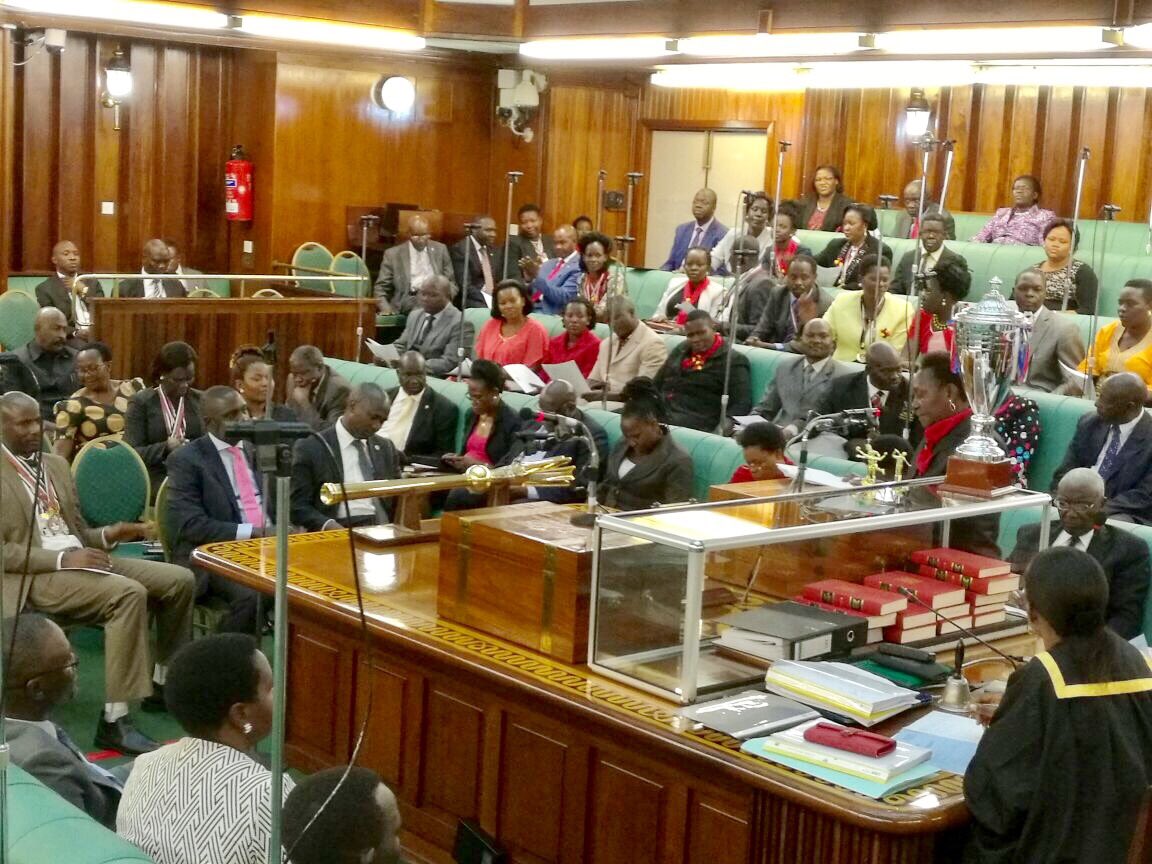

Uganda Parliament Speaker Rebecca Kadaga has confirmed that the Income Tax Amendment Bill (copy bottom) is now law.

Kadaga told parliament on Wednesday that technically, the law has been assented to despite President Yoweri Museveni returning the bill to parliament for the third time last month, seeking amendments. The Income Tax Bill has therefore been passed without amendments.

The bill seeks to amend the Income Tax Act, Cap. 340 to provide for carrying forward of losses in respect to mergers and acquisitions; to provide for the rate of tax payable by a non-resident person deriving rent from Uganda; to exclude public listed companies from the shareholding requirements as regards accessing benefits provided in an international agreement; to amend the definition of petroleum taxation; to impose an obligation on persons employed by diplomatic institutions and institutions with diplomatic privileges to file returns of income with the Uganda Revenue Authority; and for related matters.

“The Income Tax bill was already signed into law. I asked the President to ask the minister to table it as a bill,” Kadaga told Parliament, as Members of Parliament (MPs) had a final session Wednesday before the end of year break.

While the Income Tax Amendment Bill mainly deals with oil revenue, it also effects a proposal to exempt legislator’s allowances from taxes. MPs will enjoy tax exemptions despite condemnation from the public.

President Museveni had objected to the bill earlier in the year, stating that one of the proposals to exempt MPs would undermine efforts to improve domestic taxes.

In today’s session, MP Abdu Katuntu delivered a report from his Parliamentary Committee on Commissions, Statutory and State Enterprises (COSASE). It is related to the Attorney General’s findings for selected entities, including Uganda National Roads Authority (UNRA) and Uganda Broadcasting Corporation (UBC) for FY2013/14 and 2014/15.

MP Katuntu: There were incompetent contractors in @UNRA_UG , everything that goes wrong, went wrong in @UNRA_UG . #PlenaryUg

— Parliament Watch (@pwatchug) December 21, 2016

COSASE committee in their report on the Auditor General’s finds recommends that Hon Ajedra should be relieved of his duties. #PlenaryUg pic.twitter.com/Xts0XN5sbC

— Parliament Watch (@pwatchug) December 21, 2016

MP Katuntu: @ubctvuganda is another sick institution, it doesn’t pay its debts neither does it collect monies owed to it . #PlenaryUg

— Parliament Watch (@pwatchug) December 21, 2016

MP Katuntu: @ubctvuganda is another sick institution, it doesn’t pay its debts neither does it collect monies owed to it . #PlenaryUg

— Parliament Watch (@pwatchug) December 21, 2016

COSASE committee was concerned that @BOU_Official had not registered for VAT on claims that its expenditures were exempted. #PlenaryUg

— Parliament Watch (@pwatchug) December 21, 2016

MP Katuntu: To judge @UNRA_ED ‘s work at @UNRA_UG , when she joined UNRA , there was no institution. Everything was rotten. #PlenaryUg

— Parliament Watch (@pwatchug) December 21, 2016

MP Katuntu: The land title of the @ubctvuganda is still in the name of MP Margret Muhanga. #PlenaryUg

— Parliament Watch (@pwatchug) December 21, 2016

MP Katuntu: Govt spends a lot of money in advertising, if you watch @ntvuganda ,why can’t Govt also advertise with @ubctvuganda #PlenaryUg

— Parliament Watch (@pwatchug) December 21, 2016

MP Katuntu: Police ,IGG needs to take on the issue of land irregularities at @ubctvuganda . #PlenaryUg

— Parliament Watch (@pwatchug) December 21, 2016

Parliament adopts the COSASE committee report on the selected audits. #PlenaryUg

— Parliament Watch (@pwatchug) December 21, 2016

Income Tax Amendment Bill 2016 by The Independent Magazine on Scribd

****

editor@independent.co.ug

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price