By Independent Team

Amount is about half of Uganda’s national budget

Tullow Oil Plc, the U.K. explorer with the most licences in Africa has appointed Standard Chartered Plc to sell up to half its stakes in two Ugandan oil fields, the Sunday Times of London has reported.

Aidan Heavey, the chief executive, said the Company has already put together a list of about 10 companies that have pre-qualified for bidding. These are thought to include China National Petroleum Corporation, Sinopec, Total, Eni, Korea National Oil Corporation, and StatoilHydro.

The data room opens this week and Tullow is hoping to choose a buyer by the end of the year.

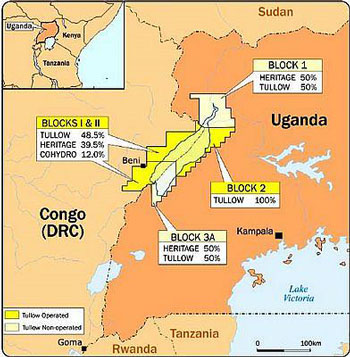

Analysts estimate that the company could pocket US$1.5 billion (Approx. Shs 3 trillion) from the sale. That money is equal to about half of the Uganda national budget for FY2009/10 which is Shs7.3 trillion. More importantly, the deal will allow it to share the immense costs of developing the two oil fields in the remote region around Lake Albert in northwest Uganda. The plan envisages a 1,300km pipeline running through Kenya to the port at Mombasa, and possibly a refinery. Those projects will cost several billion dollars to build and fall well outside Tullow’s expertise.

The winner will also need approval from the Ugandan authorities, which are expected to sign off soon on a development plan for the project. This includes details about local job creation, training, supply to the domestic market and infrastructure.

Heavey said: ‘˜We and the Ugandans will be talking with the companies to see what they can bring to the table. It’s like the beginning of a long relationship, and this is like a prenuptial agreement.’ He added: ‘˜President Museveni wants to make sure that Uganda gets the best value out of its natural resources.’

Heavey expects the fields, one of which is 50%-owned and operated by London-listed Heritage Oil, to hold up to 2 billion barrels of oil. He said speculation that Tullow has received takeover offers was ‘˜utter rubbish’. ‘˜Everyone knows we’re not for sale.’

Meanwhile, International Finance Corporation (IFC), the World Bank Group’s private-sector lending arm, plans to increase spending on sub-Saharan Africa’s oil and gas industry and sees ‘significant’ opportunities in Ghana, Uganda, and Tanzania.

‘Africa is a focus region for us,’ Kamal Dorabawila, the IFC Head of Oil and Gas in Africa, said from Cape Town.

The IFC has invested $400 million in Africa, about 19% of its global oil and gas total, Dorabawila said.

Ghana expects to pump 500,000 barrels of oil a day by 2014 as it seeks to boost supplies to the domestic market and become Africa’s newest crude exporter. Chairman King recently reported that Ghana will become one of the world’s top 50 oil producers.

Tullow Oil Plc. has drilled 25 wells in the Lake Albert Rift Basin in Uganda since January 2006, of which 24 found oil and gas.

IFC, Standard Chartered Bank Plc, BNP Paribas SA, Societe Generale SA, Absa Group Ltd. and Calyon are among financial institutions that helped Kosmos Energy LLC get a $750 million loan to fund Ghana’s Jubilee Field phase one development. Jubilee ‘is a world class oil discovery’ and Ghana’s offshore is a highly prospective area, Dorabawila said.

Ghana is seeking private investors to build three or four refineries, with at least one being located in the country’s Western region, the site of the Jubilee offshore oil field.

Story includes information from oil and gas sector websites

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price