Critics want mega-infrastructure investments scrapped

COVER STORY | IAN KATUSIIME | Big infrastructure projects such as the Standard Gauge Railway (SGR) in Uganda, have critics saying such investments have led to high inflation and increased cost of living for ordinary citizens and limited growth.

This happened after countries like Uganda, Kenya, Tanzania, Ethiopia, and Zambia have made significant investments in their infrastructure in the last two decades by borrowing heavily.

But its leading proponent, President Yoweri Museveni, has repeatedly pushed the view that investment in large infrastructure projects, be it railways, roads, and power dams, will pave way for Africa’s economic transformation.

In Museveni’s latest big infrastructure push, Uganda has reportedly broken ranks with its Chinese partners over the delayed construction of the SGR.

The Chinese firm, China Harbour and Engineering Company Ltd (CHEC) had been in 2015 contracted to develop the 513km Standard Gauge Railway Project for a whopping US$7.7 billion. But it has recently emerged that, after an eight year wait without much progress from CHEC, the Uganda government is now courting the Turkey construction firms Yapi Merkezi for the job.

The Uganda government has reportedly pitched Yapi Merkezi to build the 273km section of the SGR line from Malaba to Kampala at an expected cost of US$2.2 billion. The Turkish firm is building part of the Tanzanian SGR network.

Uganda SGR Project Coordinator Perez Wamburu reportedly told The East African that Uganda was switching contractors because China Exim Bank refused to bankroll the project.

“We read between the lines when China’s Ambassador to Uganda said that after the Covid-19 pandemic, China has become more cautious on financing big infrastructure projects in Africa,” Wamburu is quoted to have said.

The East African said at the back of the Chinese reluctance was doubt that Kenya would build its SGR – also funded by the Exim Bank – all the way from Mombasa to Nairobi, Naivasha, Kisumu and through to Malaba, to link with Uganda’s in order to make the project viable.

Mounting criticism

Renowned Kenyan economist, David Ndii, in a new paper argues that such heavy investments in infrastructure in Africa have not produced the desired economic gains. In this he joins a chorus of critics against the infrastructure drive adopted by many African countries including Uganda.

“The continued emphasis on infrastructure investment fails to account for the fact that even those African countries that have invested a great deal in infrastructure continue to lag other countries in Asia (like Bangladesh) in key manufacturing sectors like textiles regardless of infrastructure quality,” argues Ndii, who has worked as an economist for the World Bank and co-founded the Institute of Economic Affairs, a think tank in Kenya.

Ndii argues that African countries that have focused on infrastructure like highways and dams do not have the same comparative advantage as the “Asian Tigers that perfected and popularised the export-led growth model”.

Ndii says that mega infrastructure projects like power stations, airports, seaways and bridges that have continued to be built have not “turbocharged growth”.

He says: “On the contrary, a robust two-decade growth trajectory from the mid-1990s to the mid-2010s that expanded Africa’s average incomes by 40 percent has petered out, and much of the continent was showing signs of debt distress even before the coronavirus pandemic struck.”

He adds that amidst the failure to boost growth, the debt servicingaccrued from infrastructure projects risks placing too much burden on public finances and their economies.

He faults the drive for infrastructureled growth in Africa saying although it sprouted several resource mobilisation platforms led by the African Development Bank, there is not much to show for it.

Ndii writes: “The continent’s estimated investment needs for infrastructure have also become something of a moving target. The most recent figure puts the annual amount at between $130 billion and $170 billion, with a financing shortfall of roughly $70 billion to more than $100 billion.”

In a case study of his own country Kenya, Ndii says Kenya “succumbed” to the allure of infrastructure led growth in 2013 under the then new government of Uhuru Kenyatta.

“In 2013, a newly elected Kenyan government unveiled a four-year investment plan to install 5,000 megawatts in power-generating capacity. This would have been a nearly fourfold increase in its generation capacity from 1,800 megawatts to 6,800 megawatts.

Ndii says two years later, the country’s generation capacity had reached 2,800 megawatts against an actual demand requirement of only 1,900 megawatts, 17 percent below the national plan’s baseline forecast of 2,300 megawatts. He says this piled additional dilemmas to those Kenya is already saddled with; “a considerable surplus in generation capacity.”

