Washington, United States | AFP | Remittances, a major source of revenue for the world’s poorest countries, are due to grow again this year after falling two years in a row, the World Bank said Tuesday.

Such cash transfers to low and middle-income countries are on course to rise by 4.8 percent in 2017, reaching $450 billion.

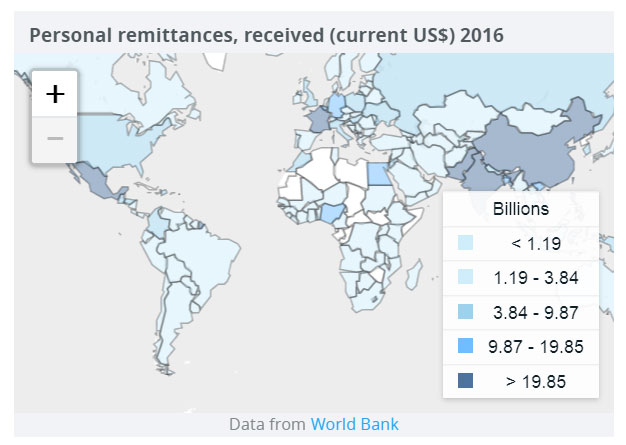

Economic expansion in Russia, Europe and the United States will see migrants and families send increasing amounts of cash back to Sub-Saharan Africa, Europe, Central Asia, Latin America and the Caribbean, according to a World Bank report.

But growth will be subdued for East Asia and South Asia, home to major recipient countries, the report found. As oil prices fall, Gulf countries, traditionally large sources of outbound remittance flows, are spending less and discouraging recruitment of foreign workers.

“Remittances are a lifeline for developing countries,” Dilip Ratha, lead author of the bank’s Migration and Development Brief, said in a statement.

“This is particularly true following natural disasters, such as the recent earthquakes in Mexico and the storms devastating the Caribbean.”

But fees remain high. Sending $200 home cost 7.2 percent on average in the third quarter of this year, well above the Sustainable Development Goal target of three percent, according to the report.

Ratha called on countries to lower costs associated with remittances. Exclusive relationships between postal services and money transfer companies drive up prices. Strict money-laundering regulations are also barriers, causing banks to close accounts, he said.

India is on track to be the top recipient in 2017, taking in $65 billion, followed by China, with $61 billion, and the Philippines, with $33 billion, while Mexico would reach a record at $31 billion.

The World Bank forecasts remittances to low and middle-income countries will rise by 3.5 percent next year.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price