New report by BOU, UBOS shows decline in foreign direct investments, local sales revenues

Uganda saw a decline of $40 million in foreign direct investments (FDI) in 2015, according to a survey conducted by Bank of Uganda in conjunction with the Uganda Bureau of Statistics, Private Sector Foundation Uganda, Uganda Manufacturers Association, and the Uganda Investment Authority.

The survey report, which was released on June 24, revealed that foreign direct investment inflows amounted to $1,058.6 million in 2014, a decrease of 3.5% compared to the estimate of $1,097.1 million in 2013. The decrease in foreign direct investment in 2014 was mainly on account of lower inflows of new equity.

The survey collected information on foreign direct investment and borrowing in resident enterprises and on other variables pertaining to private sector investment. The information generated was used in the compilation of Uganda’s balance of payments, international investment position and macroeconomic analysis to inform policy decisions. The survey noted that foreign borrowing by resident enterprises from non-affiliated enterprises amounted to a net repayment of $9.4 million in 2014 while inflows of other capital which is comprised of borrowings from foreign affiliates increased to $317.1 million during 2014 compared to $250.2 million recorded in 2013.

The major recipient sectors of FDI during the year were mining and quarrying including oil at 49.9%, ICT (23.3 %), finance and insurance (18.2%) and electricity and gas (4.5%) while the largest inflows of foreign debt from foreign affiliates went to ICT, wholesale and trade, and manufacturing sectors accounting for 79.3% of the total disbursements from foreign affiliated entities received during 2014.

The major sources of the FDI were Netherlands, Australia, UK, Kenya and Mauritius and accounted for 86.8% of total FDI inflows received by Uganda during 2014.

Businesses in the wholesale and retail trade, electricity and gas and real estate sectors received 89.4% of the total disbursements and remitted 72.7% of the repayments to non-affiliated entities during 2014.

The survey comes on the heels of the UNCTAD World Investment Report 2015 (WIR-2015) that noted how global foreign direct investment (FDI) inflows had fallen by 16% in 2014 to $1.23 trillion down from $1.47 trillion in 2013 mainly as a result of the fragility of the global economy, policy uncertainty and elevated geopolitical risks.

The WIR-2015 had also pointed to a number of risks to the forecasts including ongoing uncertainties in the Eurozone, potential spill-overs from geopolitical tensions, and persistent vulnerabilities in emerging economies all of which disrupted the projected recovery.

Paul Kirabira, the senior investment executive (Research) at Uganda Investment Authority, said the findings of the PSIS survey 2015 as well as the ones prior to it are of profound importance in that they give the benchmark on the operation status of project level and distribution of investments and employment as well as the contribution of the sector to the development of Uganda.

The data offers the basis for informed decision making during investment promotion and policy formulation and the potential investors have also found it a very important source of information for their business viability studies, he added.

The survey notes that despite a slight decline in equity investment, new equity continued to be the main component of FDI inflows to Uganda. Of the 751 questionnaires delivered, 663 enterprises responded resulting in a response rate of 88.3%.

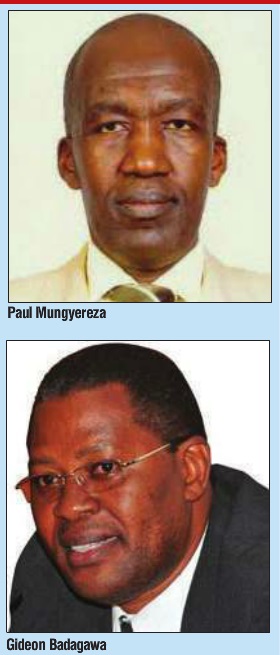

Gideon Badagawa, the executive director at the Private Sector Foundation Uganda, congratulated the business community that participated in the survey saying the information they volunteered is not in vain but is being used by government, the private sector and the development partners.

“The essence of these surveys especially the 2016 one and its uniqueness is coming at a time when several things have happened at the same time. We have just had the 15 point manifesto by the President and all these 15 points are about information in all sectors of the economy supporting and promoting investments. You cannot plan or take decisions without robust information.”

Of the 625 enterprises (94.3%) that responded to the survey were located in the Central region followed by 25 or 3.8% enterprises located in the Eastern and Northern region and 13 or 2.0% in the Western region.

The highest share of respondent enterprises (22.0%) was in manufacturing, followed by wholesale and retail activities (21.9%), finance and insurance (10.4%), I.C.T (6.8%), construction (6.5%) and transportation and storage (5.6%).

The survey revealed how there had been an increase in total sales revenue of 9.5% to Shs 24,105.5 billion in 2014 from Shs 22,014 billion recorded in 2013. The increase was largely on account of growth in construction, manufacturing, finance and insurance, I.C.T and wholesale and retail trade.

However, there was also a general decline in sales revenue across the various industries with arts, entertainment and recreation being the worst with a 59% decline from Shs 37.6 billion in 2013 to Shs 15.4 billion in 2014.

Paul Mungyereza, the executive director of UBOS, said all surveys covering national issues are carried out under the UBOS Act of 2008. At the same function Mungyereza launched the 2016 PSIS survey, which begins next month.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price