Criticism of over-concentration on infrastructure projects is not new. The renowned economist, Dr. Ezra Suruma, who is a former Finance minister is reported to have told The East African in 2014 that not only is most of the money spent on infrastructure externalised by the foreign firms that invariably get awarded the contracts, the growing pile of debt, a lot of it hinged on future oil earnings, is shunting much needed capital away from other sectors of the economy.

“When infrastructure is put forward as the only thing, as it were, then it is not the only thing; there are other equally important areas of public policy, for example employment,” he is reported to have said at the time.

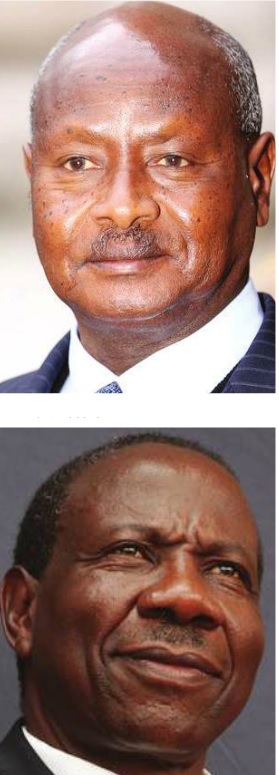

According to experts in finance matters, Museveni’s situation is not helped by the fact that all this is happening when the government is cash strapped because of economic hardships that have hit local businesses straining government tax revenue.

The international development lending arms, like the World Bank, are also playing hide and seek with Uganda. Towards the end of last year, the World Bank suspended hundreds of millions of dollars in financing for roads. It did the same again early this year. In total, that is some much-needed US$670 million being withheld by the World Bank. The suspensions have hurt the government financially and are seen as one of the many challenges hitting Museveni’s infrastructure binge.

Finance Minister, Matia Kasaija told The Independent that he had taken issue with the World Bank’s decision.

“I have told them that they have treated us unfairly,” he told The Independent in a telephone interview, “you cannot punish me twice for one mistake.”

Specifically, the World Bank suspended the financing for the Kamwenge-Fort Portal road in December 2015 citing “contractual breaches related to workers’ issues, social and environmental concerns, poor project performance, and serious allegations of sexual misconduct and abuse by contractors.”

After this, in January this year, the World Bank again suspended funding for two more road projects in Uganda apparently because government had not acted on the issues with the Kamwenge-Fort Portal road.

The suspended funds this time were part of the The Albertine Region Sustainable Development Project, which supports the protection of the sensitive biodiversity around in the Albertan Grabben, and The North Eastern Road-Corridor Asset Management Project, aimed at deepening the integration of East Africa by promoting regional trade. This suspension directly affected the 100kmKyenjojo-Kabwoya and the 340km Tororo-Mbale-Soroti-Lira-Kamdini roads.

Officials at finance hurry to dismiss any claims that Uganda is over-leveraging. Some cite a 2014 IMF statement that said: “Uganda has low external debt and high international reserves. The authorities have prudently limited external debt’s increase to 4 percent of GDP since 2007. At 18 percent of GDP now, there is space for new borrowing to finance infrastructure investment with a low risk of creating distress.”

But as officials keep pushing to get the financing for these projects, questions about Uganda’s growing debt also persist.

According to the Finance Ministry data, domestic debt as at June 2016 stood at Shs11 trillion or 13% of GDP. Total public debt meanwhile was at about Shs30 trillion. This debt, officials insist, is far below the Public Debt Management Framework threshold.

Efforts to reach Muhakanizi for a comment were futile as he couldn’t pick calls to his known numbers. A contact at Finance said he was locked up in several meetings. But he earlier told The East African that he hoped to convince the Chinese to release the financing for the SGR.

****

editor@independent.co.ug

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price