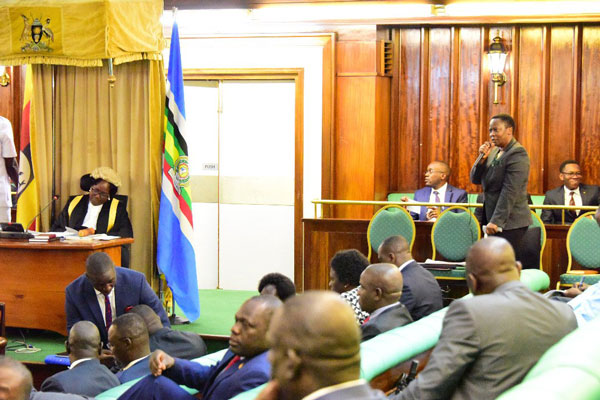

Kampala, Uganda | THE INDEPENDENT | The Speaker of Parliament Rebecca Kadaga has told off Benedict Sekabira, the Director Financial Markets Development Coordination in Bank of Uganda over his concerns on the central bank probe report.

In her communication during plenary on Tuesday afternoon, Kadaga disclosed that she had received a number of documents from Sekabira and Ms JN Kirkland and Associations raising concern on some of the findings, conclusions and recommendations by the Committee on Commissions, Statutory Authorities and State Enterprises (COSASE).

Kadaga said in order to ensure fairness, she has directed the Clerk to Parliament, Jane Kibirige to scan the documents and distribute them to legislators so that they can take them into account during debate on the report.

She also said that she would give the authors of the COSASE report an opportunity to clarify on some of the issues raised in the letters should they feel it necessary.

However, Kadaga took exception to threats in Sekabira’s letter where he indicates that in the event that his requests are not meant, he will have no option but to conclude that the speaker and COSASE have bias.

Kadaga said the threats are meant to blackmail her and arm-twist parliament and its committees.

On Thursday last week, COSASE presented its probe report following investigations into the close of seven commercial banks by BOU. The report recommended that all Central Bank Officials implicated in the sale of the loan portfolios of five closed banks be held personally liable.

The banks include International Credit Bank, Greenland Bank, Cooperative Bank, Global Trust Bank and National Bank of Commerce. The report particularly singled out Sekabira, the then Director Commercial banking and Justine Bagyenda, the former Executive Director Supervision BoU, saying they had conflict of interest in the transactions.

COSASE also recommended that the Inspector General of Police immediately seizes all land titles of the five defunct banks in possession of city lawyer Kakembo Katende of M/s JN Kirkland and SIL Investments, a loan collection company.

Investigations into the closure of Banks indicated that the Central Bank employed Kakembo Katende to secure a company that can buy the loans of the defunct banks.

According to COSASE, Kirkland identified M/s Octavian Advisors, which incorporated M/s Nile River Acquisition Company in Mauritius as a special purpose vehicle.

The company entered a contract with the Central Bank to collect loan from the customers of the defunct banks. COSASE says that JN Kirkland and Associates ended up as the local agent of the M/s Nile River Acquisition Company with rights to run an account in CitiBank where all recoveries of the sold loan portfolio are deposited.

It was also established that Nile River Acquisition later contracted SIL Investments to carry out the mandate and they have been collecting money from different debtors since 2008.

However, COSASE failed to locate Nile River Acquisition Company concluding that the debt collection mandate extended to SIL Investments is illegal. Katuntu faulted Sekabira before Parliament.

********

JN Kirkland Letter to Kadaga

In its response to the COSASE report, JN Kirkland says COSASE’s observation on the acquisition of purchaser of loan portfolios is completely false and misleading.

“JN Kirkland and Associates has never been an employee of BOU. The contract governing the relationship between us and BOU was submitted and discussed. In Clause 12 of the contract, it is specifically provided that the Consultant is not an employee of the Bank and this Agreement does not create any obligation, legal, financial or otherwise on the part client,” reads part of their letter to Kadaga.

The company also takes issues with the committee statement that they identified the purchaser of the loan portfolio, arguing that this conclusion is susceptible to misconstruction and can suggest that they hand-picked a buyer. JN Kirklans says that they never identified the buyer but rather identified a potential bidder who was professionally vetted.

JN Kirkland also says that the committee observations on the 93% discount at, which they bought loans of the defunct banks was misleading, taken out of context and creates an impression that there was some underhand dealings in the transactions. COSASE said that the 93% discount in respect of the loan portfolio of ICB, Greenland Bank and Co-operative Bank was incredibly outrageous.

“The Portfolio being discussed here is the leftover loans that could not be easily collected by the Liquidator after a period of close to nine years (“the residual portfolio”) of trying. This residual loan portfolio of ICB, Greenland Bank and Co-operative Bank, was all non-performing loans. Non-performing loans books with such aging do not attract the same discount rates as performing loans. In addition, the bulk of this loan portfolio was unsecured or poorly secured,” reads Kirkland’s response.

Kirkland says that all information was given to the Committee at the hearing on 11th January 2019 and their written submission on 15th January 2019 and that they believe that COSASE didn’t properly their submissions before arriving at a conclusion.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price