Agriculture employs over 70% of Ugandans and contributes around 26% to the national GDP, but has largely been left in the hands of the private sector with its annual budget funding recorded below 5% over the past years.

Nuwagaba says funding to the sector should be increased to cater for irrigation, financing, and inputs; including seedlings, pesticides and more. He says yields have potential to transforming the economy in general and that of other sectors.

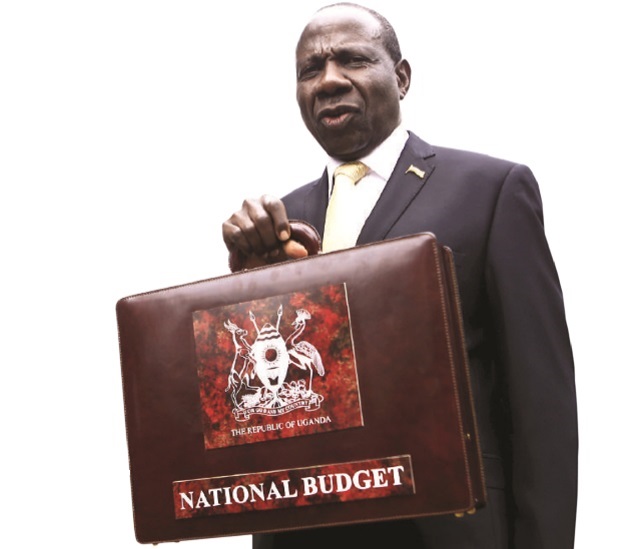

Chasing middle income dreams

The BFP concentration on infrastructure and energy and not agriculture appears anchored in the 2018/19 theme `Industrialisation for Job Creation and shared Prosperity’. The government has determined that agriculture does not yield as many paying jobs as industry.

This reflects the government’s continued commitments to achieve a middle income economy by focusing on improving productivity in all the so-called primary growth sectors – agriculture, manufacturing and industry, tourism and minerals.

The government also proposes modest increases in spending on salaries and wages and other recurrent expenditure which is expected to average 10.8% of GDP per year over the medium term. Pay rises have been a big issue in 2017; especially teachers and health workers. In the BFP, the government proposes spending Shs 1.8 trillion in FY2018/19 and Shs 3.6trillion over four years on pay reform.

But analysts want categorical commitments not to create new administrative units like districts and municipalities which are increasing politically-motivated spending.

In a joint statement issued on Jan.09, the CSOs say, to control expenditure on salaries, wages, and other recurrent expenditure, the government needs to merge some government ministries, departments, and agencies (MDAs). The government agrees. It proposes to review and rationalise expenditures on non-core items like allowances, workshops, travel inland and abroad in addition to reorganising and merging the MDAs.

On public servants salary reforms, Nuwagaba says the budget should consider funding equally what he dubs the “four frontline sectors” – health, education, agriculture and Justice, Law and Order Sector (JLOS).

“I am advocating for equal pay for work of equal value,” he says, “This is done in developed countries; why should a police officer earn less than a doctor yet they all work for frontline sectors?”

Even as the expenditure side of the budget is being criticized as misdirected in allocations, the revenue side is being hammered for lack of innovation.

Out of the estimated Shs 29.2 trillion 2018/19 budget, domestic revenue collections will be Shs15.5 trillion; Shs 15.1 trillion tax and Shs418 billion non-tax revenue. Domestic borrowing will be Shs940billion and external financing Shs6.7 trillion. Domestic refinancing is flat at Shs 4.9 trillion and appropriation in aid will contribute Shs 872 billion up from Shs757 billion.

The CSOs say large compliance gaps, a large informal sector, and a small tax base (49% of GDP) mean the Uganda Revenue Authority (URA) lacks capacity to generate the ever increasing local revenue targets.

In a radical proposal aimed at netting more tax payers, the CSOs say the government needs to give citizens one number which will work as both the current Tax Identification Number (TIN) and National Identification Number (NIN).

The government proposes only modest adjustments to the current tax regime. They goals are equally timid; ensure increased productivity of the tax system, close loopholes in the tax laws, index specific tax rates for inflation, enhance tax administration efficiency and facilitate tax payer compliance. But the bill URA is charging the government for these administrative baby steps is nothing but small; in fact Shs 90 billion.

The BFP medium term strategy also is anchored on the Second National Development Plan (NDPII) that seeks to strengthen Uganda’s competitiveness for sustainable wealth creation, employment, and inclusive growth. The BFP employs high flying terms; taking Uganda into modernity and inclusive development. But its real test is basic: Can it deal with stubborn poverty numbers that increased from 19.7% in 2012/13 to 27% in 2016/17?

As Badagawa told The Independent, to reduce poverty and positively impact the economy and the common person, the government must prioritise fighting corruption, improving standards, negotiating for markets, and ensuring proper coordination of government agencies involved in service delivery.

Proposed Sectoral Nominal Allocations – FY2018/19

| Sector Allocations | Ushs billion |

| Works & transport | 4,706.7 |

| Interest payment | 2,700.7 |

| Energy & mineral development | 2,529.2 |

| Education | 2, 419.2 |

| Health | 1,636.1 |

| Public sector mgt | 1,448.9 |

| Security | 1,356.6 |

| Justice/Law order | 1,104.2 |

| Accountability | 866.4 |

| Agriculture | 831.7 |

| Water & environment | 713.7 |

| Public Admin | 566.2 |

| Legislature | 483.8 |

| Social development | 175.1 |

| Lands, Housing & Urban development | 147.7 |

| Tourism, trade & industry | 119.4 |

| ICT & National Guidance | 109.1 |

| Sciences, technology & Innovations | 71.8 |

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price

50% should go to agriculture