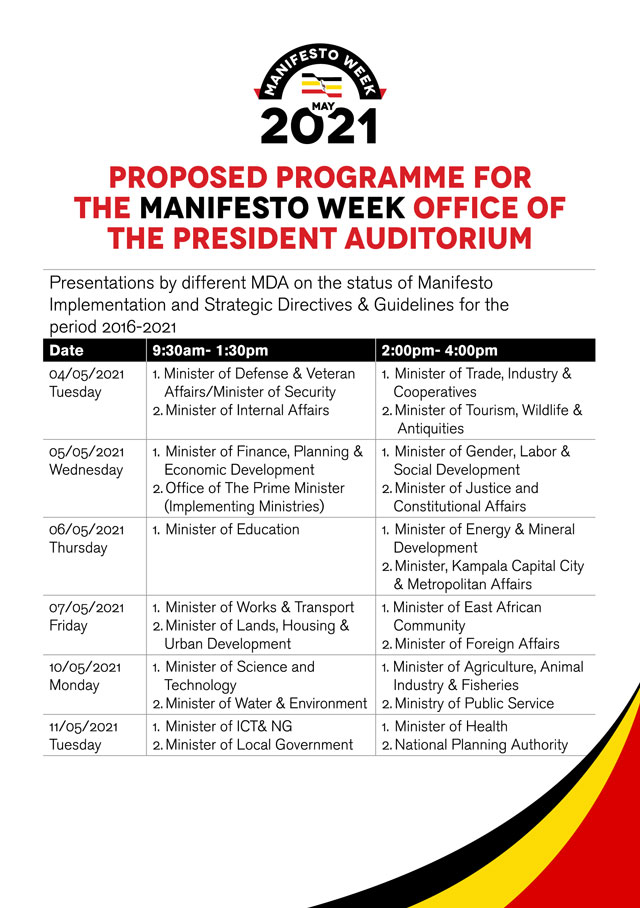

NRM MANIFESTO WEEK | The Ministry of Finance, Planning and Economic Development (MoFPED) listed its top achievements in the last five years during the 2021 Manifesto Week at the Office of the Prime Minister in Kampala. Presenting the achievements, the Minister of Finance, Matiya Kasaija, said on the target of 7% annual economic growth, the ministry performed slightly lower.

“The average real GDP growth between FY 2016/17 and FY 2019/20 was 4.9% which is below the growth target of 7% as stipulated in the manifesto. This was due to a number of shocks like droughts, floods, armyworm that attacked maize and then locusts. However, the economy attained higher growth between FY 2017/18 and FY 2018/19, registering an average growth of 6.5 percent. Unfortunately, the outbreak of COVID-19 negatively impacted economic activity with real GDP growth declining to 2.9% in FY 2019/20. This was due to the lockdown restrictive measures on people movement across borders, closure of non-essential businesses and supply chain disruptions which mostly affected the manufacturing sector,” Kasaija said in his presentation.

He noted that in order to strengthen the revenue capacity of local government units, MoFPED disbursed over Shs1 trillion between 2016 and 2021. This is broken down as follows: FY2017/18 – Shs. 493.86 Billion, FY2018/19 – Shs. 554.9 Billion , FY 2019/20 – Shs. 358.2 Billion, and FY 2020/21 – Shs. 370 Billion.

This was supported by a well maintained macroeconomic stability. Government through Bank of Uganda (BoU) continued to implement the Inflation Targeting monetary policy framework and succeeded in keeping inflation low and stable, consistent with our medium-term target of 5%. The monetary policy stance implemented was aimed at boosting private sector credit growth so as to strengthen the economic growth momentum. The CBR was reduced to 7% since June, 2020 from 17% in January, 2016 as the low and stable inflation outlook provided room for a reduction in the policy rate to support economic growth.

The average annual headline inflation for the period of 2016 to 2020 remained low at 4.3%. This was due to prudent macroeconomic policy adopted by government, as well as increased supply of agricultural produce to the market which brought down food prices. The graph below shows inflation trends in FY 2015/16 to FY 2019/20.

To support the urban poor access credit, the Micro-Finance Support Centre Limited (MSCL) was restructured. This followed a study that was conducted on the urban ghettos, MSCL has increasingly been lending to enterprises in the urban ghettos targeting the urban poor. In order to reach the urban poor, MSCL established satellite contacts in downtown areas where on given days, staff are deployed to respond to the needs and facilitate credit services to the urban poor.

In the manifesto, the NRM Government committed to undertake sustained effort towards production, productivity and value-addition in order to enhance incomes, industrialisation and job-creation. To achieve this, over the last five years, the Government distributed improved seeds and breeding materials under Operation Wealth Creation (OWC) and National Agricultural Advisory Services (NAADs) to the District Local Governments (DLGs).

These seeds include: coffee, maize, beans, Cassava Cuttings, Banana suckers, Irish Potatoes, tea, Citrus, Mangoes, grafted apples, pineapples suckers, cocoa, and rice. For instance, as a result of these efforts there was: Increased coffee production from 5.7 million 60-kg bags to 7 million bags between 2017 and 2019; and fish catches grew from 391,000 metric tonnes to 561,000 metric tonnes between 2017 and 2019 while fish export volumes have increased by 27%.

Also the government established and rehabilitated water for production facilities such as valley dams, valley tanks, irrigation schemes, and small-scale irrigation demonstrations and water harvesting sites to increase availability of water for agricultural production at farm level. Such irrigiation schemes include Doho in Butaleja District, Ngenge in Kween district and Mubuku in Kasese among others.

As regards to the manifesto pledge of introducing targeted incentives for the private sector-led value-addition and industrialisation, indeed the government Introduced power subsidy of US$5 cents for manufacturers who qualify as extra-large industrial consumers i.e. having a heavy load of 11,000 volts or 33,000 volts with an average demand exceeding 1,500KVA. However, Government intends to upscale this tariff to benefit all manufacturers in the long-term.

Similarly, the MoFPEDstreamlined tax incentives by embedding them in Tax Laws to promote transparency and predictability. The tax exemptions benefit both fiscal and non-fiscal incentives for developers in and outside industrial spaces.

To further operationalize the 2015 BUBU Policy, the Public Procurement and Disposal of Public Assets Authority (PPDA) guidelines of 2018 on reservation schemes were enacted to promote local content in public procurement. Database of local suppliers in the Oil& Gas sector was established to enable them work with foreign investors.

Over the last five years, the Government injected Shs1.1 Trillion in Uganda Development Bank (UDB) to provide long-term financing for manufacturing and agriculture and Uganda Development Corporation (UDC) as a financing strategy to enable domestic firms/ investors acquire cheap capital.

To address constraints like high lending interest rates, Government undertook reforms in the Financial Institutions (Amendment) Act, 2016 to promote the legal and regulatory efficiency in the financial sector. These reforms like agent banking, and Islamic financing have helped in reducing the overhead cost of financial institutions and other key factors considered when determining interest rates in the financial sector.

Over the last 5 years, Government promoted sound public investment management systems by strengthening capacity in Local Governments and ministries for project preparation and appraisal to ensure value for money in all public investments, including putting in place a procurement policy. For instance, Government injected resources in the development of the Third National Development Plan (NDP III) towards public investments with the view to support the delivery of key public services, connect citizens and firms to economic opportunities; so as to generate the requisite economic growth impact.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price