KAMPALA | THE INDEPENDENT | Uganda is one of several countries in Sub-Saharan Africa that stands to benefit from a new World Bank financing facility that aims to support private sector access more affordable capital for investment.

Under the 18th replenishment of the International Development Association (IDA18) – the World Bank Group’s fund for low-income countries – a $2.5 billion financing window is now available to catalyze private sector investment.

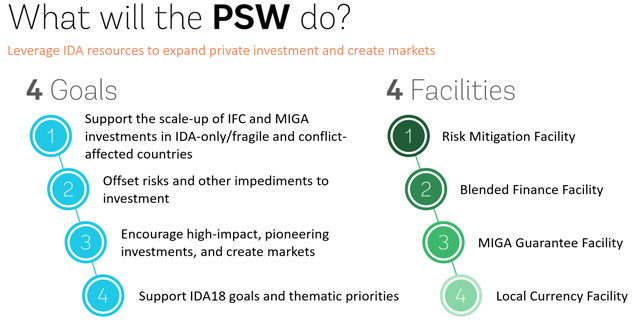

Speaking during a workshop to brief private sector companies and Government of Uganda held at the Kampala Serena Conference Centre on Monday, the IFC Director for Sub-Saharan Africa, Oumar Seydi explained that the Private Sector Window (PSW) is intended to help private companies access more affordable capital for investment by providing additional guarantees to insure against risks, particularly for countries that are affected by conflict or are politically unstable.

The new facility is spearheaded by the World Bank Group’s private sector lending arm, the International Finance Corporation, and the Multilateral Investment Guarantee Agency (MIGA) which offers political risk insurance and credit enhancement guarantees to help companies access credit.

“Many projects in emerging markets that need capital are unable to access financing because the risks are too high and the returns are not commensurate with the level of risk. The use of blended finance allows us to fill this financing gap by addressing market barriers and attract private sector investments to areas of strategic importance with high development impact,” Seydi said.

Blended Finance involves the use of relatively small amounts of concessional donor funds to offset specific investment risks. The donor funds are structured as co-investments, with a probability of reflows for future investments or other uses. Several of these investments are pioneer projects which, when successful, pave the way for other investors and help create markets in high impact sectors.

Private sector investment drops in Uganda

Private sector investments declined by 2.5 percent in the financial year period 2016/2017, a sharp contrast to the growth of 11 percent recorded the previous year, according to the 10th Uganda Economic Update released by the World Bank December 5, 2017. The decline was a result of high interest rates on loans and the uncertainty in the financial sector. In the period from June 2016 to August 2017, the weighted average commercial bank lending rate declined from 23.9 percent to 20.9 percent.

However, this rate later increased again to 22 percent. Commercial banks significantly increased their deposits, with their holdings of securities declining with the declining return. In contrast, the total value of credit extended to the private sector increased modestly, by 5.7 percent, following a strong recovery during the second half of FY 2016/17. With these developments, the ratio of private credit to GDP declined to 13.3 percent, down from 13.7 percent in FY 2015/16.

With the new IDA18 private sector window, the World Bank Group will channel its support to companies that are interested in investing in power production and distribution, and to financial institutions to help improve access to finance, including credit lines, housing finance and SME finance. Agribusinesses are also a priority under the sub-window, with financing targeted towards increasing agricultural productivity, improving food security and increase incomes of small farmers.

“We are proud of what we have achieved in the past in Uganda, but we recognize that we must do more to have the impact that we want. To that end, we hope that IFC’s renewed strategy along with blended finance tools, including the Private Sector Window, can create conditions where we can work with a larger number of companies and across a range of sectors,” Mr Seydi noted.

Over the past years, the World Bank Group has extended both financial and technical assistance to make it easier to do business in Uganda.

Under the ongoing Competitiveness and Enterprise Development Project (CEDP), a 3-year project implemented by the Private Sector Foundation of Uganda, the World Bank is supporting reforms geared towards improving the business environment, lowering the costs of doing business and improving competitiveness of the selected high impact sectors, particularly tourism.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price