Sector observers say that if there is anything else to be learnt from how government is approaching the hunt for an investor, it is that government is not taking any chances focusing on only major players. The latest approach is a big break from the past where from the onset government picked the giant and tossed around the smaller companies.

It is because of this approach that suspect companies are being accorded the same or even more respect as more serious ones.

As The Independent reported last week, technocrats are working in overdrive since the Russian company, RT–Global Resources, which claimed to be ready to pump US$ 1 billion into the refinery project and organise a consortium to fund up to 60% of the cost pulled out of the deal.

A visit by a Russian delegation to Uganda recently sparked reports that the Russian Consortium is planning to return to the talking table. There were other reports that South Koreans are also joining hands with Chinese to put in a single bid. But for now, all this remains talk according to sector insiders. Insider sources at the Energy Ministry say they haven’t seen the Russians or South Koreans joining with Chinese.

When The Independent contacted Dozith Abeinomugisha, who is in charge of the refinery project, he said he wasn’t aware of any lists.

“We are still looking at who is interested,” he told The Independent in a phone interview, “the reason you haven’t seen any official list is because it isn’t ready. When it gets ready, we shall communicate.”

Apart from selecting the companies, the officials are also looking for over US$500 million dollars as kick-start capital for the construction of the facility.

Sourcing this money is particularly problematic at a time when the government appears cash-strapped, the economy is struggling, and a major donor-the World Bank has suspended trillions in new loan money. The Chinese who previously have been funding such major projects also appear reluctant to pump more money into the Uganda economy because debt is piling, and they have concerns about its sustainability.

Until recently, the three major oil companies—Tullow, CNOOC and Total— were only interested in the pipeline and other projects in the development phase. They are expected to inject into the sector some $ 8 – 10 billion. But CNOOC has also expressed interest in the refinery project.

Tussling to reach the refinery deal lasted over two years and was only resolved in February 2014 when a Memorandum of Understanding was signed. It allowed the oil companies to focus on other infrastructure while the government built the refinery. They agreed on a small refinery of 30,000 b/d as a compromise to expand to 60,000 b/d or even bigger. But there was a catch. The refinery would have the right of first call on oil produced. Effectively, this meant there would be no oil production without a refinery. Now the government, once again, appears stuck in this sticky oil business.

But officials maintain their stance that the refinery is strategic—stands to save Uganda a yearly petroleum products import bill between US$ 1 billion (2.5 trillion) among many other advantages.

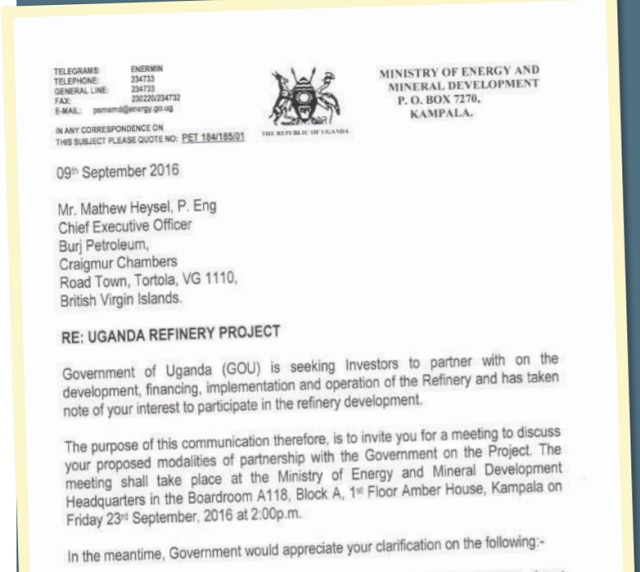

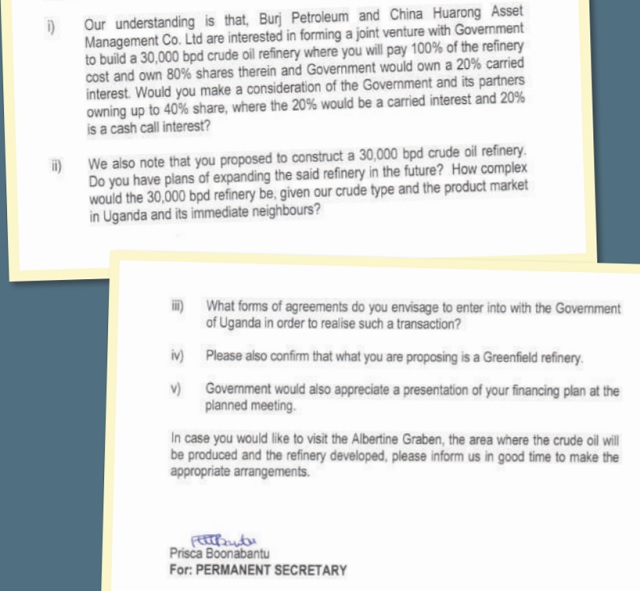

The Foster Wheeler study found that a refinery was financially viable given that as early as 2010, the demand for petroleum products in the region was growing at over 7%. But coming across a willing and credible investor is proving tough. And while government has said the refinery investigation will be public led, with no money, the likes of Burj Petroleum seem to be calling the shots.

****

editor@independent.co.ug

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price