Kampala, Uganda | THE INDEPENDENT | Players in oil and gas have pleaded with the countries in the West not to starve Uganda and Africa of financing needed to get those resources out of the ground.

The call has been sounded by the Energy and Mineral Development Minister, Ruth Nankabirwa, and other players at the opening of the 10th East African Petroleum Conference and Exhibition.

Nankabirwa said the debate about the Energy transition is coming with a cost to countries like Uganda whose resources are yet to be produced.

While noting the significance of the need to shift away from fossil-powered production, Nankbirwa said Uganda and Africa should be allowed time to exploit those resources to industrialize.

She said it would be ironic that some of the countries that supported Uganda through the exploration stages to pull out before the resources are out .

Uganda’s oil and gas sector has been under criticism by climate activists with the emergence of the energy transition debate.

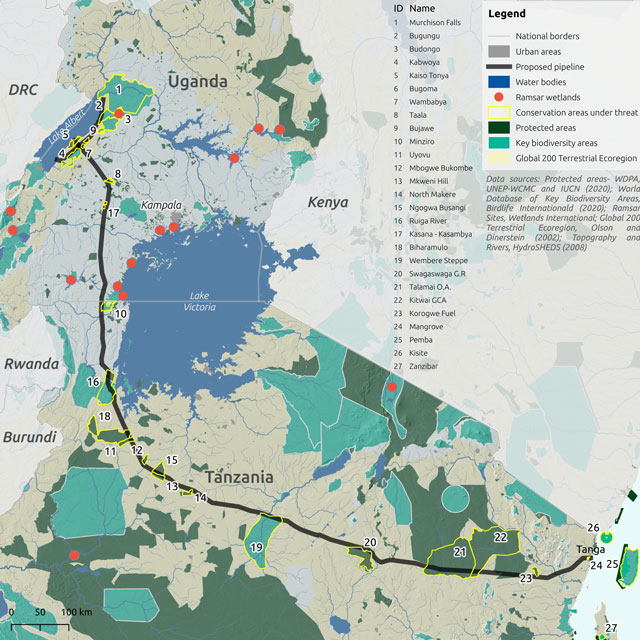

Campaigners have particularly campaigned against the planned construction of the 1,440-kilometer East Africa Crude Oil Pipeline(EACOP) from Uganda through Tanzania.

They have particularly been targeting global banks and insurance firms urging them not to finance the pipeline project that will evacuate Uganda’s oil to the international market through the Port of Tanga.

They have alleged that the pipeline will displace people from their ancestral land, destroy the environment among others.

As of June 2021, seven private sector banks had indicated that they would not participate in the funding of the pipeline project.

Those quoted included Barclays, Credit Suisse, ANZ (the Australia and New Zealand Bank group), BNP Paribas, Société Générale and Crédit Agricole, of France.

The latest was last week, when Bloomberg quoted a spokesperson at Standard Chartered Bank as saying they were not involved in the financing arrangements.

Nankabirwa however said it was unfortunate that Western Financiers were abandoning Uganda and Africa’s newly found oil and gas finds yet their countries used such resources to develop their own economies.

Nankabirwa however said with partners like African Petroleum Producer’s Organization(APO) Uganda and other countries will source for local financing of their oil and gas sectors by forming a bank dedicated to oil infrastructure financing.

Dr. Elly Karuhanga, former chairman Uganda Chamber of Mines and Petroleum said apart from the large banks withdrawing from EACOP, even local banks have not done enough to fund the local activities.

He castigated the high-interest rates by banks, the big amounts of premiums asked by insurance companies and other challenges, saying these are even frustrating the local content policy.

Karuhanga, who has previously chaired the Uganda Chamber of Mines also criticized the government for doing little to reign in on the banks.

This, he said, is made worse by oil companies holding oil and gas project contracts taking too long to pay the local suppliers, which according to him, is frustrating their businesses.

East African Community Secretary General Peter Mathuki proposed a joint natural resource exploration arrangement by the seven EAC partner states which would not only attract more investments but also be able to ward off such pressures.

Mathuki said that after all, most of the global disasters like climate change and the recent hike in commodity prices, are usually a result of actions by the developed world.

He says the region and Africa must work together to get solutions to the challenges they face.

Karuhanga, also former chairman, Private Sector Foundation Uganda attacked the government’s bureaucratic system towards investors, saying they frustrate investments.

Karuhanga, a former president of Tullow Uganda, said the private sector many times gets frustrated by the many requirements at the many offices they have to encounter at each stage of project development.

He said this is made worse by government officials who take long to respond to inquiries by the private sector, among other challenges, saying these could affect even the road to 2025.

The regional efforts to develop the oil and sector supported by NJ Ayuk, the Chief Executive of Africa Energy Chamber and CEO of Centurion Law Group, who said Africa should stop going by the dictates of the West if it is to develop.

He wondered why countries in the West that are opening new coal mines and licensing for new oil explorations are not under the same pressure as Uganda and Africa.

Ayuk says Africa should not be told to decarbonize because it hardly produces any carbons compared to what countries in other regions are doing.

Instead, he says, Africa should be allowed to industrialize so that the people are empowered not to rely on trees for cooking.

The Standard Bank Group of South Africa, the parent company of Stanbic Bank, is leading the financial arrangement and at least three banks in Japan and China, as well as the Africa Export-Import Bank are part of the negotiations.

The conference provides the opportunity to exhibit the potential of the region’s oil and gas resources. EAC developed a strategy for regional refineries to enhance the storage and distribution of oil and gas in East Africa.

******

URN

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price

What are the activities carried out in the program?