COMMENT | Wasswa Balunywa | World War II changed the world completely giving leadership to United States as the world’s leading economic power. The Soviet Union emerged to rival the US militarily until it’s collapse in the 1990’s. The United States remained as the only super power. Close to the heels of the US was Japan.

By 1986, Japan’s GDP almost matched that of the US. Japan joined World War II to fight for markets and it lost the war. But starting in the 1970’s. Japan started taking over world markets without firing a shot!

All they did was develop their own technology products and become ruthlessly efficient giving them the number two position in the world. Japan over took Germany, France, Britain, Italy and India to become number two country by 1980. It was on the brink of becoming number one, when in the New York Plaza Hotel meeting in 1986, Japan was forced to revalue its currency to support the American economy!

The miraculous rise of Japan was attributed to their planning, execution, competitiveness and the pro-people management style. Based on the reforms by Deng Xiaoping, the Chinese economic juggernaut started rolling in the 1980s and 30 years later on China emerged number two economy in the world!

Coronavirus is the turning point

There is no doubt about it, China will ultimately take the number one position and the Coronavirus is the turning point.

There is a lot of politics and rumour mongering about the source of virus and why it appeared on earth. Those who know, know the source and why it is so. It is not for discussion in this article.

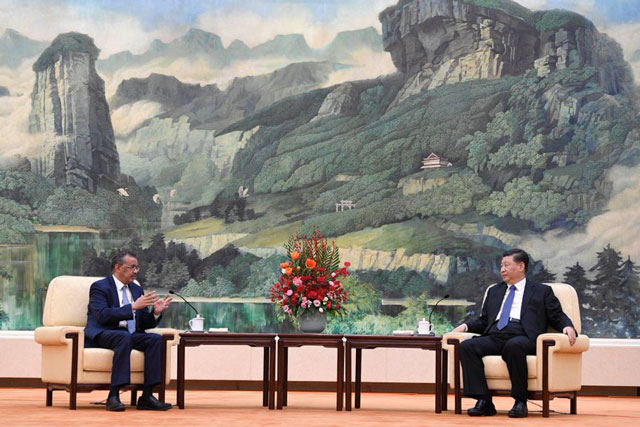

The virus is reported to have first been seen in China in December of 2019. China in it’s detailed plans and ruthless efficiency managed it and today China is back to normal. It is already taking leadership in the global economic affairs. The United States which is one of the developed countries that got the Corona problem last appears to have a worse problem than what China did have.

On Sunday March 27, 2020, the US had registered over 125,000 cases compared to 85,000 China registered at its peak. The tables are turning. More importantly the economic table. Recently the US started punishing China by locking out the Chinese electronic giant Hwuwei from the American economy. It is said that the main dispute between China and US is who is to take the lead in the development and management of 5G. It seems China has taken the lead and this has worried the United States.

The biggest challenge facing American Business Chief Executives today is the adoption of technology emerging from the 4th industrial revolution and of course China. Chinese economic might is a challenge. China is giving the west sleepless nights as it outpaces every country’s economy. The Fortune 500 list of the biggest 500 companies in the world, has fewer American companies today! The number one country is China. The biggest banks in the world today are not American banks any more, they are Chinese banks. The number of dollar millionaires in China will soon surpass that of the US. It is Chinese markets now that are important.

Europe, if it remains united, will follow China as the world second most powerful nation (group) but that is only if Japan fails to play catch up with China.

Japan’s biggest limitation is population, Japan is a wealthy country, highly competitive but because of the low population figure of 126 million when compared to China 1.4 billion and America 375 million and some of its neighbors it will be dwarfed in terms of total GDP though it will continue to a leading country in terms of per capita GDP.

The second rise of online business

At the organizational level, the Coronavirus has already brought fundamental change. With the shutdown, an organization that cannot figure out online business to survive is dead.

The rise of Jeff Bezos of Amazon and his wealth in the US along with Jack Ma in China was from spotting online business opportunities as the way a head. This is now consolidated, if you are not in it you are dead.

As organizations and countries emerge from the shutdown those countries and organization that can leverage IT will dominate the world.

Change is coming from block chain technology, the Internet of Things and robotics. Those who are ready for it will survive.

Can Uganda emerge from the Coronavirus crisis and prosper?

As developed countries find money for stimulus packages to revive their economies, Uganda and other poor African countries will have nothing to show. Possibly more dead people from the virus. In economic terms we already live off debt. What more can we do than get more indebted. Without adequate medical facilities, Africa has to beg for test kits and medication for treatment from developed world.

The Coronavirus should have brought Africa together but it hasn’t. We should be collaborating and learning from one another, but we are competing. We should be producing goods together. The worst is yet to come to Africa.

Ignorance appears to be our biggest problem. The East African region should have come together to produce masks and test kits rather than import them! Segmentation of our markets has been our biggest problem. It will continue to be.

The Coronavirus has put the world economy on a war footing. Governments must take centre stage. It was opportune for the developing countries governments to exploit these opportunities to create change in their respective economies. It seems the opportunity has gone past and by the way the worst is not yet over for Africa. We still have to deal with medical issues before we tackle the economic ones. Is Africa ready for change, I don’t think so.

*******

This was first posted on facebook. Juma Waswa Balunywa, is a scholar in management, leadership and entrepreneurship. He is also an academic administrator, who serves as the Principal of Makerere University Business School, a public institution of higher education in Uganda.

