Closing the financial inclusion gap will require government, private sector and development partners.

Kampala, Uganda | JULIUS BUSINGE | How can women and youth population participate in the country’s formal economic activities? This is what formed part of the discussion at a breakfast meeting organised by Financial Sector Deepening Uganda (FSDU) in Kampala on Oct.17 in response to the 4th 2018 Fin Scope study, released in June this year. The meeting attracted more than 100 participants.

Rashmi Pillai, the director of programmes at FSDU said while Uganda has 54% adult women and the rest men aged 16-35, majority of them are financially excluded and thus contributing less to the country’s economic activities.

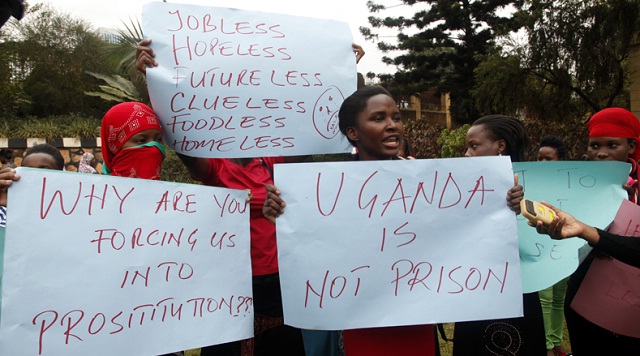

To make the situation even worse, nearly 40% of the financially excluded women do not have a source of income and thus, even if they have access to a formal bank account that makes it hard for them to actively participate in the sector.

It is on this basis that FSDU sought to demonstrate their support for a robust and more inclusive financial sector in Uganda, with a special focus on small holder farmers, women, youth, forcibly displaced people and micro, small and medium enterprises.

She also said the financial services sector has become a fast paced sector and that digital financial services – savings, ability to access credit, insurance and investments – are the future.

The 2018 Fin Scope study shows that 58% of the adult population (aged 16 years and above) use formal financial services, 22% are financially excluded and 20% only use informal financial services.

Similarly, 16% of men use formal savings mechanisms higher than 10% of women. In terms of digital payment, men were ranked at 62%, higher than women whose ranking stood at 53%.

Statistics also shows that only 57% of women who are financially included have digital connectivity compared to 69% of the included men.

Protazio Sande, the Fin Scope’s chairperson steering committee said there is a strong connection between financial inclusion and levels of economic growth.

He said over 60% of the SMEs in the informal sector are run by women and that the dynamics in this particular sector can change if the issues with regard to security are addressed. Sande stated that youth need to be organised and trained in the area of entrepreneurship so that they are able to use financial services.

He added that digitalization is the one currently advancing the inclusion agenda in Uganda evidenced by the recent uproar over mobile money taxes.

“It is important to ensure that majority of the people are formerly financially included for purposes of having orderly growth and development,” he said.

Annet Nakawunde, the managing director at Finance Trust Bank, who delivered the keynote address at the meeting, said exclusion of women and youth should be dealt with given that these two groups are interested in using financial services. She said inclusion should be driven by policies that support entrepreneurship.

Nakawunde suggested that banks, which only attract 11% of the adult population, improve on their customer relationship agenda as one way of attracting and keeping women and youth in banking.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price