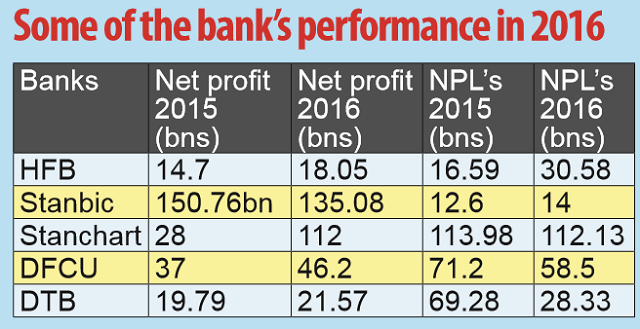

It now joins Stanbic, Stanchart, DFCU, DTB that have also recorded surge in profits in 2016

Uganda’s commercial banks spent almost the entire of last year worried about making money in a rather challenging economic environment that was characterised by high interest rates amidst slow economic activities.

But they seemed to have shrugged off the effects of the economic times experienced during the year and are now registering growth in profits compared with the previous year, with much of their profits coming from non-interest income drivers.

On April 12, Housing Finance Bank announced a 23% growth in net profit to Shs18.05bn in 2016, up from Shs14.7bn in 2015 and Shs 4.23bn in 2014 as result of high returns from investments in government securities, foreign exchange, and fees and commissions.

According to the bank’s annual performance results, its earnings from investments in government securities grew by a bigger margin to Shs 21.36bn in 2016, up from Shs 11.9bn in 2015 and Shs 8.26bn in 2014 while earnings from fees and commissions increased to Shs11.5bn, up from Shs 9.57bn and Shs 8.94bn during the year under review. Earnings from foreign exchange grew by 47% to Shs2.46bn, up from Shs 9.57bn in 2015 and Shs 8.94bn in 2014.

However, the bank’s Non-Performing Loans nearly doubled to Shs 30.58bn, up from Shs16.59bn in 2015 and Shs 18.14bn recorded in 2014 even as bad debts written off reduced to Shs 5.83bn, down from Shs8.46bn and Shs 18.94bn during the same period under review.

The bank’s deposits increased by 15.4% from Shs 306bn in 2015 to Shs 353bn in 2016 while total assets increased from Shs619bn in 2015 to Shs680bn last year.

HFB Managing Director, Mathias Katamba said the bank registered a surge in profits as a result of its improved efficiency and executing strategy that focuses on improving service delivery in spite of being a challenging year particularly for the real estate sector.

“During the year, we rolled out a new ATM Switch and card management system which enhanced the Bank’s capability to deliver more services including access to inter-bank ATM switch with over 300 ATM’s that customers can now use across the country, in addition to the mobile banking solution that was also officially rolled out during the year, where registered customers can now transact through mobile money agent network countrywide,” he said.

HFB’s performance comes at time when a number of other commercial banks including Stanbic, Standard Chartered Bank, DFCU and DTB have recorded double digit growth in net profits in 2016, with some recording bigger drop in their NPLs.

Stanbic recorded a 27% growth in net profit to Shs191.15bn last year, up from Shs150.76bn in 2015 and Shs135.08bn in 2014 as a result of investments in higher yielding government’s securities, loans and advances as well as good returns from investment of excess liquidity into the inter-bank market.

The bank saw both its non-interest and interest income grow at 21% last year, with the net interest income and non-interest jumping to Shs376bn and Shs267bn, up from Shs311bn and Shs211bn in 2015, and Shs 280bn and Shs214bn in 2014, respectively.

Standard Chartered Bank saw its net profit increase by 296% to Shs 112 billion last year, up from Shs 28 billion in 2015 and Shs 114bn in 2016 amidst a reduction in NPL to Shs 112.13bn, down from Shs 113.98bn and Shs 36bn during the same period under review.

DFCU bank recorded a 25% growth in net profit to Shs46.2bn, up from Shs37bn recorded in 2015 and Shs41.6bn in 2014.

These figures, however, do not include those of the recently acquired Crane Bank, whose NPLs accounted for Shs142bn out of the total industry’s Shs573bn in 2015.

Similarly, DTB recorded Shs21.57bn in 2016, up from Shs 19.79bn in 2015 and Shs23.7bn in 2014 in net profit owed to increase in earnings from investments in government securities, fees and commissions as well as interest on deposits and placements.

This performance so far indicates that the country’s commercial banks are for the second year in a row making their profits from non-interest services rather than the traditional drivers-loans.

Positive outlook

Analysts hope that profitability in the sector could be supported by the increase in private sector credit uptake driven by continued easing of monetary policy by the central bank. On April 12, BoU reduced its policy interest rate – the Central Bank Rate by 0.5% points to 11% in April, a signal for banks to lower lending rates.

BoU Governor Emmanuel Tumusiime-Mutebile said the decision to ease monetary policy was to support private sector credit and boost economic activities.

Since the previous reduction of the CBR in February this year, banks have announced reductions in interest rates for both new and existing loan facilities offered in local currency in a bid to attract borrowers and grow their loan portfolio. Official average lending rate currently stands at about 23% (year-on-year) down from around 25% recorded in most parts of last year.

****

editor@independent.co.ug

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price