Kampala, Uganda | THE INDEPENDENT | Uganda’s private sector has blamed the poor attitude towards compliance with tax obligations on what they call unfriendly tax policies. This comes as the government seeks more ways of encouraging more Ugandans to pay taxes as and when they fall due, and also increasing the …

Read More »Grant of tax waiver to companies queried

Kampala, Uganda | THE INDEPENDENT | Legislators on the Committee of Finance have questioned the manner and criteria the Uganda Revenue Authority (URA)is using to extend tax waivers to companies and individuals. While appearing before the committee, the State Minister for Finance (General Duties), Henry Musasizi said the tax waivers will …

Read More »To preserve democracy, tax the rich

A progressive tax system would redistributes incomes to the poor while preserving incentives for the rich COMMENT | KAUSHIK BASU | While there are many ways to measure economic inequality, key metrics consistently show that disparities are getting worse. According to a recent United Nations report, 71% of the world’s population …

Read More »Tax exemptions for MPs at Sh159 billion every year

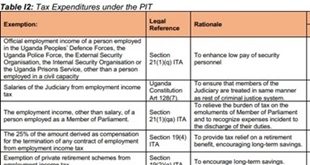

Kampala, Uganda | THE INDEPENDENT | Tax exemptions on employment incomes of various government officials is costing government 458.9 billion Shillings a year in foregone revenue, as per the year 2022/2023. According to the Tax Expenditure Report for Financial Year 2022/23, a total of 158.56 billion Shillings or just over …

Read More »East African states deviate from agreed tax rates in local production battle

EAC-CET was established to protect the common interests of various partner states by safeguarding specific sectors, and the lack of uniform application Kampala, Uganda | THE INDEPENDENT | Import costs in the East African Community states are expected to remain high under the newly implemented Common External Tariff (CET) as countries …

Read More »Students challenge govt on tax waivers, free sanitary pads

Masaka, Uganda | THE INDEPENDENT | Students have appealed to the government to consider dropping tax levies on private education institutions and to accelerate the process of providing free sanitary pads to schools. While making submissions before the Education Police Review Commission, during its regional consultation meeting at Masaka Senior Secondary …

Read More »Kenyan president announces forum to tackle youth issues amid protests

NAIROBI, Kenya | Xinhua | Kenyan President William Ruto on Tuesday announced that a national multisectoral forum will be held on July 15 to address issues raised by the country’s youth that sparked three weeks of protests across the country. Ruto said the proposed six-day forum will deliberate on issues …

Read More »Shop owners in Tanzania go on strike over unfair tax estimations

DAR ES SALAAM, Tanzania | Xinhua | Shop owners in Tanzania’s six regions have shut down their shops and gone on strike over what they termed unfair tax estimations by revenue authorities. The strike by the shop owners began Monday in Kariakoo, a hectic shopping center in the port city …

Read More »Kenyan president drops tax proposals amid deadly protests, announcing austerity measures

NAIROBI, Kenya | Xinhua | Kenyan President William Ruto on Wednesday announced that his government had dropped tax hike proposals, which had sparked nationwide protests since June 18 when the financial bill was first made public. Speaking at a news conference in Nairobi, Ruto said his government would institute austerity …

Read More »Kenya tax riots surprise Ugandans

How is that even possible? COVER STORY | THE INDEPENDENT | As thousands of mainly youth have been holding protest across Kenya against new tax proposals made in the annual budget for FY 2024/25, the main question in Uganda has been: How is that even possible? Many Ugandans took to the …

Read More » The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price