Report shows how govt lost Shs 452 billion in Umeme deal – Who is to blame?

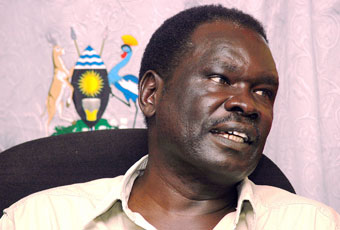

By Andrew M. Mwenda | When General Salim Saleh presented the report of his investigations into the high cost of electricity in Uganda to Energy Minister Hillary Onek on October 5, the focus was on the numbers.

‘We have identified areas of cost reduction that should lead to a reduction in the tariff by Shs188 from Shs426 per unit. This implies a substantial reduction of 44%,’ Saleh, who chaired the Interim Review of Electricity Tariff Committee of six, told the minister and board members in the boardroom of the Electricity Regulatory Authority (ERA) in Kampala.

The Independent has since obtained the highly guarded report and noted that whereas it accuses Umeme of defrauding government of Uganda to the tune of Shs 452 billion over the last four years by over-declaring losses, it misses or glosses over other major considerations.

According to the report, when Umeme took over the concession from Uganda Electricity Distribution Company Limited (UEDCL), total electricity losses were at 28% while Uganda Electricity Regulatory Authority (ERA) put them at 30%.

The committee shows that the government’s lack of capacity to negotiate led it to contract to compensate Umeme for technical and commercial losses which Umeme inflated to 40%, thus getting rebates (refunds on losses) on 10 to 12 percent. The committee said that Umeme did this in collusion with ministry of energy and finance officials.

The report argues that given that one percent in losses is worth Shs 10 billion per year, and given that government contracted to refund 99% of the losses, ‘using the base line losses reported by UEDCL (who are the supervising entity of Umeme) at 28% losses during unbundling, 10 percentage points (38-28) equals Shs 100 billion annually lost in rebates.’

However, according to the agreement between government and Umeme, at the time of the concession, total losses (both commercial and technical) were estimated at 33%. This figure was arrived at after a study on UEDCL by an independent consultant hired by government of Uganda. This was the figure put into the concession agreement and used to calculate the tariff. Indeed, the concession agreement had a loss reduction schedule agreed to by the parties which said that the losses should fall continuously to 28% by 2012.

Industry experts, however, told The Independent that when Umeme inherited the UEDCL billing system, it realised that the losses, especially commercial ones were much higher than anticipated in the concession. It complained to ERA. ERA then hired a Norwegian consultant, NORCONSULT who found that the losses were actually 40%. It recommended that Umeme changes the entire billing system. When Umeme found that there were 70,000 accounts that were billing zero meaning that there were 70,000 clients who were consuming but not paying for electricity, it was decided that both parties revise the figure which was adjusted to 38%.

Another area of contention between government and Umeme is over the amount of investment the private concessionaire has so far made. According to the concession, Umeme was supposed to invest US$ 65m over five years. The report says that Umeme claims it has so far invested US$ 67m, more than promised and ahead of schedule. But the report also says some values of investments are yet to be accepted by ERA. ‘The committee observed some inconsistencies in the data which was first submitted to it. Umeme subsequently reconciled it,’ the report notes.

The report takes issue with Paul Mare’s role as a ‘Trojan Horse’ in the whole matter. It argues that he was brought in as MD of UEB (1999-2001). When the privatisation and unbundling of UEB was being undertaken, he was its head. After unbundling UEB into five successor companies (Generation, Transition, Distribution, UEB Asset Management, and ERA), he became MD of the generation company ‘ UEGCL (2001) and the distribution arm, UEDCL (2002-2004) before finally becoming MD of Umeme (2004 -2009). Over this period, the report notes, Mare was actually working for Eskom.

It notes further that over the same period, at least 13 senior management/technical staff of former UEB were laid off, leading to loss of vital historical company data.

As a result, the report notes, ‘the information on system losses submitted by Mr Mare did not reflect the actual status and it debased the values of the successor companies.’

Indeed, government sources The Independent spoke to claim that Umeme made huge profits but declared losses. However, the report fails to provide any evidence of this claim promising that ‘the truths will come out when the forensic audit of the computers that were confiscated comes out.’

Can this be possible? Umeme has since 2006 been 100% owned by Globeleq which is a subsidiary of ACTIS, the private investment arm of the British government’s Commonwealth Development Corporation (CDC). The primary aim of CDC is not profit maximisation but promoting development in poor countries, ACTIS to support private sector investment. Analysts wonder why a development arm of the British government would cook books: To benefit who?

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price