To suggest printing money or ceding national assets to pay debt reflects utter economics myopia

COMMENT | Mukwanason A. Hyuha | In The Independent (April 26-May 02, 2019 edition), Andrew Mwenda purported to respond to my Saturday Monitor (April 13, 2019) article on Uganda’s debt sustainability. I have also read Derrick Wintergreen Kitto’s and Dr. Michael Mugabira’s reactions (The Independent, May 10-16 edition) plus Twitter comments by Moses Odokonyero, Acacia Bengo Ssembajjwe and others on Mwenda’s ‘rebuttal’ of my article. Did Mwenda understand my article?

In my article, I did not aim “to demonstrate that Uganda’s debt is unsustainable” as Mwenda alleges. Instead, the aim was to shed light on a number of issues surrounding the subject of debt sustainability in Uganda, and, in so doing, to discuss the half-truths, myths, irrelevancies and digressions in Mwenda’s article.

Issues that had provoked me into writing the reaction to Mwenda’s article included the following:

- The self-styled economist appeared not to know the difference between a stock and a flow—a concept that even ‘A’ level and undergraduate students of economics are made aware of.

- That, in discussing the relevant topic, it was not necessary to compare Uganda’s situation vis-à-vis debt sustainability with other counties’ situations.

- That the “ability to repay a debt and its servicing depend on how the borrowed funds were used or invested”, not on whether the interest rates on the borrowed funds are zero, highly concessionary, or commercial.

- Mwenda disputing Muhumuza’s assertion that Uganda’s economy has been growing below its potential, without backing his dispute with evidence, or a discussion of issues of the productivity, absorption, management and coordination of borrowed funds, or a mention of the leakages (e.g. corruption, capital flights and unwarranted reverse flows, late release of counterpart funds and donor aid, etc.) that lead to suboptimal use of borrowed funds.

- The apparent reference to Dr. Muhumuza, who holds a PhD (Economics) degree, as a third-rate economist—as if Mwenda himself holds any or better qualifications in Economics.

- This nth-rate (where he assumes n < 3) economist’s failure to state what rate he considers to be the potential or optimum, in view of his dispute of Muhumuza’s assertion.

- Mwenda’s apparent lack of understanding of the difference between “necessary” and “sufficient” conditions—hence, his assertion without evidence that the debt/GDP ratio of 50% is a sufficient condition for debt sustainability in Uganda and elsewhere.

- Mwenda’s apparently incurable disease of using half-truths, irrelevancies, digressions and superfluous political undertones in his article—rumblings that add no value to his discussion.

In view of the above, I am strongly persuaded to believe that Mwenda is not the economist he claims to be. If he is, then he is apparently an nth-rate economist (where, n ≥ 6). Hence, using Hon. Kahinda Otafiire’s expression, he should “leave issues of the generals to the generals”.

Mwenda obviously needs re-reading my article possibly for better results. If he had understood it, his rebuttal should have dwelt mainly on the above points. By the way, the two textbooks published in 2017 are in the area of Monetary Economics as I had specified, not “on the economics of debt” as Mwenda states. Anyway, I believe the following discussion sheds ample light on these issues

Meaning of Debt Sustainability

Previously, I defined: = total debt (borrowed funds), = total interest payable on the debt, = other resultant charges (commitment fee, disbursement charges, bank charges, etc.), and = total (net) income realised by investing the . Now, let Y = national income, proxied by the gross domestic product (GDP), K = net capital stock, and P = penalties imposed because of failure to service or pay off the debt. Then, note the following tautological inequalities (where the signs ‘<, >, and ≥’ mean ‘less than’, ‘greater than’, and ‘greater than or equal to’, respectively):

- I < Y < K

- D < Y < K; in fact, for Uganda, D is said to be 41% of Y

- I < (D+R+C) or I ≥ (D+R+C), as stated in my article

- (D+R+C) < Y < K and P ≥ 0

- (D+R+C+P) < Y < K

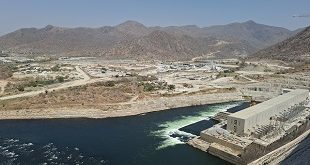

Thus, in theory, a country cannot fail to settle its external debt obligations, since if I < (D+R+C), the Y or the K can be used, given inequality (5) above. For an individual, this means that he/she can use either the income realised from investing the borrowed funds, or use other incomes to top up the I, or sell off some of his/her capital stock (chickens, cattle, furniture, houses, land, etc.) to settle the debt. For a country, this means that if the I is insufficient, the Y and K can be used. For example, in Uganda’s case, the country in practice can cede ownership of the Entebbe Express Way to the lender (China); which will manage the fixed asset until all debt obligations are settled. With respect to Chinese loans, this is not theoretical; it is currently happening in Sri Lanka, Papua New Guinea, Maldives, Laos, etc. Note that Chinese loans bear interest rates of 6% to 10%, with a short maturity period of 5 to 10 years—compared to the IDA type of loans discussed in my article.

Further, as Mwenda states, indeed, the domestic debt can be paid off by resorting to money printing. The cost here is inflation that will eventually impact adversely on income distribution, the country’s foreign exchange rate, trade relationships, etc. Eventually, when inflationary expectations set in, the inflation may metamorphose into hyperinflation, with complete loss of faith in the domestic currency, among other things. This occurred in Germany following the first imperialist war, and, recently, in Zimbabwe. It should be noted that the transformation of double-digit inflation into hyperinflation is essentially beyond a country’s control, given expectations (see Chapter 6 of my first textbook).

Consequently, if the I is inadequate, external debt obligations can be settled by resorting to Y or K; and the domestic debt can be settled by switching on the money printing press. Both of these are, however, extremely undesirable and imprudent. So, to suggest any of these (as Mwenda does) is a great reflection of utter economics myopia, policy imprudence and utopianism as if one were not living on Mother Earth. If these were prudent, viable options, most countries would be using them to solve their debt problems. It is, therefore, foolhardy to suggest that these are viable policy options.

The debt is sustainable if servicing or amortising it does not cause any significant discomfort, distress or sizeable upheaval—like ceding ownership of one’s assets, selling off one’s capital stock, igniting inflation, over-depleting one’s foreign exchange reserves, incurring new debts to pay off old debts, et cetera. Mwenda needs a lecture or two to appreciate these common sense (not theoretical) issues.

Needless to state, Mwenda’s assertion that the ability “to service the debt depends on government revenue and on the credit worthiness of a country – which allows it to borrow new loans to pay off old ones” leaves a lot to be desired.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price

You will immediately get too usse cheats also.

Wow!