Kampala, Uganda | THE INDEPENDENT | While microfinance institutions are a vital source of credit for many businesses, experts are stressing the need for financial literacy to truly empower entrepreneurs and break the cycle of poverty. Jane Nalunga, Executive Director of SEATINI Uganda, says business training should be tailored to the …

Read More »UMRA proposes new loan terms for money lenders

Kampala, Uganda | THE INDEPENDENT | The Uganda Microfinance Regulatory Authority (UMRA) is suggesting new changes in the traditional money lenders’ loan structures. The changes among others suggest caps on interests charged by the money lenders The changes are part of the proposed amendments to the Microfinance laws and regulations. “As …

Read More »UMRA drafts guidelines for digital lenders

Kampala, Uganda | THE INDEPENDENT | Uganda Microfinance Regulatory Authority is drafting new guidelines to regulate digital lending. Digital money lenders are emerging as the latest innovation to small loans extended through online platforms or digitally but there have been concerns that they are not regulated. But the emergence of …

Read More »Speaker urges finance minister to resolve challenges slowing saving groups

Kampala, Uganda | THE INDEPENDENT | The Speaker of Parliament, Anita Among, has tasked the Minister of Finance, Planning and Economic Development and other stakeholders to find a lasting solution to the challenges affecting the growth of microfinance and saving groups in the country. She said as a country, there …

Read More »Changes to microfinance deposit-taking institutions act approved

Kampala, Uganda | THE INDEPENDENT | Cabinet has adopted the proposed changes in the Microfinance Deposit-Taking Institutions-MDIs Act 2003. According to the proposed changes, MDIs will now offer all services offered by other banks, which has not been the case. The Minister of Information and National Guidance, Chris Baryomunsi communicated …

Read More »Six money lenders arrested in Buikwe for impersonating microfinance staff

Njeru, Uganda | THE INDEPENDENT | Police in Njeru Municipality in Buikwe district have arrested six money lenders for impersonating staff of the Uganda Microfinance Regulatory Authority (UMRA ) and extorting money. The suspects work with Moskal Enterprises Uganda Limited, a money lending agency located at Wobulenzi , Luwero district. …

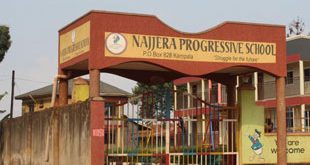

Read More »Private school owners reject Microfinance Support Centre loans

Kampala, Uganda | THE INDEPENDENT | Proprietors of private schools have rejected a government offer for them to access loans from the Microfinance Support Centre. They say schools require a lot more money than the Microfinance Support Centre is able to offer and the interest rates offered are too high. Following …

Read More »Behind micro-credit loans

No one deserves to die from excessive peer pressure because of failure to re-pay a micro-credit loan COMMENT | Nathan Were |The Daily Monitor newspaper of February 02, 2019 led with a sad story of Gubindi – a resident of Jinja town in eastern Uganda who, after failure to …

Read More »Banks high interest rates hurt more than lenders

World Bank describes impact on business growth, spending, saving culture. The banking segment is the most visible face of Uganda’s financial sector. So could the bad name it currently carries be hurting individuals and the economy generally? The World Bank Manager in Kampala, Christina Malmberg Calvo, thinks so and she …

Read More »Microfinance’s macro potential

By Prashant Thakker With forward-looking regulation and technology, MFIs can provide more access to financial services Microfinance is, at its heart, an effort to provide financial services to people who are not served – or are under-served – by the formal banking system. With appropriate, accessible, and fairly priced …

Read More » The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price