Kampala, Uganda | THE INDEPENDENT | Private healthcare professionals have said that the directive by President Yoweri Museveni to add them to the list of businesses that can benefit from the credit facility under Uganda Development Bank (UDB) is not a solution to their financing problems.

Over the weekend, President Museveni said representatives of the Uganda Medical Association had requested him to help doctors running private hospitals to access loans from the government, as part of the solutions into high charges in private facilities that were brought to a fore at the height of the second wave of COVID-19 infections.

“I supported their request since they assist the government in providing medical services to the population. Their businesses has also been affected by the pandemic and as such should be assisted to access cheap credit,” Museveni stated in a letter to Finance Minister Matia Kasaija.

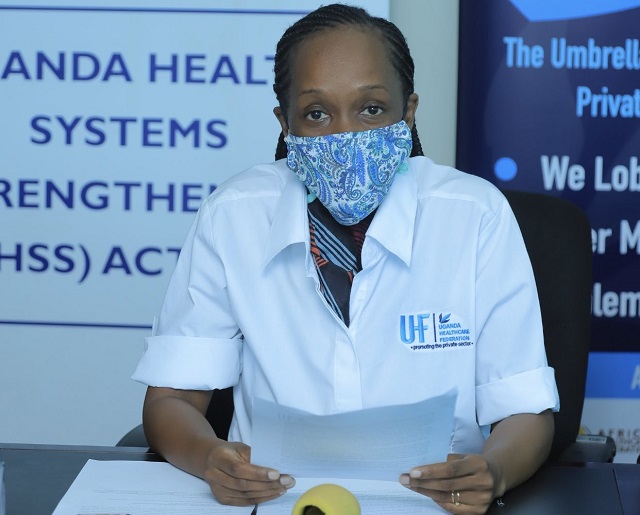

But Grace Kiwanuka, the Executive Director of Uganda Healthcare Federation (UHF) says the president was only given half the information since their earlier meetings with UDB had shown that they are not an alternative to their problems considering the uniqueness of the health business. She says that to be able to access money from UBD, they need collateral that many health providers don’t have, yet the interest rate is also still high.

She suggests that the president instead considers setting up a medical credit fund that is specially designed to look at the health sector.

Dr Richard Idro, the President of Uganda Medical Association who was part of the delegation that met the president in June told URN on Monday that the modalities of how and where to access credit by health providers were never discussed. He says their suggestion was to have a unique facility for private providers that put into account their nature of operations considering that their return on investment takes a bit of time.

He said they are pushing for a meeting with the Ministry of Finance where issues of the interest they are likely to be charged, collateral and grace period before repayment commences will be discussed.

He says they would like to have something like the youth livelihood programme or the agriculture fund because many of the health businesses will not raise the interests involved with UDB credit.

However, UDB Chief Executive Patricia Ojangole declined to comment on the matter, although the president directed that UDB works with the Ministry of Finance to come up with the modalities on how private health providers can be assisted. But information on the bank’s website shows that the interest charged on the credit accessed depends on the kind of business.

Last year owing to the challenges to businesses arising from COVID-19 disruptions, the government committed to capitalizing UDB with 1 trillion Shillings tagged on supporting production, processing, and manufacturing of essential items for the country to be resilient amidst the supply chain disruptions.

In mid-August 2020, the bank received 455 billion Shillings as additional capital and of this, 2 percent went towards businesses relating to the provision of health services as the biggest chunk of the money went towards agriculture related businesses.

******

URN

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price