This was first posted on facebook. Juma Waswa Balunywa, is a scholar in management, leadership and entrepreneurship. He is also an academic administrator, who serves as the Principal of Makerere University Business School, a public institution of higher education in Uganda.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price

Is prof. Balunywa reading from a wrong Ouija?

By many accounts and by Ugandan standards, Professor Waswa Balunywa is the shining knight. Having headed the faculty of commerce and later becoming the first principal at Makerere University Business School, he revolutionized the Ugandan education sector when he spearheaded the “private scheme” at Uganda’s oldest university. But it goes without saying that he made blunders along the way. In 2001, at the time when Uganda airlines was being liquidated, he was its serving board chairman. He has previously been criticized by his fellow professors as nepotistic in character. But this is not another agony column. Today, and in a space of four days, Professor Balunywa has so far penned two articles; “How the Coronavirus will change the world, which appeared on 3, April, 2020 and, “Does Coronavirus give Africa a New Lease of Life?” (6, April, 2020). His articles are embedded in a historical economic perspective. However, he has at times paid a blind approbation to the facts of post world war ll. What both of Balunywa’s articles provide us with is, (1) He has offered a lot of optimism to the conspiracy theorists who have for long “predicted” the fall of the United States and the emergency of China as the world’s number one economy but with no justifiable conclusions. (2) He has “blindly” replaced “Japan” with “China” and, therefore, blindly recommended that the world is still “bi-polar” as it was after world war ll. With such analysis, Balunywa falls into the same trap the American economists found themselves after the “Plaza Accord.” What the Americans assumed was that the world had only two currencies (the dollar and the yen). They had assumed that by devaluing the dollar against the yen, a stronger yen would force Japan exporters raise their prices and encourage American consumers buy American goods. They had also assumed that the prices of the American imports would fall in terms of the yen, thereby, encourage Japanese consumers buy more of the American goods. But there were other players like the Europeans and South Korea whose markets were “outside” the “assumed” dynamics. Secondly, outside the “efficient technology”, as quoted by the professor, Japan was helped by the 1945 Korean war. The participation of the United States in the Korean war, meant that the required ammunition and logistics to the American forces were to be bought at a lesser cost from Japan other than if they were to be shipped from America. After gaining support from the United States and achieving domestic economic reform, Japan was able to soar from the 50s to the 70s. Thirdly, the world recession of the seventies and the surge in oil prices transformed production from “product based” to “technology based.” The point is, other than Japan’s internal operations there are other factors outside Japan that could have contributed to its success.

In his first article, Balunywa argues that due to a higher population in China this will disadvantage America in terms of total GDP. But he doesn’t apply the same reasoning when discussing about the success of Japan over the United States after world war ll. This also runs counter to what Stephen Cohen and John Zysman called the “economies of scope.” In his second article, Balunywa tries to explain in detail, what Africa should do in order to make desirable changes. He states that African governments should come up with “tight laws” (legislation) in order to control the level and type of skills. This is not what Japan did. To the contrary, Japan under Hayato Ikeda, Japan “liberalised” more than 60% of the economy. Balunywa also urges African governments to own up shares in “big companies.” In other words “lend” to big companies. This takes us to his first article about the successes of Japan. He does not give reasons to what brought Japan’s budding economy to a grinding halt. The “devil” is in the detail. The economic success brought about the “asset price bubble.” This was mainly due to the “doubling” of the exchange rate of the United States dollar against the Japanese yen. The central bank of Japan dictated excessive loan growth quatas on banks. Banks lent more money with less regard to the “quality” of the borrower. In so doing they helped “inflate” the bubble economy. Balunywa is so “worried” about the Uganda’s deficit. He notes, “ It is not surprising that in Uganda our exports fetch 2billion dollars and imports 6billion annually.” He continues, “To cover up that gap, IMF “must” (emphasis mine) continuously lend us money.” This rather a slithery ground for Africa to stand on. The IMF strategy for dealing with debt crisis was/still is that the advanced capitalistic nations insist that the poor countries get the cash to service their loans by exporting more and consuming less but with the terms of trade so negative this becomes an impossibility. It also creates a lot of repartition in terms of repayments.

Professor Balunywa seems to be providing more “up to bottom” solutions than “bottom up” solutions. But what this results into, is what has bedeviled Africa since independence. Surrendering all powers to governments that are in most cases held “hostage” to the whims of one ruler has greatly contributed to the “big Man syndrome” which in most cases runs “syndicate” with corruption. To state that one is to bring about change in Africa by eradicating corruption with the current leadership is simply setting the Africans on a rainbow chase.

In conclusion, much as China would like to take the world’s first economic spot, Chinese authorities realise the fact that a heavily indebted American consumer cannot be relied on as a “buyer” for Chinese goods. In order to stimulate their ailing export industry the Chinese seem resolved to carry on “pegging” their currency to the dollar. On the other hand, the Americans too, seem equally willing to “prolong” their “addiction” to cheap money as long as their economy is still in dire straits. Will Africa be able to “develoo” with foreign money? The answer will most likely depend on our “absorption capacity.” The absorption approach to the balance of payments states that a county’s balance of trade will only improve if the county’s output of goods and services increases by more than its absorption. Where absorption is the expenditure by “domestic residents” on goods and services. If African governments take on the mode of indiscriminate borrowing then, they will run the high risk of creating “zombie organisations!”

Rajab Kakyama.