It depends on working-age population which is predictable and productivity which is uncertain

Project Syndicate | JIM O’NEILL | Last month, I wrote about the growing divide between economic theory and real-world economic conditions, and reminded readers that economics is still a social science, despite whatever loftier ambitions its practitioners may have. Nonetheless, when it comes to the specific question of what drives economic growth in the long term, one can still offer rigorous predictions by focusing on just two forces.

Specifically, if one knows how much a country’s working-age population will grow (or shrink), and how much its productivity will increase, one can predict its future growth with considerable confidence. The first variable is reasonably predictable from a country’s retirement and death rates; the second is more uncertain. Indeed, the reported slowdown in productivity across advanced economies since 2008 is widely regarded as an economic mystery.

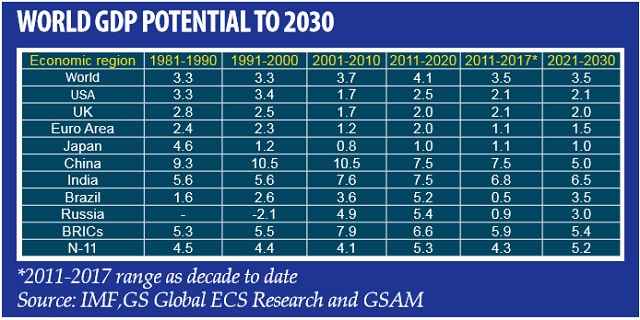

Is it really a mystery, though? Consider the following table, which shows GDP growth since the 1980s for the larger economies, the BRICs (Brazil, Russia, India, and China), and the “Next Eleven” (N-11) most populous developing countries.

With the fourth column (2011-2020) showing what my colleagues and I had projected back in 2001 when we coined the BRIC acronym, one can observe differences between what was forecast and what has happened this decade (2011-2017*). For the world as a whole, we predicted growth of just over 4% in the current decade, owing to the rise of China and the other major BRICs. And it is precisely for that reason that growth in the 2001-2010 period was stronger than in the preceding decades, when the persistence of 3.3% annual growth led some economists to conclude that the global economy had reached its full potential.

Now consider what has actually happened. Growth in the United States, the United Kingdom, Japan, China, and (arguably) India has come close to what we predicted. But the same cannot be said for the eurozone, Brazil, and Russia, whose poor performance must reflect weak productivity, given that our predictions had already accounted for demographic trends.

It is worth noting that no major country or region has performed better than we predicted back in 2001. The table shows that there can be some asymmetry between actual and potential growth, and that such divergences are not random. On the contrary, the eurozone, Brazil, and Russia clearly have underlying problems that need to be addressed.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price