Parliament asked to expedite Pension reforms as bosses defend cautious approach to investment

Only days after the National Social Security Fund (NSSF) slashed the interest rate paid to members from 13% to 12.3%, the Fund’s top bosses faced their members at their Annual Members Meeting on Oct.12, writes Patrick Kagenda and Juddie Kilungu.

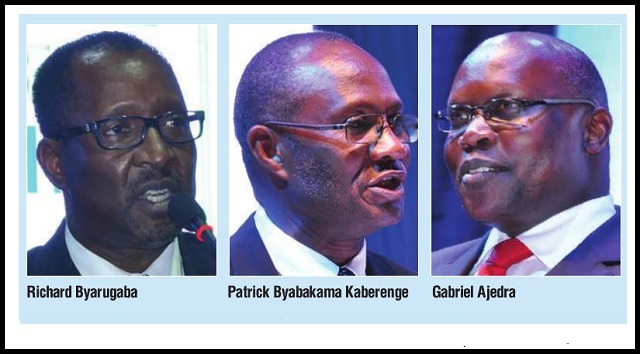

After making their routine speeches, Board Chairman Patrick Kaberenge and Managing Director Richard Byarugaba had to perform the more difficult task of taking the tough questioning from the members in line with the theme of the meeting- ‘transparency and accountability for the members savings.’ Gabriel Ajedra, the state minster for general duties, who was also the chief guest, was also keen to listen to both the questions and the answers. Earlier, Auditor General John Muwanga gave a report about the financial progress and status of the Fund.

Indeed, the year was a challenging one for the financial sector and other sectors as the economy grew at a lower rate than the estimate due to conditions outside Uganda. However, despite those challenges, NSSF benefited from a higher compliance rate, which brought more than Shs 74 billion in contributions. One member wondered how the Fund was able to pay an interest of 12.3%, yet it was generally hoped that it would be lower.

Byarugaba said one of the reasons the Fund has been successful is because of its diversity. “We have invested greatly in Kenya Tanzania and even Rwanda because they give very great tax incentives. They don’t charge tax on the interest that we earn, you find that in Uganda once we have invested and we have paid an interest rate income, there is a withholding tax I think of 15% or 18% which is charged with that. In those countries they have come up with specific bonds, specific infrastructure instrument which are tax free,” he said.

He explained that they had to go regional and also diversify for instance in the Tanzanian economy, which freed their capital markets and now there are more companies listing their like Vodacom. In Uganda, the last time a company listed was in 2012. Byarugaba suggested that the government needs to across to see what is happening in other places and pick a leaf. For instance, he added that the capital markets in Kenya have longer dated maturity paper extending up to 20 years.

One member asked why the Fund’s managers are too “cautious” when it comes to investment in real estate. Byarugaba argued that property prices have come down, “the market has crushed,” there is no liquidity, hence the need to be cautious and keep members’ money safely. He said ahead of the oil production, many rental properties were set up but most of them are empty.

Asked about the future of the Board, Kaberenge boasted that they had “done well in being cautious.” He said on a recent visit to the US, they found out that their national Fund invests 100% in government paper yet in Uganda they had invested ¾ of the money in Government securities in terms of debt and bonds. Asked if the Fund was looking to benefit from the oil and gas industry, Byarugaba said they would only think about if any of the oil companies considered listing on the Uganda Securities Exchange.

“Why is NSSF slow on influencing policies that should allow midterm benefits like education health and housing?” Another member asked.

In response, Byarugaba cited the outdated law. He said if the law were amended, it would allow them to introduce new products. “There are advantages of reforming this sector but it’s the politicians that have to make the decision,” he stated.

“We have regulators in place and you pay the regulator money yearly, what value addition has they brought to NSSF? And is NSSF giving bailouts to companies that are crying out?” Another member asked

“I think there is a conflict of interest that has been built within the law but I suppose the law has actually provided that the regulator will be funded by the players in the industry,” Byarugaba said, before distancing the Fund from any bailout proposals. Byarugaba said they have “strong views” about some of the clauses in the Bill currently before Parliament adding that what needs to happen is that that law needs to change fundamentally so that it reforms the sector so that the Fund can do some of the “interesting things” that many of the members are demanding including new products, midterm benefits, being able to go the informal sector. “We do not want to destroy the NSSF; it has proved itself and can resolve the problems of our savers,” he said.

However, Economist don Fred Muhumuza of the Makerere University College of Business & Management Sciences, told The Independent that the Fund is currently torn between seeking to make quick money and taking on a developmental role that savers would like to see.

For example, one of the reasons the Fund is a major shareholder in Housing Finance Bank (possibly up to 49% shares) was to enable members get mortgages for housing. That has not happened as HFB behaves like a commercial bank. NSSF could have used its shareholder position to bear and change the strategy but it also needs to change its own strategy first. “Thus shareholders or members of the Fund have a point,” he said.

BEST NSSF EMPLOYERS AWARDS 2016

OVERALL WINNER AWARD – DFCU Bank

PLATINUM – Price Water House Coopers

GOLD – Electricity Regulatory Authority

SILVER – Jubilee Insurance Company

BRONZE – Kampala Motors Ltd

****

editor@independent.co.ug

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price