After the Panama Papers were released, on April 1, 2016, Heritage attempted to deny attempting to evade tax. It told the UK Guardian newspaper that it relocated “long before the completion of the transaction (in Uganda) … (and) for a variety of business reasons”.

The yearlong investigation was carried out by the International Consortium of Investigative Journalists, German newspaper Süddeutsche Zeitung and more than 100 other news organisations worldwide. The files expose offshore companies controlled by the prime ministers of Iceland and Pakistan, the king of Saudi Arabia and the children of the president of Azerbaijan.

They also include at least 33 people and companies blacklisted by the U.S. government because of evidence that they’d been involved in wrongdoing, such as doing business with Mexican drug lords, terrorist organisations like Hezbollah or rogue nations like North Korea and Iran.

One of those companies supplied fuel for the aircraft that the Syrian government used to bomb and kill thousands of its own citizens, U.S. authorities have charged.

“These findings show how deeply ingrained harmful practices and criminality are in the offshore world,” said Gabriel Zucman, an economist at the University of California, Berkeley and author of “The HiddenWealth of Nations: The Scourge of Tax Havens.” Zucman, who was briefed on the media partners’ investigation, said the release of the leaked documents should prompt governments to seek “concrete sanctions” against jurisdictions and institutions that peddle offshore secrecy. World leaders who have embraced anticorruption platforms feature in the leaked documents. The files reveal offshore companies linked to the family of China’s top leader, Xi Jinping, who has vowed to fight “armies of corruption,” as well as Ukrainian President Petro Poroshenko, who has positioned himself as a reformer in a country shaken by corruption scandals.

The files also contain new details of offshore dealings by the late father of British Prime Minister David Cameron, a leader in the push for tax-haven reform.

The leaked data covers nearly 40 years, from 1977 through the end of 2015. It allows a never-before-seen view inside the offshore world—providing a day-to-day, decade-by-decade look at how dark money flows through the global financial system, breeding crime and stripping national treasuries of tax revenues.

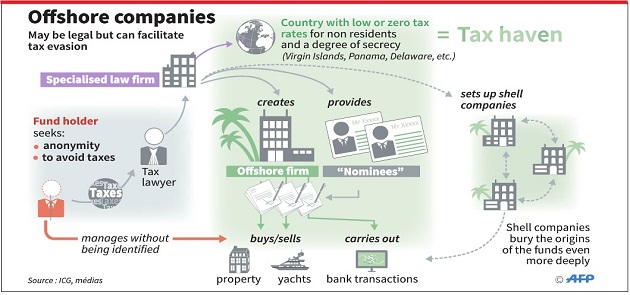

Most of the services the offshore industry provides are legal if used by the law abiding. But the documents show that banks, law firms and other offshore players have often failed to follow legal requirements that they make sure their clients are not involved in criminal enterprises, tax dodging or political corruption.

In some instances, the files show, offshore middlemen have protected themselves and their clients by concealing suspect transactions or manipulating official records. The documents make it clear that major banks are big drivers behind the creation of hard-to-trace companies in the British Virgin Islands, Panama and other offshore havens.

The files list nearly 15,600 paper companies that banks set up for clients who want keep their finances under wraps, including thousands created by international giants UBS and HSBC.

The records reveal a pattern of covert maneuvers by banks, companies and people tied to Russian leader Putin. The records show offshore companies linked to this network moving money in transactions as large as $200 million at a time.

Putin associates disguised payments, backdated documents and gained hidden influence within the country’s media and automotive industries, the leaked files show.

Mossack Fonseca’s fingers are in Africa’s diamond trade, the international art market and other businesses that thrive on secrecy. The firm has serviced enough Middle East royalty to fill a palace. It’s helped two kings, Mohammed VI of Morocco and King Salman of Saudi Arabia, take to the sea on luxury yachts.

In Iceland, the leaked files show how Prime Minister Sigmundur David Gunnlaugsson and his wife secretly owned an offshore firm that held millions of dollars in Icelandic bank bonds during that country’s financial crisis.

The files include a convicted money launderer who claimed he had arranged a $50,000 illegal campaign contribution used to pay the Watergate burglars, 29 billionaires featured in Forbes Magazine’s list of the world’s 500 richest people and movie star Jackie Chan, who has at least six companies managed through the law firm.

As with many of Mossack Fonseca’s clients, there is no evidence that Chan used his companies for improper purposes. Having an offshore company is not illegal. For some international business transactions, it is a logical choice.

The Mossack Fonseca documents indicate, however, that the firm’s customers have included Ponzi schemers, drug kingpins, tax evaders and at least one jailed sex offender.

A U.S. businessman convicted of traveling to Russia to have sex with underage orphans signed papers for an offshore company while he was serving his prison sentence in New Jersey, the records show.

The files contain new details about major scandals ranging from England’s most infamous gold heist to the bribery allegations convulsing FIFA, the body that rules international soccer.

The leaked documents reveal that the law firm of Juan Pedro Damiani, a member of FIFA’s ethics committee, had business relationships with three men who have been indicted in the FIFA scandal — former FIFA vice president Eugenio Figueredo and Hugo andMariano Jinkis, the father-son team accused of paying bribes to win broadcast rights to Latin American soccer events.

The records show that Damiani’s law firm in Uruguay represented an offshore company linked to the Jinkises and seven companies linked to Figueredo.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price