Unfavourable economy forces NSSF to cut interest rate for first time in six years

For every Shs 1 million you have saved with the National Social Security Fund (NSSF), Shs 123,000 has already been credited to your account as interest payment. Of course this is lower than the Shs 130,000 you received for every Shs 1 million saved in 2014/2015, thanks to the unfavorable economic environment that prevailed in the 2015/2016 financial year.

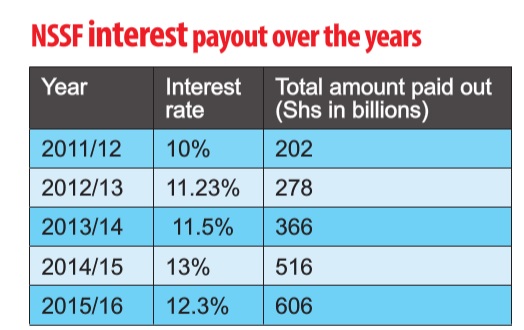

Matia Kasaija, the minister of finance, planning and economic development, announced the 12.3% interest rate in Kampala on Sept.30, as stipulated in the NSSF Act. During the year, the provident Fund made a profit of Shs 491 billion after tax, but the 12.3% interest rate translates into over Shs 606 billion – a big increase from the Shs 516 billion it paid to members as interest in 2014/15. The interest payment is higher than the profit because NSSF sets aside a surplus account to ensure that its members get a handsome interest payment even when it makes lower profits than expected.

Kasaija told journalists that although the interest rate slightly dropped from 13% in the previous year, it was still above annual inflation, which ensures that members’ savings are not being eroded.

“The rate this year is above the 10-year average rate of inflation, now at 8.85%, against which the fund rates itself. This means NSSF is indeed growing the value of its members’ savings,” said Kasaija. “I am also pleased to note that despite the tough investment environment, the Fund has performed well, as reflected in the interest rate that will be paid to its members.” But considering that the 10-year average rate of inflation stands at 8.85%, it means that the real gain in value for members’ savings was just Shs 34,500 for every Shs 1 million on the account in 2015/2016 – the rest was nibbled up by inflation. So, if pension savings are to retain their value, the government must work more to control inflation and NSSF has to work harder to earn more profits.

Kasaija appeared to offer some assurance to the members by stating that the government is committed to guaranteeing a stable macro-economic environment so as to enable entities such as NSSF to perform well for the good of the entire country.

NSSF Managing Director Richard Byarugaba re-echoed his earlier concern about how the Fund’s performance had been affected by the decline of equity markets across the East African region, which affected NSSF`s equity position. Coupled with the volatility of the Uganda Shilling, which depreciated against all foreign currencies and the 2016 general election uncertainty, they all had an impact on the business environment.

However, Byarugaba stated that the Fund had grown from Shs 5.6 trillion in 2014/2015 to Shs 6.5 trillion in 2015/2016, reflecting an increment of 18%.

The growth in fund size was driven by the continued growth in both member contributions and investment returns. Realised revenue for the year went up by 21% from Shs 583 billion to Shs 708 billion, driven by improved bond yields and dividend income from equity investments. Treasury yields improved across all maturities, rising above 17% compared to last year’s 16.7%.

Patrick Byabakama Kaberenge, the NSSF board chairman, said they are committed to strengthening the Fund’s corporate management and internal controls to ensure that members’ savings are secured. “The Board is fully committed to ensuring that funds are invested in projects that give a reasonable return,” he added.

Key numbers in 2015/2016

- Assets up by 18% from Shs 5.5 trillion in Financial Year 2014/2015 to Shs 6.58 trillion in Financial Year 2015/16.

- Contributions up by 14% from Shs 688 billion in 2014/2015 to Shs 785 billion in 2015/2016

- Interest payment up by 17 % from Shs 516 billion in Financial Year 2014/2015 to Shs 606 billion.

- 3% interest is above the 10 year inflation rate of 8.85%.

- Benefits paid to retired members grew by 28% from Shs 186 billion to ShsUGX 238 Billion in Financial Year 2015/16.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price