Uganda’s insurance industry premiums are expected to grew 20% to Shs733 billion this year on the back of sustainable economic expansion and demographic shifts and new opportunities.

Five years ago, the insurance industry in Uganda could barely raise Shs 500 billion in total premiums. Across the border in Kenya, total premiums amounted to Shs 5.2 trillion, though still way below South Africa’s Shs 178 trillion. That shows Uganda still has a long way to go. However, a new report by the Insurance Regulatory Authority of Uganda (IRA-U), the industry regulator, shows that the industry has seen a resurgence thanks to the growing economy and large scale infrastructure projects.

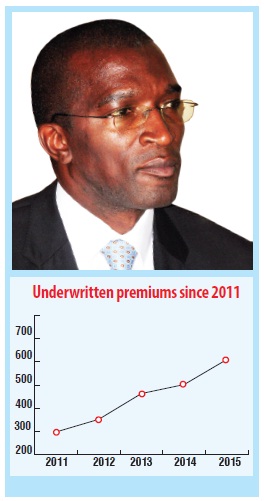

Ibrahim Kaddunabi Lubega, the chief executive officer, told journalists in Kampala on April 26 that insurance premiums to be underwritten in 2016 year are expected to shoot to Shs 733 billion compared with Shs 611 billion in 2015, an increase of Shs 122 billion. He attributed the growth to the sustainable economic expansion and demographic shifts, which he said are making the insurance market increasingly more attractive.

Gov’t earmarks Shs 5 billion for farmers’ insurance in 2016/17

The expansion in the insurance industry this year will be driven largely by tapping into opportunities presented by banc assurance and gaining grip into product synergies, ability to access new markets particularly of the informal sector, and enhanced public sector investments in infrastructural projects, according to Kaddunabi.

“Innovations into the development of customer-centric products and strategic partnerships have improved both product affordability and accessibility…customers are now more informed and are looking out to solutions as opposed to mere policies,” he said. Also prospects in the oil and gas sector as well as the growing affluent class will also stir the underwriting premiums.

According to a recent report by KPMG on the insurance industry in Africa, the key determinants of an insurance sector in any particular country are income levels, political stability, the depth and sophistication of the financial sector, the level and volatility of inflation, and the capacity of companies to innovate among others. Kenya was particularly singled out as a good performer because of its ability to innovate while it also has a reasonably well-developed financial sector.

Global insurance premiums grew by only 2% in 2013 but expanded by 8% per annum in Sub Saharan Africa, which makes the region not only one of the fastest-growing regions in the world, but also the most attractive to international insurance giants.

Currently, Uganda has 29 insurance companies including global giants Prudential and Britam, which joined the industry recently. IRA-U is currently drafting regulations to guide the roll out of banc assurance products onto the market after President Yoweri Museveni signed the Financial Institutions (Amendment) Bill 2015 into law earlier in the year, to pave way for the sale of insurance covers through commercial banks.

The Independent Uganda: You get the Truth we Pay the Price

The Independent Uganda: You get the Truth we Pay the Price