Interest payments

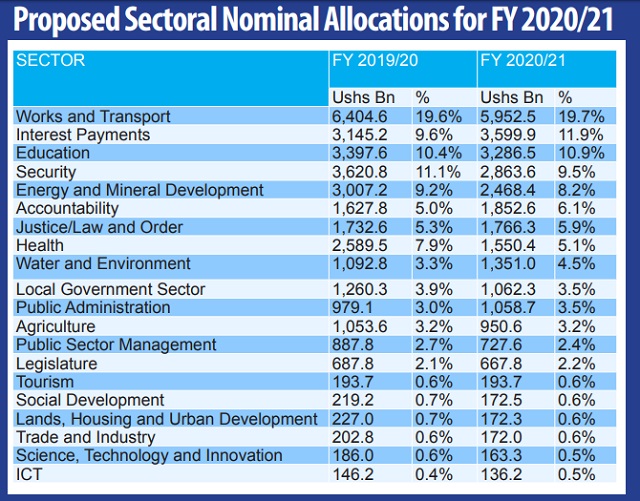

In FY2020/2021, interest payment is projected to be the second budget priority taking a budget share of 11.9 percent (Shs3.6tn). This percentage is higher than the 9.6 percent (Shs3.1tn) in FY2019/20 and 10.2% (Shs3.5tn) in FY2018/19.

The group said that interest payments has continuously made great demand on domestic revenue which could be allocated to capacitate social sectors hence consuming a huge chunk of national resources thereby cheating other service delivery efforts.

Going ahead, they said that the government should effectively implement all proposals it has committed to mobilize and raise national revenue as guided by the Domestic Revenue Mobilization Strategy to close funding gaps.

Whereas the government targets to finance the budget through domestic revenue at a tune of Shs21.5trilliom (54%), the group is greatly concerned about URA’s low revenue collection performance and delay in implementation of digital stamps.

The group is also bothered by the government’s continued creation of more administration units which have no funding, a concern that the Secretary to the Treasury, Keith Muhakanizi, seems to agree with.

While appearing before MPs on the Finance Committee on Jan.9, Muhakanizi blamed the perennial budget deficits on government officials.

“When I go naked, the Ministers get angry. When you increase wages, that is cabinet and President, remember these are powerful people. When you create permanent structures, like cities, we can’t cry over something you have created. (Moreover) these things are created without my knowledge. How can I manage when powerful people aren’t respecting my advice?” asked Muhakanizi.

According to CSBAG, government lacks funds to fully operationalize the newly created 364 sub counties, 352 Town Councils units.

“We recommend that Government reviews the policy of creating new administrative units and start rationalising the existing ones. The same applies to rationalising Government agencies and reducing the numbers of MPs,” the group said.

The group is also concerned about the poor absorption capacity of government ministries, departments and agencies given that the country continues to face several challenges. For instance, in FY2018/19, government MDAs returned Shs350bn to the treasury, of which Shs210bn was at the centre for agencies like the NAADS Secretariat, Mulago Hospital, Uganda National Roads Authority while Shs139.5bn was from local government including Wakiso district, Gulu district, Kitgum and Kabale district.

The group is also calling upon the upward revision of budgets for social sectors which are largely relied by majority of the poor citizens. This comes as the government plans to cut budgets for key social sectors such as agriculture and health.

In the agriculture sector, the government plans to reduce the budget from Shs1trillion in FY2019/20 to Shs950.615bn in FY2020/21.

In relation to the health sector, the budget is projected to reduce to Shs 1.55trillion from Shs2.58trillion in FY2019/20.

Meanwhile, the development budget is set to reduce by Shs1.4trillion while recurrent expenditure is projected to increase by Shs1trillion.

2020/21 budget strategy

The budget strategy for FY2020/21 will be anchored on the medium-term growth and development objectives of the third National Development Plan, under the theme, ‘Industrialization for Job Creation and Shared Prosperity, according to the NBFP.

The new budget, which is projected to reduce from Shs40.48 trillion to Shs39.6 trillion, will be the first budget to operationalise the National Development Plan III to guide national planning for the next five financial years.

Expenditure on non-wage is projected to amount Shs17.56trillion (49%) in FY2020/21 inclusive of Shs9.85trillion for interest payment.

Expenditure on wage will amount to Shs4.7trillion (13%). External development expenditure will account for 18% (Shs6.6trillion) and domestic development is 20% (Shs7.32trillion).

The FY2020/21 NBFP comes at a time when the Uganda Bureau of Statistics (UBOS) has just rebased Uganda’s economy. Over the same period, Gross Domestic Product (GDP) Per capita rose marginally from Shs3.160million to Shs3.295million.

Mukunda said their hope is that the rebasing of the country’s economy is complemented with favorable economic policies that trigger inclusive growth to translate the budget theme into reality.

****

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price