Last year, the government revised the current budget from Shs 18.3 trillion to Shs 23.9 trillion citing the upcoming general elections, which it was claimed required more funding. The national budget that will be presented next month will be worth a record Shs 26.3 trillion, an increase of 9%. What explains the increment? Indeed, the government had earlier showed interest to cut the budget to Shs 21.2 trillion citing reduction in anticipated public expenditure.

Nevertheless, it later turned out on April 27 that it had edited the financial plan to include an additional Shs 5.1trillion, contained in the Budget Corrigenda – a document that highlights additional estimates and variations – to finance some crucial activities. Finance ministry officials led by State Minister David Bahati told Parliament that the money was to finance various development projects including Shs 200 billion National Agricultural Advisory Services to boost production, Shs 445 billion in infrastructure, and Shs 30 billion towards compensation of people in Luwero and Northern Uganda.

Other areas whose funds were initially excluded from the budget, according to finance officials, were to Finance Treasury redemption and external financing.

Fred Muhumuza, a research and advocacy specialist at the Financial Sector Deepening Uganda, is one of the analysts who expressed surprise at the new development. He told The Independent that while some of the projects would not necessary require new funding since they are meant to reconcile the records with the Treasury bills issued, the finance ministry should have seen and made steps to avert the last-minute revision earlier.

His opinion was that some of the extra funds are only required for political reasons and as such the government is trying to safeguard itself from requesting for supplementary budgets in case of political pressures from the voters in the coming months.

“The government is simply trying to ensure that everything is in the budget so that when need a rises, they will not seek for a supplementary budget,” Muhumuza said.

The proposal to raise the national budget is raising even more eyebrows given that it comes at a time when the Uganda Revenue Authority is struggling to meet its revenue targets to finance the budget. To make matters worse, Members of Parliament are trying to deny the budget an additional Shs 40 billion by exempting their allowances from taxes.

Analysts wary as tax revenues falter

URA has so far collected Shs 8.1trillion in the last nine months, showing a shortfall of Shs 194.6 billion against the target for the period, and an indication that it is likely not to meet its annual target of Shs 10.6 trillion with only three months left.

For the years now, Uganda tax efforts to finance the budget has stagnated around 12.5 to 13% of the GDP largely due to the narrow tax base and large informal sector, says Ezra Munyambonera, a Senior Research Fellow at the Economic policy Research Centre, Makerere University.

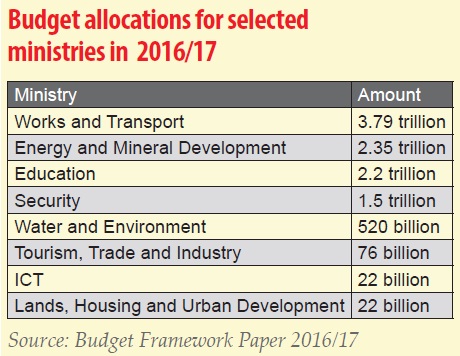

On this year’s budget allocation, of which 70% is to be financed locally through domestic taxes and local borrowing, the ministries of works and transport, energy and mineral development, health and agriculture are expected to get an increase in the government spending, according to the national budget framework paper 2016/17.

The government plans to spend Shs 3.78 trillion in the ministry of works and transport, up from Shs 3.32 trillion last year, to meet the costs of ongoing infrastructural development projects such as roads and water transport.

The education sector is to get an allocation of Shs 2.2 trillion, up from Shs 2.02 trillion whereas health and agriculture ministries are to be allocated Shs 1.38 trillion and Shs 627.7 billion respectively. For agriculture, this an increase from Shs 480 billion. However civil society organizations under their umbrella Civil Society Budget Advocacy Group (CSBAG) say in their statement recently that there’s need for more funding in the agriculture sector to take care of pests and diseases such as Foot and Mouth and tse tse flies to boost animal production.

However, security, trade and ICT ministries are expected to register a slight reduction from Shs1.64 trillion, Shs 81bilion, and Shs66.7billion to Shs1.50trillion, Shs76.6billion, and Shs22.1billion, respectively.

This forthcoming budget, according to the budget framework paper for 2016/17, prioritises infrastructure development, supporting wealth creation with special focus on the Youth and Women Entrepreneurship Programme, microfinance, as well as raising the quality of social services to improve the general welfare of Ugandans.

Further, the budget gives priority to enhancement of national security, promotion of production and productivity through support to NAADS and value addition in the key growth sectors of the economy, scientific research and innovation.

For that, the country’s economy is projected to grow by 5.8% in the financial year 2016/17, up from the projected 5% in 2015, mainly driven by a scale up in public infrastructure spending and a rebounding private sector activity following the general election.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price