2012

2013

2014

2015

2016

2017

2018

2019

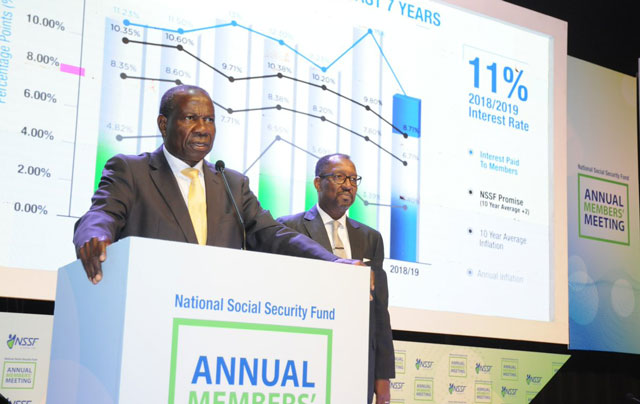

Kampala, Uganda | THE INDEPENDENT | Ugandans saving with the National Social Security Fund (NSSF) will earn 11 per cent on their savings this year, a drop from the 15 per cent declared last year. The new rate means that if you have savings of Uganda Shillings 2 million with NSSF, you will be paid an interest of 220,000 this year.

NSSF Managing Director Richard Byarugaba told the annual members meeting today that the conditions they operated in last year were tough especially on the stock exchanges across the region. The fall of stocks meant that NSSF incurred a paper loss of 402 billion Shillings.

Byarugaba said the fall in value was because most institutional investors were withdrawing from the equities in the region. This meant there was oversupply compared to demand, leading to a drop in value.

While announcing the rate, Finance Minister Matia Kasaija said that although there is a drop in the rate, other fundamentals indicate that the fund was still performing better than it did previously.

Patrick Byabakama, the NSSF Board Chairman said that the fund was on a growth trajectory and that share prices on stock exchanges were moving because of sentiments that should not worry the savers.

Byarugaba said the interest, despite it falling, was still above the 10-year inflation average of 6.2 per cent, which means savers continue to benefit from their money. NSSF collected at least 1.2 trillion Shillings last year, up from 1 trillion Shillings in 2017. This is on average 102 billion Shillings monthly.

NSSF grew assets to 11.3 trillion Shillings last year from 9.8 trillion Shillings in 2017.

But also, Byarugaba said, the bad news was the losses made on the foreign exchange, where the shilling appreciated against major currencies, meaning NSSF earned less from the holdings in Kenya, Tanzania and Rwanda.

Another area where NSSF got less revenue than anticipated was on the government bonds of the 15-year tenure. Byarugaba said the interest paid on this paper dropped from 17 per cent to 15 per cent which meant the fund earned less.

NSSF invests most of its money (80 per cent) in fixed income that is government securities and fixed accounts in the bank. At least 6 per cent of its money has been put in real estate where NSSF is constructing a couple of buildings around the country.

There are a couple of projects already in progress where NSSF is spending billions of Shillings.They include the pension towers along Lumumba avenue, Lubowa housing project, and the Kyanja housing project.

******

URN

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price