COMMENT | DR SIMON M MUTUNGI | During the British imperial rule in India, the city of Delhi found itself grappling with a significant infestation of venomous cobras. In an earnest attempt to mitigate this issue, the British colonial government instituted a reward system for the public: a bounty was offered to locals for each dead cobra. Initially, this strategy appeared as a pragmatic means to address the perilous snake problem plaguing Delhi.

However, an unforeseen turn of events transpired as entrepreneurial individuals started breeding cobras with the sole aim of collecting the offered bounties. Recognizing the unintended consequences of this policy, the government swiftly decided to terminate the reward program. This abrupt policy shift left the cobra breeders in possession of a surplus of now worthless snakes, prompting them to release these dangerous snakes into the wild. Ironically, this well-intentioned initiative ultimately led to an exacerbation of the cobra population, leaving Delhi in a more precarious situation than before.

Since then, “The Cobra Effect” has served as a cautionary tale about the potential pitfalls of well-intended policies and interventions that can backfire and create unintended negative consequences. It has since become a metaphor used in economics and public policy discussions to illustrate such situations. Interest restriction on loans is one such policy with similar pitfalls.

Earlier this year, in June, at a cabinet retreat held in Kyankwanzi, President Museveni assigned the Attorney General, Mr. Kiryowa Kiwanuka, with the responsibility of conducting research into the potential enactment of legislation aimed at overseeing interest rates in Uganda – effectively reviving decades-long deliberations regarding interest rate caps. This ‘homework assignment’ to the Attorney General stems from an understandable frustration on the part of the President and the general public.

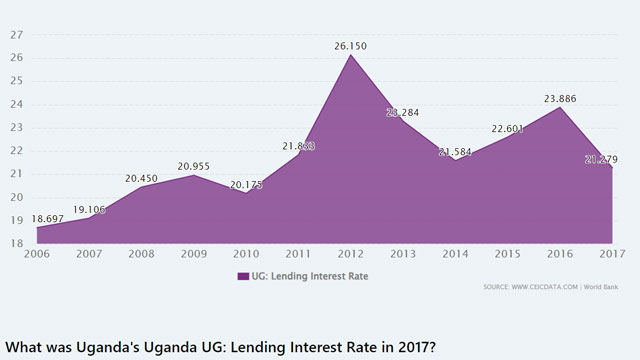

Following Uganda’s financial reforms and liberalization in the early 1990s, the country’s banking system has been characterized by high-interest rates, wide intermediation spreads, and substantial bank profitability. Since mid-2011, the average lending rate in Uganda has exceeded 20%, while implicit deposit rates have averaged 13% over the same period. Compared to regional peers, Uganda’s lending rates are high in both real and nominal terms with a significantly higher interest rate spreads. For instance, according to the World Bank, Uganda in 2017 had the fifth highest nominal lending rate on the continent at 21.2%.

According to Central Bank (BoU) data, the prime lending rates on shilling denominated loans from the final quarter of 2022 through the first quarter of 2023 averaged 20.5 %. For foreign currency loans such as the US Dollar, the weighted average lending rate decreased to 7.7 % during the first quarter of 2023, marking a decline from the previous market average rates of 8-10 %.

The Cobra’s Bite behind interest rate caps

Interest rate caps, while well-intentioned, can lead to two major problems namely:

- Reduced access to credit and credit rationing: Caps often discourage lenders from offering loans to high-risk borrowers, limiting access to credit for those who need it most – Small and Medium Enterprises (SMEs). Instead, lenders might ration credit apportioning most of it to the wealthy class or provide smaller loan amounts to SMESs to comply with caps, negatively impacting borrowers’ ability to meet their financial needs. Consequently, this hinders efforts to promote financial inclusion by limiting the availability of credit options in the market.

