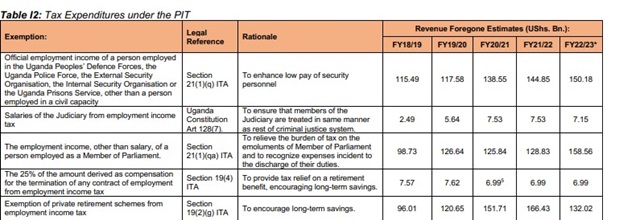

Kampala, Uganda | THE INDEPENDENT | Tax exemptions on employment incomes of various government officials is costing government 458.9 billion Shillings a year in foregone revenue, as per the year 2022/2023.

According to the Tax Expenditure Report for Financial Year 2022/23, a total of 158.56 billion Shillings or just over a third of this employment income exemptions was for the benefit of Members of Parliament.

This was higher than the 128.83 billion Shillings foregone in the previous year. In the Income Tax Amendment Act 2016, MPs agreed to exempt their emoluments from tax, other than salary, with the aim of relieving themselves from the burden of paying taxes and recognize expenses that come with performance of their duties.

Cumulatively, the tax exemptions on MPs allowances have so far cost the government 638.6 billion Shillings since 2018, according to the Tax Expenditure Report for Financial Year 2022/23, by the Ministry of Finance, Planning and Economic Development.

Official employment income of a persons employed in the Uganda Peoples’ Defence Forces, the Uganda Police Force, the External Security Organisation, the Internal Security Organisation or the Uganda Prisons Service, other than a person employed in a civil capacity contribute 150.18 billion shillings to the revenue foregone.

This was an increase of about 6 billion Shillings foregone in the year 2021/2022. This, according to the report, arose after the Income Tax was amended to enhance the otherwise low salaries of persons in the armed forces. Exemptions of the salaries of the Judiciary from employment income tax, as per the Uganda Constitution Art 128(7), amounted to 7.15 billion, a slight fall from the 7.53 billion Shillings recorded in 2021/2022 financial year.

The decision to exempt judicial officers was aimed to ensure that members of the Judiciary are treated “in same manner as rest of criminal justice system”. In total, all tax expenses including exemptions on investors and others amount to 2.97 trillion shillings, or 12.5 percent of the total revenue collections for the year. This is also 1.6 percent of the country’s GDP.

This is more than the budgetary allocation to the the agriculture sector for that year by a whole 1 trillion Shillings. This figure, however, is not comprehensive as some values could not be captured for various reasons, meaning that these are estimates, according to the Ministry.

Based on estimates, VAT is the tax head with the highest tax expenditures, according to the data picked from the Budget department and the Uganda Revenue Authority. Government spends through the tax system in form of tax exemptions, rate reliefs, allowances, deferrals and credits, and revenue foregone is the tax expenditure.

“Tax Expenditures in Uganda exist for numerous reasons, whether to support investment, local manufacturing, job creation, for a social purpose, or due to administrative difficulties in collecting revenue from hard-to-tax sectors,” says the report.

Data and modeling limitations mean that it is not possible to calculate the revenue foregone associated with every single tax expenditure outlined in this report, while assumptions are made to allow us to provide estimates for some expenditures.

This lack of adequate data means that the headline aggregated numbers are underestimated.

Other employment incomes exempted from taxes included the 25 percent of the amount derived as compensation for the termination of any contract of employment from employment. This remained constant over the two years at 6.99 billion.

This exemption was meant to provide tax relief on a retirement benefit, encouraging long-term savings. In the same way, there are also exemptions of private retirement schemes from employment income tax, aimed at encouraging long-term savings. The amount foregone here was 132 billion.

Others were education grants, aimed at assisting the recipient to study at a recognized educational or research institution.

Data was not captured. Similarly, exemptions on non-business capital gains Section, as well as the value of a right to acquire shares granted to an employee under an employee share acquisition scheme, were also not captured.

****

URN

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price

No wonder MPs don’t understand the pain of taxpayers. They are supposed to feel the pinch felt by taxpayers so that they represent us properly and act accordingly. How can we be represented by people who don’t know the pain of tax the way we know it?

If you think about it carefully, they are not even supposed to be getting any salaries as MPs… yet they get inflated salaries and they don’t even pay taxes… how can they represent us effectively when they are so far removed from our reality?

No wonder parliament isn’t working for the people of Uganda. All this nonsense must be brought to an end.