But will he achieve the Shs 20 trillion in savings by 2022?

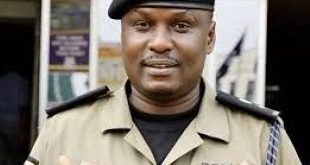

Kampala, Uganda | JULIUS BUSINGE | Richard Byarugaba was recently re-appointed as the managing director of the National Social Security Fund for another five-year term.

His performance in the first term seems to have impressed his supervisor – the Ministry of Finance Planning and Economic Development, Minister Matia Kasaija – culminating into the renewal of his contract.

Since then, Byarugaba has been preaching his next big plans for the Shs8.2 trillion Fund and its members for the next five years, with the latest being a media dialogue at the Kampala Serena Hotel on Nov. 21.

“The recent executive and managerial staff changes that the board announced are precisely to create the required capabilities to deliver the Fund’s Mission and Vision,” he said, “Our focus now is to work on the key success drivers and clearly articulate the key initiatives needed in the next five years.”

He said his plan is to now grow the Fund’s current assets under management from the current Shs 8.2trillion to Shs 20 trillion by 2022, making it one of the East Africa’s largest financial institutions.

He promises to fulfil this by increasing investment in private equity and tapping into the opportunities of new sectors like oil and gas, completion of stalled projects in Temangalo, Lubowa, Nsimbe, Pension Towers and Yusuf Lule.

He said the Fund would work towards integrating with systems of government partners like Uganda Revenue Authority, National Identification and Registration Authority and Uganda Registration Services Bureau.

Regarding the number of membership, Byarugaba, said he plans to ensure that the Fund’s members grows more than three-fold from the current 1.7 million (800,000 are actively saving) to around five million during the period.

The long queues inside the NSSF branches will also be reduced leveraging on adoption of information and technology, he said, adding that the Fund’s anticipated growth would be supported by its strategy of making employees happy, innovative, business process re-engineering and making prudent investments.

This new plan comes at the time the government is puttingin place new pension sector reforms currently in Parliament for debate. Their approval will see legal reforms that will bring new benefits to the members including maternity, housing, critical illness and funeral benefits and more as opposed to current few benefits – age, survivors, withdrawal, invalidity, exempted employment and emigration grant benefits.

Riding on past stellar performance

Analysts believe that based on the performance of the Fund in the last seven years where Byarugaba has dominated management, notwithstanding the looming liberalization of the sector, his new five year dream might be realised.

For instance, in the last seven years, contributions to the Fund have increased from Shs 295bn in 2009/2010 to Shs 916 bn in 2016/17, assets under management grown from less than Shs 2.1trillion to Shs 7.9 trillion in 2016/17.

Revenues increased from Shs 129 bn in 2009/2010 to Shs 912 bn in 2016/17, cost to income ratio declined by 35% in 2009/2010 to 12.5% in 2010/2017. Interest paid to members has grown from Shs 89bn to Shs 681bn in the period under review.

The other performance relate to customer satisfaction which was 49% in 2009/2010 but now is 92% and is expected to increase to 95% in the next five years. Compliance levels which were at 47% are now at 80% and would further increase to over 90%, staff satisfaction that was at 48% seven years back is now at 84% and would jump to 95% in the next five years; benefits payments which used to last 105 days now take 10 days and plans are to cut these days to two in the next five years.

In addition, the Fund has been able to offer members a minimum of 2% above 10-year inflation in interest since 2012/2013.

What analysts say

Enock Nyorekwa Twinoburyo, an economist (PhD) and Andrew Muhimbise, a keen follower and critic of NSSF’s investments and private companies told The Independent on Nov. 24 that Byarugaba has carefully mastered how to keep an eye on the performance of the Fund.

“So I think it is a well deserved appointment…he should be able to continue with the balancing while delivering consistent value for the members,” they said.

They added that the former Deputy Managing Director, Geraldine Ssali whose contract was not renewed deserves credit for challenging Byarugaba’s management credentials but also for keeping the Fund up and running when she acted as MD in 2014 before Byarugaba bounced back.

The two agreed with Byarugaba’s five years strategy based on four success drivers – happy employees, business process re-engineering product innovation and prudent investment. But on investment, they said that the Fund’s core business in the next five years should be about exploring some of the legal restrictions by pushing for new reforms to pass. On increasing investment on the equity segment, they warn that the Fund may not easily achieve growth there because the space is small, sallow, illiquid and passively inactive.

On maintaining 80% of its cash in fixed assets, the two experts said it is a prudent strategy in light of the fact that it is about social welfare and that it is a risk free field.

However, they said that the challenge is that in the growing fiduciary or fiscal risk on government and recent downgrades of its debt by international agencies, the debt risk is getting pronounced.

“Already fiscal cost on the budget is already high. On macro front, increased issuance has downside effects for the market as private sector that creates employment which NSSF needs is crowded out,” they said.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price