The lender’s cost cutting strategy delivered good returns

Kampala, Uganda | ISAAC KHISA | Uganda’s largest commercial bank, Stanbic Bank, seem to have surprised its investors with a 7% growth in net profit to Shs 215bn in 2018, closing out the year that the banking industry generated some Shs 700bn in net profit amidst worries of eased monetary policy.

The bank had in February last year anticipated ‘worse performance’ for the year owed to the central bank’s decision to lower the Central Bank Rate to 9% and 10% – the lowest since 2011 when Inflation Targeting Lite (ITL) was introduced to tame inflation, a move that saw banks lower interest rates from as high as 25% to as low as 18% per annum.

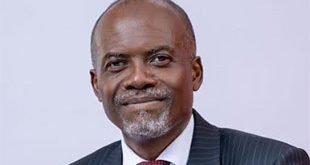

“2018 is going to be a tough year; there is no doubt. If you look at the yield curve…it is in the unchartered territory,” Stanbic Bank’s Chief Executive Officer, Patrick Mweheire, told journalists then as he announced the bank’s financial results.

“Banks in this country have never had a Central Bank Rate of 9% (as it is at the moment). It is a good thing for the economy (as interest rates will drop) but it is very hard for banks to make money.”

Faced with such circumstances, Stanbic, seem to have done something magical to make money for the shareholders.

For instance, the lender increased its market share in extending letters of credit, government guarantees, bonds and funding the ongoing construction of power and infrastructure facilities from 38.9% to 44.6%.

The bank also recorded increase in revenue from diversified revenue streams with the ratio of net interest to non-interest income standing at 44% to 56%.

Similarly, the private sector credit across the banking industry –recorded 11% growth to Shs 1.4trillion during the years – driven by manufacturing and agriculture sectors, trade and personal and household finance also boosted the bank’s profitability.

Mweheire, who announced the bank’s financial results at the Kampala Serena Hotel on March 28, revealed that since the bank anticipated pressure on their revenues as a result of a decline in lending rates, they had to optimize on cost structure to deliver good returns.

He said the bank also heavily invested in a customer centric model of operation that enabled it to create innovative solutions and channels that helped improve convenience for the customer while bringing down transaction costs.

“Digital channels have enabled us to see overall transaction growth of over 25% year on year basis with transactions on these alternate channels growing by over 40%,” Mweheire said.

“As at end of 2018, approximately 80% of our transactions were being done on our alternative digital channels.”

Commenting on the bank’s key performance indicators, Sam Mwogeza, the bank’s chief financial officer, revealed that the bank also reported improvement across all key financial metrics.

“We recorded a double digit growth in our loan book which recorded an annual growth of 18% in 2018 growing to Shs2.5 trillion from Shs2.1 trillion in 2017. This resulted in a market share gain for the bank of 20% from 19% at the start of the year,” he said.

“We were very particular with the sectors that we lent money to and we availed more credit to those sectors that we saw having a higher growth rate rebounding…that enabled us to be more proactive in seeing the switch in borrowing appetite and requirements from clients.”

As a result of the superb performance, the bank earnings per share also went up to Shs4.2 in 2018 up from Shs3.9 the previous year. The dividend payout increased by 8% to Shs 97.5billion.

Going forward

Mwheire said the bank has transitioned into Stanbic Bank Holding Uganda Ltd, a step that would enable it access funding more easily but also tighten capital requirements and regulatory oversight.

He said this development will enable the bank to set up a number of non-core banking businesses including Stanbic securities, Stanbic Digital and Stanbic real estate.

He said, for instance, that the Bank plans to transfer its real estate assets it acquired from the Uganda Commercial Bank to the new company and simply rent the facility to enable the bank earn some income.

He said the new business model will ensure that the bank sustain its market leadership position and attain business growth.

Mweheire said the bank also plans to set up upcountry business incubation centres in Mbarara, Mbale, Gulu and Hoima to train entrepreneurs eyeing the oil and gas sector.

So far, more than 192 small and medium enterprises trading different goods and services have been trained under the bank’s Business Incubator initiative housed in Kololo, a leafy suburb of Kampala.

****

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price