According to the African Business Magazine, the plant will handle 1,000 vehicles this year, increasing over time to 5,000 units as it also looks at venturing into newer markets including Tanzania and Ethiopia.

French carmaker, Peugeot disclosed in February that it will roll out its first Kenyan assembled car this year, starting with the production of at least 1,000 units at ago, and employing over 200 people.

In a bid to attract investors in the production for export, the Kenyan government has introduced the Special Economic Zones (SEZ) where it will provide 100% capital deduction on buildings and machinery within the first year of utilisation.

This will also include exemptions from Withholding tax for dividend paid to non- residents by SEZ enterprises.

President Uhuru Kenyatta signed into law the Finance Bill 2015, which spelled out key measures to revamp activities in the special economic zones located mainly in urban areas as part of its Vision 2030 to diversify manufacturing activities and create employment.

The zones are currently undergoing a pilot programme in Mombasa, Lamu and Kisumu. For investors seeking to invest in marine, fisheries and fish processing, investment deductions at 150% will be granted on the capital expenditure incurred.

Available data shows that Kenya’s Export Processing Zones (EPZ), which employs more than 37,000 people, earned the East African country $543 million in 2013, with the bulk of the exports consisting of textile and apparels destined mainly to the US market.

In Rwanda, investors willing to invest in industries will be exempted from paying import duty for raw materials including all machinery used in textile and leather industry, instead of the 25% import duty.

And to ensure that the tax exemption indeed yield the desired results – discourage import of used clothes and protect new clothes made locally – the government has for the second time in a row, increased import duties for used clothes from US$2.5 to US$4 per kilogramme.

In the area of Information and Communication Technology where the EAC’s smallest country has gain reputation over the past years, the government has zero rated import of telecommunication requirements. Initially, the equipment adopted 25% import duty.

This also applies to electronic transactions that involves the use of smart cards, ATM cards, Point of Sale cards and their operating sales aimed at promoting cashless economy.

On the other hand, Tanzania has incorporated part of Kenya and Rwanda’s initiatives as it strives for growth in the competitive bloc.

For instance, it has moved fast to surpass Kenya with regard to corporate tax cut for motor vehicles assembling industry, putting it at 10% to stimulate growth of the assembling industry.

This comes barely two years after Tanzania lifted 30 % excise duty levied on vehicles assembled within the bloc as part of implementing the EAC common market protocol.

In addition, the Tanzanian government has exempted tax on capital goods to reduce importation costs for plants used in production of edible oil, textile, leather and pharmaceutical.

Value added tax on ancillary transport services in relation to goods in transit when they are on the country’s soil has been zero rated.

Moving Forward

Peter Kyambadde, director tax and corporate services at KPMG said during the post budget analysis on June 08 that while Uganda has tried to extend incentives to investors, it I still minimal compared with its peers in the region.

“Yes, Uganda has tried to offer various incentives to attract investors including bringing back of Initial Allowance, where plant and machinery placed into services outside a radius of 50 kilometres from Kampala qualifies for 50% initial allowance but a lot more is still needed to attract more investors,” he said, adding that favourable tax incentives in the rest of the EAC countries could leave investors with no choice but to venture into those markets instead of Uganda.

Gideon Badagawa, the executive director at the Private Sector Foundation Uganda, said there’s need for the government to boost the private sector through creating a conducive environment that will enable them access cheap loans. He said proposed capitalization of Uganda Development Bank is a ‘drop in the ocean.’

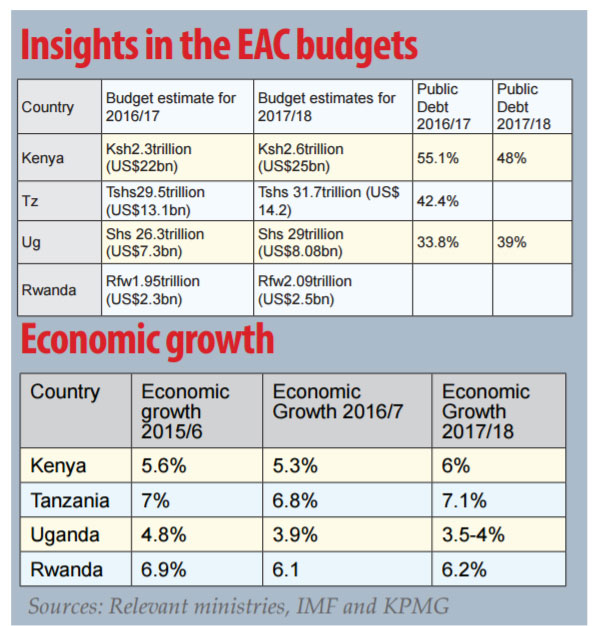

Insights in the EAC budgets

| Country | Budget estimate for 2016/17 | Budget estimates for 2017/18 | Public Debt

2016/17 |

Public Debt 2017/18 |

| Kenya | Ksh2.3trillion (US$22bn) | Ksh2.6trillion (US$25bn) | 55.1% | 48% |

| Tanzania | Tshs29.5trillion (US$13.1bn) | Tshs 31.7trillion (US$ 14.2) | 42.4% | |

| Uganda | Shs 26.3trillion (US$7.3bn) | Shs 29trillion (US$8.08bn) | 33.8% | 39% |

| Rwanda | Rfw1.95trillion (US$2.3bn) | Rfw2.09trillion (US$2.5bn) | ||

Country’s economic growth

| Country | Economic growth 2015/6 | Economic Growth 2016/7 | Economic Growth 2017/18 |

| Kenya | 5.6% | 5.3% | 6% |

| Tanzania | 7% | 6.8% | 7.1% |

| Uganda | 4.8% | 3.9% | 3.5-4% |

| Rwanda | 6.9% | 6.1 | 6.2% |

Budget proportion on development projects

Rwanda-44%

Uganda-31%

Tanzania 40%

Kenya 27.9%

Sources: Relevant ministries, IMF and KPMG

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price