Similar queries have been raised about some of the mega projects in Uganda; including the floundering 600MW Karuma Hydropower Project on the River Nile. Analysts have bemoaned the lack of transmission lines from the immense hydro power project whose mission is to power Uganda’s industrial growth.

Chinese dominance

Although roads are the flagship projects of the government infrastructure development drive, their deterioration with disrepair and increasing cracks and potholes appears to support Ndii’s view that they are White Elephants. This as Chinese companies have hogged the lion’s share of road contracts in Uganda, from municipality roads in far off districts to 100km highways and city roads.

Until now, Uganda has appeared unable to wiggle itself out of the Chinese trap with available loans coming from the Export and Import (EXIM) Bank of China and to the carte blanche granted to Chinese investors by President Yoweri Museveni.

But last December Museveni announced plans to build a brand new SGR line from Kampala to Kasese in western Uganda. He said this would later be extended from Kampala to the border of Kenya and then to South Sudan.

“We want [to lower the] cost of transport [and] improve our competitiveness,” Museveni told a meeting of private sector chief executive officers.

That was the first public revelation that Uganda is pursuing SGR arrangements separate from its contract with the Chinese firm CHEC.

It is not unusual for Museveni to ring-fence projects for contractors. This includes mega ones like the proposed Kampala-Jinja Expressway which

Museveni at one point had directed Uganda National Roads Authority (UNRA) to award the contract to a Chinese consortium.

According to the President, procurement consumes time and he deems it a cumbersome procedure when a contractor can extend financing.

The 600MW Karuma Hydropower Dam constructed at a cost of $1.7 billion is a flagship Chinese project in Uganda. Its construction started in August 2013 and is yet to be completed nearly ten years later.

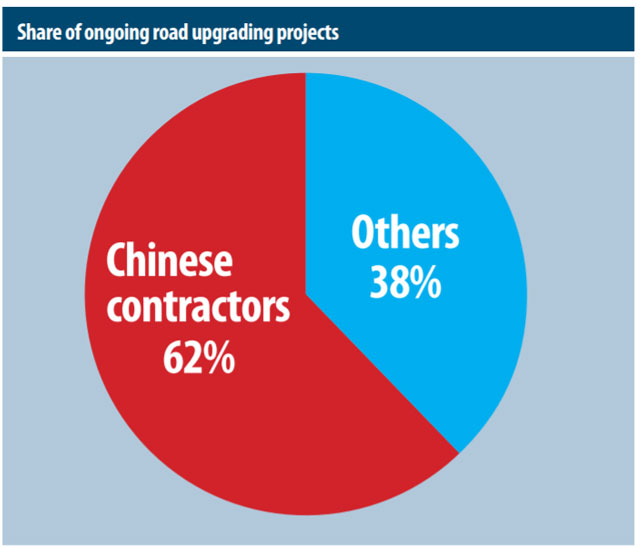

Meanwhile Chinese contractors continue to snap up projects in Uganda in almost all critical sectors. A project brief by UNRA in August 2021 offered a snapshot into the dominance of Chinese contractors in Uganda. These were four major road projects in the heart of the country.

The design and build contract for Masindi-Park junction; SambiyaMurchison Falls; Tangi Junction-ParaaBuliisa and Wanseko-Bugungu; a project containing four lots totalling length of 159km was awarded to M/S China Communications Construction Company in 2018. The contract value was US$217m (Approx. Shs800 million) with a large chunk of financing from Exim Bank.

The design and build for upgrading of Mubende-Kakumiro-Kagadi Road (107km) was also awarded to China Communications Construction Company at a cost of Shs484 million in 2016.

For the design and build of Masindi-Biiso; Kabale-Kiziramfumbi; HohwaNyairongo-Kyarushesha-Butole (97km) upgrading project, UNRA awarded the contract to China Railway Seventh Group in 2019. The government of Uganda applied for financing support from Industrial and Commercial Bank of China of over Shs500m for the project.

In 2018, UNRA contracted yet another Chinese firm; China Wu Yi Co. for the design and build of BuhimbaNalweyo-Bulamagi-Igayza-Kakumiro Roads upgrading project (93km). The contract price was US$138 million with a loan obtained from China Exim Bank.

