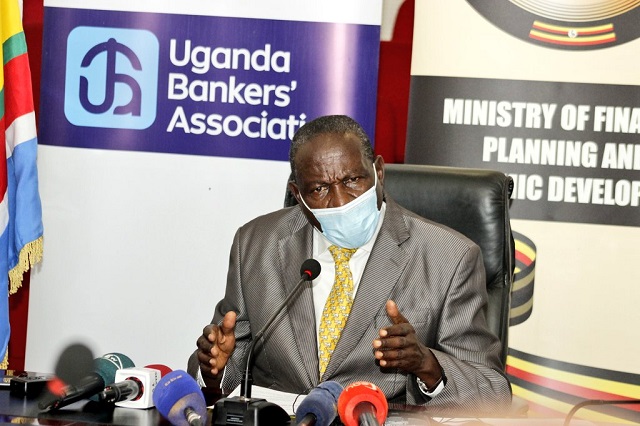

The Minister of Finance, Planning and Economic Development, Matia Kasaija says eligible businesses will include all small businesses operated by individuals, groups, partnerships, and companies employing 5-49 people and with an annual turnover of 10 million to 100 million shillings.

The participating institutions shall only charge an interest rate of up to 10%, on a declining balance basis, and this will also be limited to only the funds that the banks contribute, and not the government part of the funds.

Kasaija also said the facilitation fees charged by the lending institutions must not go beyond 0.5% of the sum borrowed. He said every borrower has only one chance to borrow from this fund, while those who have benefitted from previous funds are not eligible.

On why the banks have been allowed to charge interest and even ask for collateral and yet this is aimed to be a relief, the Uganda Bankers Association chairman Mathias Katamba says they have to be cautious because the money must be returned. But he says it will also help the borrowers move towards formalization of their businesses, which has been a major impediment to access to formal finance, among other benefits.

The negotiations on the fund also involved private sector representatives to avoid what the ministry called mistakes committed in the creation and management of previous funds.

The Executive Director of the Federation of Small and Medium-Sized Enterprises, John Walugembe Kakungulu welcomes the packaging of the fund which tried to eliminate multiple beneficiaries. He also welcomes the 10 percent interest as the best they could get from a loan facility.

He however expressed concern about the provision for collateral in the partnership agreement which has largely been left to the financial institutions. Walugembe says it should have been clearly stated the types of security or item that will be allowed by the lenders because most people know that land is the only acceptable collateral by banks.

Walugembe also says that provisions that make the beneficiaries formalize businesses are also welcome because they should also start contributing to the government revenues formally.

*****

URN

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price