The company acquired LAC at US$ 6.5million

Kampala, Uganda | JULIUS BUSINGE | South Africa-based financial services firm, Sanlam, has upgraded its market share in Uganda with the acquisition of Lion Assurance Company (LAC) at US$6.5million. This follows approval from the Insurance Regulatory Authority of Uganda (IRA-U) nearly two weeks ago.

Sanlam through its subsidiary, Sanlam General Insurance Uganda Limited (SGIU) controlled merely 3.85% of the market share out of the country’s 21 non-life insurance industry players according to the latest data from IRA-U while LAC controlled 6.7% market share.

But LAC’s market share might have gone up this year following the acquisition of AIG insurance which had a controlling 7.1% market share as at the end of 2016.

LAC’s parent company, Masawara, a public limited company incorporated in Jersey and listed on the London Stock Exchange with about US$300 million in assets and with other operations in Botswana and Zimbabwe, moved to sell its Ugandan subsidiary to settle the Group’s long term debt facility.

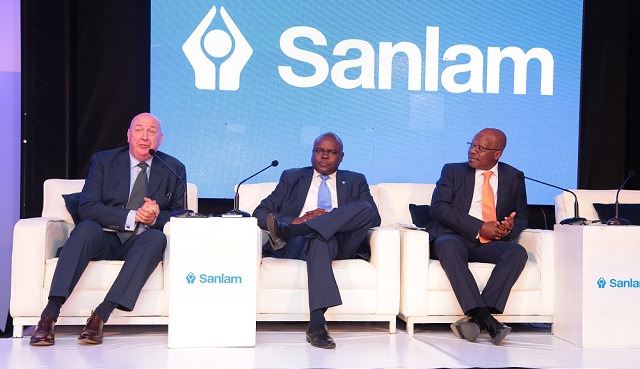

Julius Magabe, Sanlam’s regional executive for East Africa told The Independent on Nov. 21 that the new acquisition and the subsequent merging of the two entities has raised its overall market share in the general insurance industry and that the business is now valued at US$20 million (Approx. Shs 70bns).

Magabe said that the acquisition of LAC was because the latter had significant market share in Uganda and that it had carefully designed products in the areas of motor, financial (loan protection and fidelity guarantee), personal accident and fire insurance among others.

He said the success of the new acquisition was also triggered by SGIU’s product offering of services – for personal, commercial and corporate clients now with a 5% market share.

“We are unlikely to drop any service that Lion was offering; actually if we did, we would lose the value of the integration. All we will do is to improve on whatever was offered by Lion,” he said.

SEM’s Chief Executive Officer, Junior Ngulube said Uganda’s insurance sector is a key market in Africa and the transaction supports their strategy of bold-on acquisition to achieve scale.

“We are also confident that this transaction will offer us an opportunity to strengthen our position in the market while benefiting our clients who will have access to the combined expertise of our staff as well as our product range,” he said.

Rebranding

Ngulube said LAC will be rebranded to SGIU in line with Sanlam Group’s aim of strengthening its identity and expanding its visibility in Uganda and beyond. SGIU also operates in Kenya, Rwanda and Tanzania.

To the clients of the two merging companies, executives said, LAC would renew all existing client policies under the Sanlam brand. In addition, LAC client policies will be managed by SGIU who will administer claims, organize any changes to existing policies and provide cover for any new requirements for LAC clients.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price