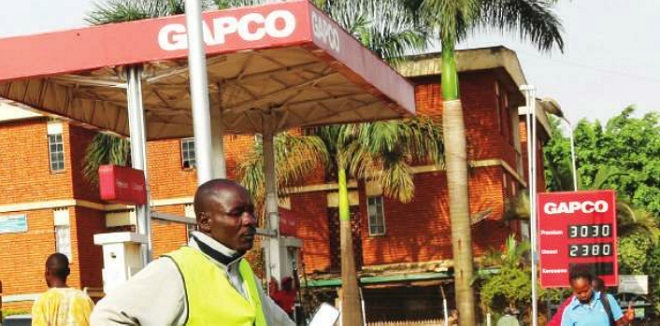

Final touches are being made on a deal in which Total will take over all GAPCO operations in the region.

The development follows months of intense negotiations between the two for Total Outre Mer SA, the retailing arm of Total, to acquire all the Gulf Africa PetroleumCorporation (Gapco) assets in the EAC region.

Gapco’ minority shareholders as well as India’s Reliance Industries, which owns 76% in the company, have reportedly agreed to exchange their shares for cash.

With only minor regulatory glitches remaining, the deal valued at $400 million, will see Total acquire all the GAPCO operations in Uganda, Kenya and Tanzania. The company’s assets include logistic terminals, 108 fuel stations, and 260,000 kilolitres of storage capacity.

GAPCO, which has been operating in Uganda since 1994 after acquiring the assets of then Esso Standard Uganda Ltd, has 32 fueling stations spread across the country and has been the 3rd biggest distributor of petroleum products after the two international giants; Total and Vivo Energy (Shell).

The deal will nowmean Total has become the biggest industry player in Uganda and the region followed by Vivo Energy which trades Shell brands. Kenyan distributor KenolKobil and the other small players will follow.

Analysts cite tough market conditions, see more acquisitions or mergers

The deal is the second major acquisition for Total in the region after its acquisition of Chevron Oil, which traded as Caltex, in 2008.

While petroleum industry players have remained silent and preferring not to comment, analysts said the tough economic times are taking their toll on the petroleum industry.

Hans Paulsen, MD, Vivo Energy Uganda said,“Competition is healthy for the industry and we welcome it. Our biggest competitor to date has more sites than Shell. We currently have 123 Shell service stations however we are market leaders in the overall industry and in the retail segment specifically. We definitely aim to maintain this position by continuing to focus on the customer and ensuring that we not only meet but exceed their expectations.”

Gideon Badagawa, the executive director of the Private Sector foundation Uganda (PSFU), said: “The times are getting tougher in the global business environment and we will see more of this happen not only in Africa but globally. The environment is increasingly becoming rough to sustain market presence for many companies.”

He added that only those companies that are more resilient both internally and externally would sustain market presence.

He said the message Total is sending is that companies can only survive if they do proper financial planning, market intelligence, logistical planning, sound management and very well-selected business partnerships etc. “Small players must be cautioned not to expand and grow very fast,” he added.

Fred Muhumuza, an Economics don at the Makerere University School of Economics shared a similar view. He said the challenging times the oil industry is facing have pushed many to consolidate in regions they find big and commercially viable. Just like Caltex pulled out, theAfrican market is challenging. Even Shell decided to let Vivo take their charge. Small companies like GAPCO have to exit by selling shares or a merger. Total seems to be ready to take the business.

“We might see more mergers and exits going forward as the global economy fails to recover,” he added.

The acquisition of GAPCO by Total will most likely heat up the competition between the two major international players – Total and Vivo Energy – and will relegate the small players to the peripheries of the industry, which could create more room for acquisitions and mergers.

Stephen Kaboyo, the managing partner at Apha Capital Partners, believes that this particular transaction may not necessarily be due to financial distress or consolidation but opportunity to expand by acquiring assets at a reasonable price.

Kaboyo suggested that it’s tough for small players as competition is tight and the big players continue to widen their market share.

“There is no doubt that the acquisition widens Total’s footprint, which is seen as critical in driving up sales and giving customers more access to their brands,” says Kaboyo.

The Total Group has been in Uganda since 1955 through the marketing and services division for which it is the market leader with over 118 active fuel stations. Total currently operates a network of more than 4,000 fuel stations in Africa and aims to raise its market share in Africa from 17% in 2015 to more than 20%.

Shell, whose brands are now marketed by Vivo Energy, has been present in Uganda since 1953 with the company steadily building up its portfolio over the years and acquiring interests in major local fuel suppliers.

In June 2000, Shell acquired all the assets of Agip comprising 320 retail fueling stations, depots and sales networks in five African countries, namely; Kenya, Uganda, Ethiopia, Eritrea and Ivory Coast. Shell at the time issued a statement indicating that the acquisition represented a significant investment on these key markets.

Today, Vivo Energy has operations in 16 African countries with over 1,600 fuel retailing stations under the Shell brand and has access to approximately 900,000 cubic metres of fuel storage capacity.

In 2011, KenolKobil, which has been in Uganda since 1999 acquired all the assets of Phoenix Petroleum including a 1,800 m3 (1.8 million litres) fuel depot in Jinja, a modem three-storey office block and three fuel retailing stations in Kampala. It is slowly growing its presence in the country and could be opting to acquire other small players.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price