- Informal lending: With reduced credit options, borrowers who can’t access formal credit may then turn to informal lenders, potentially facing higher costs, rates and risks. This would ironically exacerbate the problem the President is trying to solve – pushing the public towards unscrupulous loan sharks who despite the 2016 enactment of the Tier 4 Microfinance and Money Lenders Act have continued to subject clients to unconscionable repayment terms with much higher interest rates than their bank counterparts.

The following are drivers of high interest rates (and the Panacea)

- High operational costs: These encompass a wide range of expenses associated with the day-to-day operations and management of a bank often eating into banks’ revenues consequently driving profitability down. Nonetheless, some banks have consistently posted profits. For example the largest bank by assets, Stanbic Bank posted a profit of Shs275b in 2021 and Shs243b posted in 2020 despite the COVID-19 pandemic storm.According to a 2020 study by the International Growth Center, the high operational costs are partly due to redundant infrastructure. Exploiting opportunities for infrastructure sharing for instance through adoption of open banking techniques, shifting from branch-dependent banking toward financial technology (FinTech) platforms and agency banking could significantly reduce these costs. Allowing staff to work from home, outsourcing non-core functions like customer support and data entry to third-party providers would respectively allow banks to reduce rental costs on office space and focus on their core competencies reducing labor and infrastructure expenses.

- Increased government borrowing from the domestic market: This increases the demand for credit, reduces lending capacity for the private sector, raises inflation expectations, introduces risk premiums, and prompts tight monetary policies. These factors collectively contribute to an environment of elevated interest rates in the domestic market. Reducing government borrowing reverses the crowding out of SMEs from the credit pool. It could also potentially lead to lower real government bond and treasury bill rates. This change in the incentive framework might encourage banks to shift their preference away from holding high-yielding government securities toward riskier assets – SMEs.

- Non-performing loans: Banks become more risk-averse when there is an increase in bad loans. To compensate for the risk of potential loan defaults, they add that risk premium to the interest rates, essentially increasing it. Ironically, increased interest rates are a correlation and causation factor for loan defaults. The June 2022 BoU Financial Stability Review revealed that the ratio of these bad loans to total gross loans was 5.3% but warned that this number could increase in the near term due to rising lending rates.To counter this problem, banks can invest in technology adoption of data analytics and artificial intelligence to enhance their credit risk assessment and monitoring techniques. Loan diversification, frequent strategic portfolio reviews and training of staff could also assist in identifying and addressing potential weaknesses or concentrations of risk.

- Lack of competition: A concentrated economy with few banks allows them to set higher interest rates on loans and offer lower rates on deposits since customers do not have alternatives to choose from. With its small size, Uganda’s economy is not so much a problem of a few banks but rather that smaller financial service providers face almost insurmountable entry barriers into the market. The recent increase in capital requirements from Ugx25b to UGX150b while well intentioned almost solidified the entrance gates closure. To overcome this, smaller banks can be incentivized to consolidate and prop up competition against the larger banks. This can be achieved through tax breaks, grants and subsidies by the government. Government should also support the FinTech sector as it has notoriously driven down banking costs worldwide through aggressive competition. The enactment of the decade-long shelved Competition Act would also be helpful.

The Cobra’s Bite on Kenya’s Banking System

In conclusion, the Kenyan experience offers some crucial insights into interest rate caps. Kenya implemented an interest rate cap in 2016 and removed it in November 2019. Initially set at 4%, equal to the Central Bank’s base rate, the cap aimed to make credit more affordable for SMEs and individuals.

After years of lobbying and pressure from the International Monetary Fund, then President Uhuru Kenyatta, who with popular support initially advocated for the cap, refused to renew the cap due to the aforementioned unintended consequences. SMEs, in particular, were adversely affected, with reports of denied loans amounting to around Kshs300 billion ($2.97 billion). Credit extension to SMEs as a percentage of total bank loans also decreased from about 25% to 15% after the cap was introduced.

********

The author has master’s and doctoral training in financial sector regulation. He is currently servicing a 20 percent interest rate loan with a local bank.

shakamara@gmail.com / @shakamara on Twitter/X

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price