Tourism opportunities

The government plans to do aggressive marketing of Uganda’s tourism in key markets like South Asia and Europe. It will also do tourist product development related to religious, historical, cultural, natural heritage and agro-tourism institutions.

Government will also reduce the minimum investment thresholds that allow investors in hotels and tourist operators to be eligible for tax incentives from $15million to $10million.

Transport infrastructure

Kasaija said in the New Year, the target for completion of paved roads is 6,000 km. He said rural roads connectivity and low-cost sealing of district roads will be prioritised. Road maintenance and rehabilitation of district, urban and community access roads and national roads will be undertaken.

The rehabilitation of the national airport, the meter gauge railway in the short-term and the revamping of water transport facilities will be prioritised. The construction of the Kabaale International Airport in HoimaDistrict, and the operationalisation of the Uganda National Airline, and the acquisition of two more Bombardier regional aircrafts have been prioritised.

In order to enhance access to tourism sites, an additional Shs57.8billion has been provided to UNRA to embark on the South-Westtourism circuit. In addition, support will be provided for rehabilitation of aerodromes to facilitate domestic flights.

Energy infrastructure

To further support economic activities, the government plans to have more power production. The lined up projects are; Ayago(840MW), the Oriang (392MW), the Kiba (330MW) and the Uhuru (600MW) hydropower projects will be developed in the medium to long term inpartnership with the private sector.

ICTs and sports

The government plans to extend the National Backbone Infrastructure for ICT to cover all districts. This plan will reduce internet costs through the implementation of the new national broadband policy. The policy will compel telecommunication companies to provide services to people countrywide. This will enhance improved service delivery both in Government and the private sector. In sports, the construction of the national high altitude centre in Kapchorwa is 68% complete and the Nakivubo stadium is undergoing reconstruction.

Minerals sector

This is another opportunity that the new budget intends to provide. Kasaija said the government will conduct the airborne geophysical survey of Karamoja region. It will also work on the divestiture of Kilembe Mines on a fast-track basis with an emphasis on prospective investors with capacity to carry out further exploration, following repossession by government from the previous investor.

It also plans to fast track the exploration of the 18 priority mineral target areas for rare earth, and metallic minerals to a level of certified mineral resource as well as carryout a review of the licensing rules and regulations to eliminate speculative and non-performing licenses.

Oil and gas development is also on top of the government’s agenda.

Implementing all these initiatives, Kasaija says the government hopes to create a solid base for the economy while creating jobs.

Matters tax

The minister reported that excise duty act was amended to provide for registration of manufacturers, importers and providers of excisable goods and services.

Going into the New Year, he said, this will also reinforce other tax reforms like digital tax stamps. He added that income derived from leasing or letting facilities in industrial parks has been exempted from income tax for 10 years from the date of commencement of construction.

Withholding tax on long term bonds has been reduced from 20% to 10% to encourage investment in long term government securities but at the same time reduce financing costs to government.

The stamp duty act was amended to provide for a uniform stamp duty payable on bank guarantees, insurance performance bonds, indemnity bonds and similar debt instruments in order to reduce the cost of debt financing and ease tax compliance and administration.

There is also going to be VAT exemption on agro-processing, rice mills and agricultural sprayers. In order to promote investment and industrialisation, import tariffs on products which are locally manufactured have been increased.

The government also plans to purchase and deploy scanners at major ports of entry into Uganda to facilitate faster clearance of goods and curb mis-declaration.

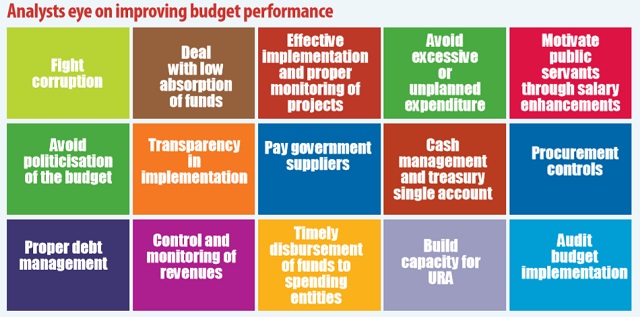

Going forward, critics, however, say Uganda’s budget has over the years appeared to be very good on paper but its implementation is the problem.

****

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price