Kampala, Uganda | THE INDEPENDENT | The agreement for the sale of Crane bank to DFCU was shoddy and fraudulent, Former Crane Bank owner, Sudhir Ruparelia has told the ongoing Bank of Uganda probe. According to Sudhir, the Purchase of Assets and Liabilities (P&A) agreement signed between BoU and DFCU did not have details of all assets and liabilities that were being taken over.

Crane Bank Limited was closed by Bank of Uganda (BoU) on October 20, 2016 after it failed to comply with a capital call on July 1, 2016. Central Bank Governor Emmanuel Tumusiime Mutebile says that the Crane Bank takeover was guided by the systemic nature of the undercapitalized institution to avoid financial sector instability.

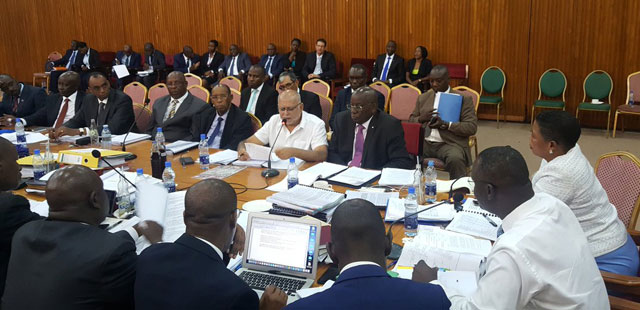

But Sudhir says that the documents that were signed were shoddy and especially engineered for a fraudulent transaction. Sudhir made the statement while appearing before parliament’s Commissions, Statutory Authorities and State Enterprises (COSASE) Committee, which is currently investigating the closure and sale of commercial banks.

Sudhir was responding to questions by COSASE Chairperson Abdu Katuntu and Bukedea Woman MP Anita Among on the whereabouts of the list of assets and liabilities that were sold to DFCU.

Alex Rezida, a lawyer and former Director in Crane Bank said that the illegality of the sale is confirmed by the Auditor General’s report which stated that the Central Bank would have been concerned with the revival of the institution instead of breaking it.

The Auditor General had earlier queried the failure by the Central Bank to prepare a plan to revive Crane Bank and the consideration of 200 billion Shillings from the bad books as the selling price for Crane Bank to DFCU Bank.

BoU officials had also told the same committee that they never had a plan to revive the bank since the financial institution could not be revived. But Rezida argued that BoU shouldn’t have appointed a statutory manager if their institution could not be revived. He further said that a decision to sale Crane Bank should have been born out of a report by the statutory manager.

Rezida says that there was unprofessional conduct in the sale of Crane Bank.

But Katuntu told Rezida that the BoU Statutory Manager Edward Katimbo Mugwanya had told his committee that he learnt of the bank sale when he received a WhatsApp message indicating that DFCU was a carrying out files from Crane Bank. Katimbo also told the committee that he never handed over a report.

*****

URN

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price

Well before we go to sale lets first look at how and why it failed. Because I think its more important to know what killed the cow than how it was slaughtered