MTN launches paperless payment service, MomoBusiness in South Africa as it seeks to replicate Safaricom’s Lipa Na M-pesa’s success in Kenya.

SPECIAL REPORT | BIRD AGENCY | MTN has unveiled MoMoBusiness wallet, a suite of payment solutions to tap into the growing demand for cashless transactions in the South African market.

Through its wallet, businesses can settle bills, salaries, and suppliers, collect bulk payments, access financial services such as loans and savings, and create invoices.

“Businesses can accept payments directly from customers for transactions on everything from prepaid services to shopping vouchers, completely fee-free. Flexible cash-out options ensure easy access to funds, providing both convenience and security in financial management,” said MTN SA Chief Financial Services Officer Bradwin Roper.

“Within MTN stores, new point-of-sale devices will also allow users to make card payments at a lower service fee, giving customers the choice to pay for purchases with MoMo and receive cashback rewards.”

The telco has also partnered with money transfer dealer, Clicksendnow to set up a remittance service.

MTN hopes to leverage its large customer base of over 290 million subscribers and its extensive network coverage to offer mobile money solutions at competitive fees.

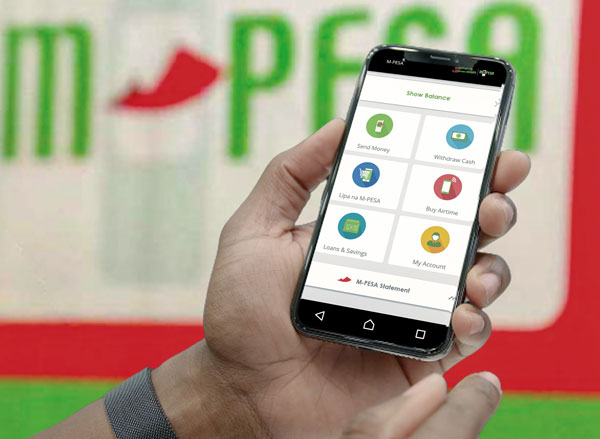

MTN’s MoMoBusiness draws a parallel to Safaricom’s hugely successful Lipa Na M-Pesa offering which transformed how most Kenyans shop and pay for utilities.

The better-known M-PESA mobile money transfer lets you send and receive money from anyone in Kenya using your phone, whereas Lipa Na M-pesa lets you instantly pay for goods and services using your M-PESA, account either remotely or at the till, with any merchant that has a till number or a QR code.

While Kenya’s mobile money adoption was bolstered by factors like a lack of entrenched banking systems and an imperative need for accessible financial services, South Africa presents a somewhat different backdrop.

A significant portion of the population already uses established banking and financial services, and there’s a palpable preference for traditional transaction methods.

South Africa therefore has been a hard nut to crack for most telcom firms seeking success with the mobile money offerings, partly also blamed on a rigid regulatory environment which has contributed to M-PESA’S slow growth in the South African market.

MTN, well aware of these nuances, is making strategic moves to ensure MoMoBusiness aligns with these unique market characteristics.

Still, its MoMoBusiness wallet will compete with other players in the mobile money space, such as Vodacom’s M-PESA, which relaunched in South Africa in 2020 after exiting the market in 2016 due to poor performance.

With a mere 1 million subscribers by the close of March 2015, the adoption of M-PESA had been deemed a failure in South Africa.

Vodacom’s M-PESA offers similar features as MTN’s MoMo business wallet, such as interoperability, international remittances, and financial services.

It is also MTN MoMo’s second stint in South Africa, having previously exited the market in September 2016 after a four-year run, due to inadequate commercial viability.

Nevertheless, MTN reintroduced Mobile Money to South Africa in January 2020 and presently, the telecom company boasts approximately 9 million registered MoMo subscribers in the nation.

As of mid-2023, Connecting Africa reported that MTN Group recorded a total of 60.5 million active MoMo users spread across its extensive network in the Middle East and Africa.

*****

SOURCE: Seth Onyango, bird story agency

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price