New strategy of pay-out boosts confidence

Kampala, Uganda | ISAAC KHISA | Uganda’s National Social Security Fund (NSSF) seems to be determined to bring more savers to its portfolio, its statistics show.

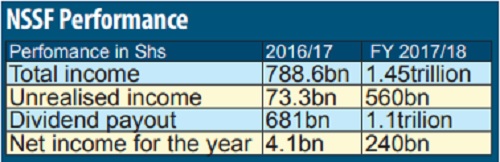

The Fund’s latest Transparency Statement reveals that though it recorded growth in income from Shs788.6bn to Shs1.34trillion, with nearly half of it being unrealised, it paid out dividends worth Shs1.1bn to its savers for the year ended June 30.

This represents a 60% surge in dividend pay-out. NSSF recorded a seven-fold growth in unrealised income from Shs73.7bn to Shs560bn during the period under review citing a surge in the share price for listed companies where it has stakes across the East African region. In addition, the depreciation of the shilling led to an increase in the value of investments.

Unrealised income is profit or gain that has been made but not yet realised or collected through a transaction– such as a stock that has risen in value but is still being held. Significantly, though, is that the dividend pay-out to the savers contributions was pegged on both realised and unrealised income.

This means that NSSF paid dividends to its savers prior to collection of some of its profits or gains that substantially contributed to the growth in income amidst the risks of non-collection or even losses, financial experts told The Independent.

The Fund paid a 15% interest rate on savers contributions – the highest ever in the country’s history – for the Financial Year 2017/18 citing good performance of the economy. “NSSF’s decision to pay 15% interest to social contributors based on realised and unrealised income is okay as they complied with a relevant accounting standard in recognition of such income but most importantly is that the Fund is trying to tell people that it is capable paying high returns, said Peter Otyanga Bere, a certified public accountant attached to Alebtong District.

He added that such interest pay outs attract more (voluntary) contributors or savers. The payout means that NSSF has enough cash generated from its ordinary operations and that it is better to invest with it than save with the commercial banks that usually give interest rate of 6-12% depending on the value of saving, he explained.

Bere said the NSSF decision implies that whereas they are yet to collect a good chunk of their income, the risks attached to it are low.

He, however, said the move could at times be risky in the event that there are no proper systems in place to mitigate risks of writing off such unrealised income.

Similarly, a source who preferred anonymity said NSSF’s inclusion of unrealised income in payout dividend may cost the workers at some point in case of failure to come up with a good plan to collect the contribution for savers. “The inclusion of unrealised income in paying dividend to savers may not well represent its performance.

This is because once share prices falls, then, that unrealised income may also be wiped out,” he said. He, however, said NSSF is well positioned in that it has diversified its investments. NSSFs’ Assets Under Management (AUM) has grown from Shs5.68trillion in 2015/2016 to slightly over Shs10trillion as at the end of July 30, 2018, with 75% of the total assets invested in fixed income (treasury bills and bonds), 18% in equities (listed companies), and about 7% in real estate.

The Fund states that 60% of the assets are invested in Uganda, 31% in Kenya, 8% in Tanzania and 1% in Rwanda. Some of the companies that NSSF has substantially invested include; dfcu, Umeme, Stanbic Bank and Safaricom.

NSSF’s total savers contributions increased by 14% to Shs1.05trillion for the FY2017/2018 comparedto the Shs917billion in the previous year. This was the first time in the history of NSSFthat it recorded over a trillion shillings in collections from members citing a steady rise in compliance level reported at 81% over a three months’ period.

Contributions from the Fund’s voluntary members totalled to 10,000 during the period under review. Benefits paid to qualifying members rose by 29% to Shs360billion for FY2017/2018 from Shs278billion the previous year.

On the other hand, the cost to income ratio declined by 1% to 12.6% for the Financial Year 2017/2018 from 13.4% the previous year. NSSF currently has 2.2million members but only 900,000 are active. The target is to have at least 5 million by 2025.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price