Stage set for competition with other regional commercial banks

Kampala, Uganda | ISAAC KHISA | Patrick Mweheire, the former Chief Executive at Stanbic Bank Uganda, is considered to be one of the best brains within banking sector circles. This view is supported by his stellar performance at the bank where he recorded faster growth in the bottom line for all the years starting 2015.

Mweheire became Stanbic’s first Ugandan CEO and his management style centred on employees meeting their set targets with minimal supervision.

But he was also not shy to pull back responsibility the moment he realised that a particular employee was not up to the task.

It is this attribute that threw bank employees into anxiety when news broke on Feb.25 that he was leaving the prestigious office on the 11th floor, Crested Towers effective March 01.

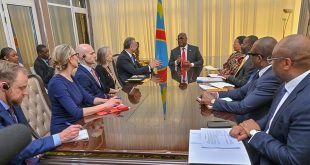

Mweheire would take on a new role as the regional group managing director and regional group chief executive of Standard Bank Group for Eastern Africa in Nairobi.

Standard Bank Group, based in South Africa, is the parent company of Stanbic Banks in East Africa.

“There’s a mixed feeling,” he told The Independent in an interview, “Actually, people who have been with us (for long) are surer (of the bank’s future) than those who joined us recently but ultimately, there’s a comfort level that Uganda is also part of my portfolio and so there is no way I will let them down.”

The bank has been quietly preparing to usher in Anne Juuko as the new chief executive. She has been working as the Head of Corporate and Investment Banking at Standard Bank, Namibia, since January 2018.

Mweheire says his new role will now be coordinating the bank’s activities across East Africa – Kenya, Uganda, Tanzania, South Sudan and Ethiopia.

“I have some aspirations to connect our bank in the region…I want to see how we can create a “real” regional bank with regional clients,” he said, “I would also like to see how we can have regional clients and sharing platforms.”

Mweheire said he intends to look at how the bank will tap into the new trade corridor that will be created between Uganda and Tanzania hinged on the planned construction of the $3.5bn oil pipeline.

Uganda hopes to start oil production in 2023/24 starting with at least 60,000 barrels per day.

Stanbic’s new strategy, however, signals a looming market rivalry with the Kenyan giants – KCB and Equity.

Both KCB and Equity have presence in the region and are sharing banking platforms and working to grow their clientele.

KCB, with total assets standing at $7.46 billion as per the lender’s financial statements for the six months ending June 30, 2019, has operations in Kenya, Tanzania, Uganda, Rwanda, Burundi, South Sudan and a representative office in Ethiopia.

Equity, too, operates in Kenya, Tanzania, Uganda, Rwanda, DRC, South Sudan and the representative office in Ethiopia.

In addition, Equity is in negotiation with Atlas Mara, a step that would see it not only strengthen its position in Rwanda and Tanzania but also increase its presence in Zambia and Mozambique.

Nevertheless, Stanbic Bank Uganda’s remarkable growth in its bottom line, reduction in operational costs and creating confidence in the customers, demonstrates Mweheire’s able leadership.

The bank for instance, registered Shs215bn in net profit in 2018 compared with Shs135bn recorded in 2014.

The bank’s balance sheet has increased to Shs6trilion and so is the balanced business across retail and SME corporates.

Further, Stanbic’s business now looks sustainable as Non-Performing Loans scores are good and the cost-to-income ratio is under 50% compared with 55.8% in 2014.

The number of bank accounts has increased from 485, 218 in 2014 to 522,972 in 2018. Points of sale terminals have grown from 398 to 658 during the same period under review.

The bank is currently executing 5% of its transactions using digital means, almost 20% through agency banking and the rest through physical bank branches.

Meanwhile, the bank’s staff portfolio has reduced from 2,000 to 1,500 partly attributed to the use of technology to deliver the service.

“If you take snapshot of the business now vis-a-vis where we have come from, you will be happy that this bank has been in a good place,” Mweheire said.

“Initially, we had a bank that was large but a complacent organisation that had no direction. Now that was a hard position to navigate. For the person coming in now, there’s really good foundation.”

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price