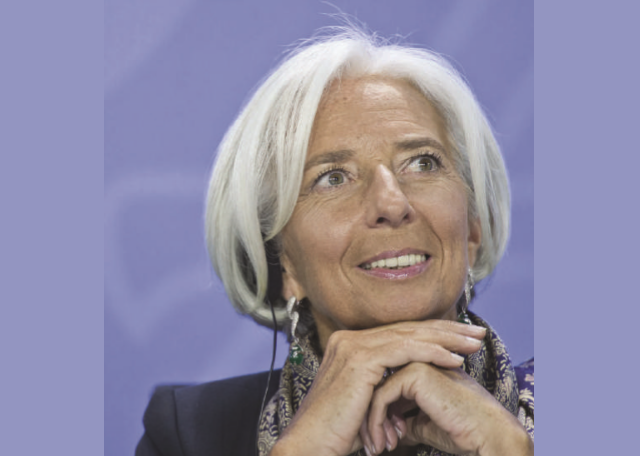

Christine Lagarde says government need to focus on reducing inequality

The International Monetary Fund Managing Director Christine Lagarde on Jan. 27 found herself on the defensive as the audience sought for the global fund’s roles on Uganda’s development.

This was during a public lecture held at the Kampala Serena Conference Centre under the theme “Becoming the champion: Uganda’s development challenge.”

The queries ranged from IMF’s liberalisation policies and conditions on loans that have had a disastrous impact on development to how a country can manage funding competing priorities amidst small resource envelope.

But Lagarde said she has not been in Uganda for the last 30 years although countries that adopted its policies have not suffered.

“Uganda has done well. That is my personal view,” she said, attracting laughter in the crowd.

She, however, said policies that Uganda chooses at the moment will determine whether or not will be on a road to overcome poverty and provide opportunities to the entire population.

Uganda’s poverty levels – measured by international ratings of US$1.25 earning per day per person –have declined to 19.7% in 2013 from 56.4% in 1993 – putting Uganda in the bracket of countries that met the target of the first Millennium Development Goal of halving poverty by 2015.

On increasing taxes, Lagarde said it makes sense for Uganda to have all sorts of taxes as longer as they are affordable and likely to attract Foreign Direct Investments (FDI) and increase domestic resource mobilization while lessening unwanted external resource mobilization.

In addition, Uganda’s tax to Gross Domestic Product ratio remained almost stagnant for 19 years at 11% from 1997 and has since grown to between 11-13%, which is lower than the 18% of Sub Saharan Africa.

“I suggest that there’s need to put in place concrete measures to strengthen value added tax (VAT) administration and removal of some exemptions on the VAT and corporate income tax,” she said. “The IMF estimates that this could raise revenue by 3% of GDP or more.”

She said government’s reliance on borrowing alone to finance infrastructure would be unworkable as debt would become too high and unmanageable in future.

Economists’ view

A section of economists, however, told The Independent that while they agree with some of the IMF policies, there’s need for the government’s inner involvement in driving economic activities to avoid exploitation of consumers by greedy investors.

“I can’t blame IMF; the blame is on government,” said Prof. Augustus Nuwagaba, a consultant at Reev Consult in Uganda. “The government can do anything as longer as it does not hurt the business or the consumer. Decisions must be fair to both parties.”

He cites BoU’s monetary policy – inflation targeting lite – that uses the Central Bank Rate – to determine interest rates in the market. He said this system has led the market record skyrocketing interest rates at the expense of borrowers and investment decisions.

For instance, sometime in 2012, prime lending rates for banks went up to approx.30% when the CBR touched a 23% mark amidst highest inflation levels of 30.5%, the highest since 1993.

Former Finance Minister and now Presidential Advisor on the economy, Ezra Suruma in his book; Advancing the Ugandan Economy: a Personal Account, says privatization led to the sale of Uganda Commercial Bank, which as managing director then, was performing well.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price