As of September 2022, Chinese contractors were working on a combined length of 626km of upgrading road projects out of the total 1,000km under upgrading in the country according to data from UNRA. That is 62% of the contract value being handed out. Funding alone from Exim Bank on on-going projects totaled to US$673 million (Shs2.4 trillion)

Chinese contractors have also routinely run into trouble in Uganda over workers’ rights, project delays, contract disputes and the accusations of economic exploitation.

In February 2022, the Parliamentary Committee on Commissions, Statutory Authorities and State Enterprises (COSASE) met officials from China Communications Construction Company (CCCC) and they reportedly failed to explain how the company acquired the contract for the expansion of Entebbe International Airport.

“CCCC officials were on 03 February 2022 appearing before COSASE on their contractual terms and obligations in regard to the US$200 million Entebbe International Airport expansion and upgrading project,” Parliament reported on its site.

COSASE Chairperson Joel Ssenyonyi asked CCCC officials to explain how the company obtained the contract to expand and upgrade the Airport to no avail. CCCC is the same company working on the upgrading of the 159km Masindi-Buliisa Road project.

In spite of the debt burden, the delay of major projects like Karuma HPP and the failure by some estimates to deliver on economic gains, the President, Ministry of Finance, National Planning Authority (NPA) and other technocrats continue to plan for more big ticket projects to boost economic growth.

Debt distress

Ndii’s paper reads like a cautionary tale for the Ugandan government with its renowned tunnel vision on infrastructure.

The paper mentions the emergence of China as a major and often preferred source of development financing and the counteroffers from Western countries. He says Chinese lending has led to a rapid rise in sub-Saharan Africa’s public debt burden within a decade.

According to a report tabled in parliament by the Committee on National Economy on the State of Indebtedness and approved on August 30, 2022, Uganda’s total public debt has increased dramatically over recent years. Implementation of the Government’s investment agenda dominated by infrastructure and the effects of the COVID-l9 pandemic that caused revenue shortfalls are to blame.

According to the report, Uganda’s public debt stock increased by 22% from Shs56.938 trillion two years ago to Shs69.513 trillion by end of last Financial Year. Additional data from the Ministry of Finance shared in parliament by the Committee on the National Economy shows that Uganda’s public debt by June 2022 was Shs78.8 trillion which is a 13% monthly year-on-year increment. Up to 20% of that debt is owed to Chinese entities.

Uganda and many African countries that are hooked on Chinese loans recognise that they offer less favourable financial terms than those offered by Western bilateral lenders and institutions like the World Bank and the IMF. But the heads of African states still chase Chinese loans because, as an article by the Makerere University Kampala-based Economic Policy Research Centre (EPRC) said, “they give the appearance of no strings attached”.

African heads of state contrast China’s principle of non-interference in the internal affairs of other countries with the West “lectures” on good governance and democracy.

In the EPRC article titled “How Uganda can avoid China debt trap”, Smartson Ainomugisha and Sawuya Nakijoba wrote that while China is indeed supporting various development projects in the country, it must be clearly known that China is also doing business.

“In case of failure to pay its loans, it may take over the collateral security, including key national resources and government assets,” they said.

Ndii’s paper titled ‘Africa’s Infrastructure Led Growth Experiment is faltering. It is Time to Focus on Agriculture,’ was published in December 2022 by Carnegie Endowment for international Peace, a U.S. think tank.

It lays out in detail what else he considers African countries to have missed out in the

infrastructure drive.

Ndii advises African countries to heed the experience of Latin American countries with similar resource endorsements: a greater relative abundance of land than low cost labour.

“As this experience shows, countries can make far more durable, sustainable economic gains by focusing on improving agricultural productivity with relatively low-cost improvements targeted at smallholder farmers for whom a boost in productivity would have the largest impact,” he writes. “Rather than a scarcity of infrastructure, the real binding constraint on growth in Africa is low agricultural productivity, or the agricultural productivity gap,” Ndii argues.

Whereas the new government of Kenya where Ndii works as a top economic advisor to President William Ruto, has vowed to revise the policy of heavy borrowing for infrastructure, Uganda appears unlikely to change tack anytime soon. In 2006, the Uganda government took a decision to spend Shs4 trillion (Approx. US$1 billion) on its roads sector going forward. The budget for the sector has gone up incrementally. ■

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price