Kampala, Uganda | THE INDEPENDENT | The Ministry of Finance has proposed establishing a mechanism to track the beneficiaries of interventions that helped Uganda recover from the effects of Covid-19.

Among the initiatives that were put in place by the government include the Emyooga program, small recovery fund, SACCO money through the Micro Finance Support Centre.

The others were the COVID-19 Economic Recovery and Resilience Response Program by the Private Sector Foundation and the MasterCard Foundation. The program extended immediate relief, recovery, and resilience interventions to counter the impact of COVID-19.

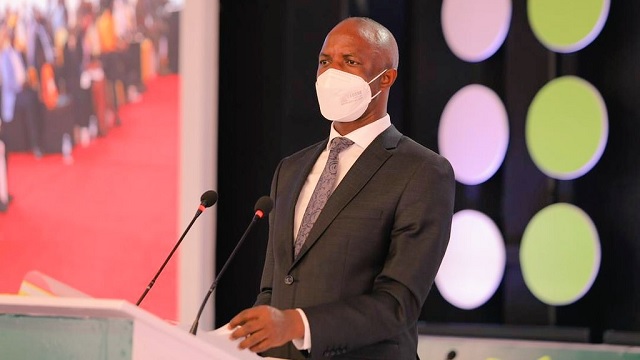

Ramathan Ggoobi, the Permanent Secretary Ministry of Finance says that as a ministry, they want to ensure that the interventions are well aligned to benefit a wide section of people.

He explains that without such a mechanism, the interventions might end up benefiting the same people.

Ggoobi was speaking in an interview at the sidelines of the launch of a five-year Micro and Small Enterprise recovery fund under the young Africa Works initiative targeting to support 50,000 enterprises recover from the effects of the pandemic.

Rashmi Pillai, the Executive Director of Financial Sector Deepening (FSD), the founder of the fund says that besides supporting the Small Medium Enterprises, they will also build the resilience of grassroots financial service providers by digitalizing their workflow processes.

She says they will also help to strengthen their capacity to attract more long-term institutions capital to address shocks for the sustainability of system growth.

Joseph Lutwama, the Director Programs, Financial Sector Deepening-FSD Uganda says the Fund has 70 Billion Shillings to benefit the youth and the women-owned businesses that employ and sustain the livelihood of many Ugandans.

According to Lutwama, unlike the several similar programs that have been in place, this fund will go ahead to work closely with the institutions in which the funds will be channeled to ensure that it is effectively implemented. These include microfinance institutions and SACCOs.

Patricia Ahumuza, the Compliance Officer Uganda Micro Finance Regulatory Authority, says that several surveys carried out worldwide project closure of small businesses and laying off workers. She says that such cases cannot be taken lightly by the government and such initiatives targeting the SMEs recovery need to be supported.

Eligible SMEs can borrow from 100,000 up to 10 million Shillings at an interest that will be determined by the lending institutions but not more than 25 percent.

*****

URN

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price

Ok.