Kampala, Uganda | JULIUS BUSINGE | Stanbic Uganda Holdings Ltd (SUHL), part of the Standard Bank Group, Africa’s premier bank by assets, recorded a 15.2% increase in profit after tax, reaching Shs412 billion for the year ending December 31, 2023.

Operating under the ticker SUHL on the Uganda Securities Exchange, the conglomerate oversees a diversified portfolio including Stanbic Bank, Stanbic Properties, SBG Securities, Stanbic Business Incubator, and FlyHub, collectively employing close to 2,000 individuals. This financial double digit growth in profit is attributed to robust performances across all product lines and services including loans. Stanbic bank, for instance, disbursed more than Shs 160 billion affordable loans, targeting key demographic segments such as farmers and women-owned enterprises, through various programs including the SACCO lending and capacity-building initiative, and Stanbic4Her.

Stanbic4Her initiative alone saw loans worth Shs 80 billion disbursed to women as more than 50, 000 others participated in the lender’s capacity-building initiative. In addition, more than two million members attached to 6000 SACCOs countrywide, accessed affordable credit at 10 percent interest rates to the tune of Shs 85 billion, indirectly impacting more than 10 million Ugandans.

FlexiPay records sharp increase in adoption

Similarly, SHUL’s digital platform, FlexiPay, also saw remarkable growth, doubling its user base to over 840,000 and processing transactions worth Shs464 billion. SUHL’s total revenue surged to Shs1.19 trillion in 2023, with operational costs recorded at Shs584 billion. Of these expenses, a significant portion of the expenditure, approximately Shs169 billion, was channeled to local suppliers, highlighting the company’s commitment to supporting the domestic economy.

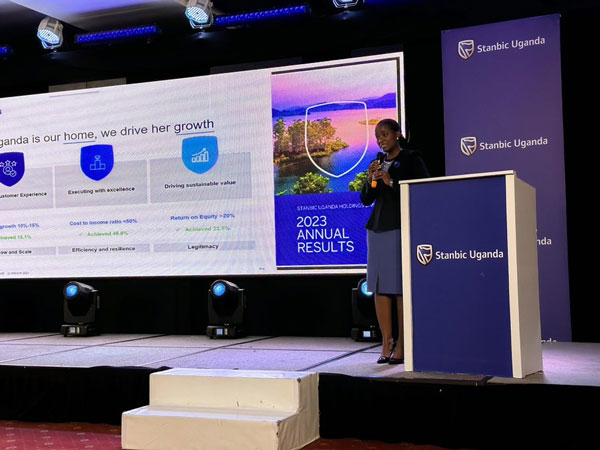

Francis Karuhanga, SUHL Chief Executive, credited the exceptional performance of Stanbic Bank across its retail, business, and investment banking portfolios for the group’s strong financial outcome.

“Our franchise’s resilience and sustained double-digit growth have been remarkable, culminating in a Return on Equity of 22.5 percent,” Karuhanga said, adding that the company anticipates increasing its dividend payout to 68 percent for FY 2023, pending regulatory approval.

Anne Juuko, the chief executive at Stanbic Bank Uganda said, given the high-interest rates in 2023, the bank had to devise innovative approaches to ease the burden of borrowing on clients, especially smallholder farmers, womenowned businesses, civil servants, and the government of Uganda which enabled them to access credit under friendly and flexible terms.

“For instance, in 2023, we boldly extended the repayment tenure of existing personal loans to up to seven years, from five and created the much needed legroom for top-up lending which enabled access to money to finance pressing needs such as school, medical and household expenses. As a result, our consumer loan book grew by Shs 369 billion in 2023 from Shs 309 billion the previous year—2022,” She said.

“We remain committed to supporting economic growth by giving business to local suppliers. Out of the 672 registered suppliers, at least 520 of them are local vendors; this has increased from 394 the previous year.”

Karuhanga said, in terms of paying taxes to the government, Stanbic paid Shs 354 billion, having increased from Shs 272 billion. “We are proud to be among the country’s top ten largest taxpayers. The banking subsidiary alone paid Shs314 billion in taxes,” he said

Through the Stanbic Business Incubator, over 900 local businesses received capacity building training to enhance their efficiency in management, market competitiveness, bidding processes, tax management and recordkeeping. The Stanbic Business Incubator was also honoured by the Uganda National Oil Company as the best local content partner in appreciation of its contribution to supporting local enterprises to participate in the oil and gas economy.

dfcu’s profits decline

On the other hand, dfcu Bank, another major player in Uganda’s banking sector, reported a slight decline in net profit from Shs29.4bn in 2022 to Shs28.7bn in 2023 citing increase in expenses. The bank’s assets declined from Shs3.2trillion in 2022 to Shs3.1 trillion in 2023 as its liabilities reduced from Shs2.6 trillion to Sh 2.5 trillion, according to the financial results.

dfcu recorded a 1.5% increase in total interest income from Shs 345 billion in 2022 to Shs350 billion in 2023 and a 12% increase in non-funded income from Shs86bn to 97 billion during the same period under review.

Meanwhile, the lender’s interest expenses increased by 24% from Shs74bn to 92 billion driven by a rising cost of deposits with the industry average time deposits rate going up by 1.2% from 10.7% in 2022 to 11.9% in 2023.

The Bank continued to exercise a cautious approach to credit extension which resulted in a 17% reduction in the loan book. The total number of borrowers continued to grow, increasing by 19% as the lender expanded its credit outreach to more households across the country.

The concerted effort put in place to manage credit risk led to the impairment of loans and advances to customers reducing by 6% from Shs88bn to 83 billion. On the positive, growth in customer numbers, transaction volumes, fees, and commissions supported the company’s performance.

A statement from the Board of Directors of dfcu Limited noted that the Group’s trading entity dfcu Bank, “ implemented a refreshed strategic plan aimed at refocusing the business, anchored on five pillars covering economic sector specialization, customer relationships, technology, performance culture, and sustainability.”

“We have started harnessing the benefits of the plan as we witnessed improved customer service across the group,” dfcu said in a statement. dfcu will this year celebrate 60 years of existence as it continues to contribute to communities across the country, through its wide distribution network and programs such as dfcu Women in Business, Rising Woman and the SME Business Accelerator for Small and Medium Enterprises.

Stanbic has recommended a final dividend of Shs 3.03 per share, translating into Shs 155 billion while dfcu has recommended a dividend payout of Shs 6.8bn, subject to shareholders approval.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price